Income Tax Preparation for Your Mary Kay Business Facts 5 Form

What is the Income Tax Preparation For Your Mary Kay Business Facts 5

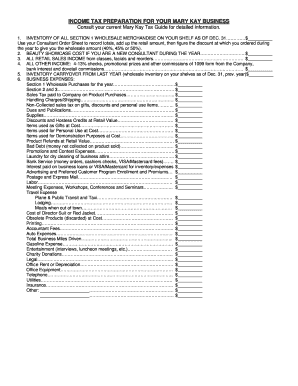

The Income Tax Preparation For Your Mary Kay Business Facts 5 form is specifically designed for independent beauty consultants operating within the Mary Kay business model. This form helps you report your income accurately and ensures compliance with IRS regulations. It encompasses various aspects of your business income, expenses, and deductions, which are essential for calculating your tax obligations. Understanding this form is crucial for maintaining financial health and meeting legal requirements as a Mary Kay consultant.

Steps to complete the Income Tax Preparation For Your Mary Kay Business Facts 5

Completing the Income Tax Preparation For Your Mary Kay Business Facts 5 form involves several key steps:

- Gather all relevant financial documents, including sales records, receipts for business expenses, and any 1099 forms received from Mary Kay.

- Accurately report your total income from Mary Kay sales, including commissions and bonuses.

- List all eligible business expenses, such as inventory costs, marketing expenses, and vehicle mileage related to your business activities.

- Calculate your total taxable income by subtracting your business expenses from your total income.

- Review the completed form for accuracy and ensure all necessary signatures are included.

IRS Guidelines

When preparing your Income Tax Preparation For Your Mary Kay Business Facts 5 form, it is essential to adhere to IRS guidelines. The IRS requires accurate reporting of all income and expenses, and failure to comply can result in penalties. Familiarize yourself with the IRS Publication 535, which provides detailed information on business expenses and deductions. This resource can help you understand what qualifies as a deductible expense and how to properly document your financial activities.

Required Documents

To complete the Income Tax Preparation For Your Mary Kay Business Facts 5 form, you will need several key documents:

- Sales records detailing your income from Mary Kay products.

- Receipts for business-related expenses, such as supplies and promotional materials.

- Form 1099 if you received one from Mary Kay, which reports your earnings.

- Bank statements that reflect your business transactions.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Income Tax Preparation For Your Mary Kay Business Facts 5 form is crucial to avoid penalties. Generally, individual tax returns are due on April fifteenth each year. However, if you need additional time, you can file for an extension, which typically grants you until October fifteenth to submit your return. Be aware that any taxes owed are still due by the original deadline to avoid interest and penalties.

Penalties for Non-Compliance

Failing to accurately complete and submit the Income Tax Preparation For Your Mary Kay Business Facts 5 form can lead to significant penalties. The IRS may impose fines for late filing, underreporting income, or failing to pay taxes owed. These penalties can accumulate quickly, so it is essential to ensure that your form is completed correctly and submitted on time. Regularly consulting with a tax professional can help mitigate these risks and ensure compliance with all tax obligations.

Quick guide on how to complete income tax preparation for your mary kay business facts 5

Effortlessly Prepare Income Tax Preparation For Your Mary Kay Business Facts 5 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Income Tax Preparation For Your Mary Kay Business Facts 5 on any device with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Adjust and Electronically Sign Income Tax Preparation For Your Mary Kay Business Facts 5 with Ease

- Find Income Tax Preparation For Your Mary Kay Business Facts 5 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Income Tax Preparation For Your Mary Kay Business Facts 5 to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax preparation for your mary kay business facts 5

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is income tax preparation for my Mary Kay business?

Income tax preparation for your Mary Kay business involves organizing financial documents, calculating taxable income, and ensuring compliance with tax laws specific to Mary Kay consultants. Understanding these factors is crucial for maximizing deductions and minimizing your tax liability. Using resources like airSlate SignNow can simplify this process substantially.

-

How does airSlate SignNow assist with income tax preparation for my Mary Kay business?

airSlate SignNow helps streamline the income tax preparation process for your Mary Kay business by allowing you to easily gather, send, and eSign necessary tax documents. This ensures that you have all your paperwork in order, which can save you time and reduce stress during tax season. With an organized approach, you'll be better prepared for income tax preparation for your Mary Kay business.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow offers various pricing plans designed to cater to businesses of different sizes and needs. Their tailored solutions ensure that you'll find an option that fits your budget while providing effective tools for income tax preparation for your Mary Kay business. You can choose a plan that scales with your growing business.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow provides features such as eSignatures, customizable templates, and document workflows that are essential for efficient income tax preparation for your Mary Kay business. These features facilitate seamless document handling, ensuring that you can focus on your business instead of paperwork. Additionally, they help ensure compliance and security for your financial documents.

-

What benefits can I expect from using airSlate SignNow for tax preparation?

Using airSlate SignNow for income tax preparation for your Mary Kay business brings numerous benefits, including enhanced efficiency, improved accuracy, and greater compliance with tax regulations. The platform's user-friendly interface allows you to manage documents effortlessly, reducing the time spent on tax prep. Moreover, you'll have peace of mind knowing that your documents are securely handled.

-

Can I integrate airSlate SignNow with other business tools I use?

Yes, airSlate SignNow offers integrations with various business tools such as CRMs, accounting software, and cloud storage services. This flexibility allows you to incorporate income tax preparation for your Mary Kay business seamlessly with your existing processes. By connecting these tools, you can enhance productivity and ensure that all your financial data is in one place.

-

How can I ensure that my records are accurate for tax preparation?

Ensuring your records are accurate for income tax preparation for your Mary Kay business is essential for avoiding audits and penalties. It's important to keep organized financial records, track your expenses diligently, and utilize tools like airSlate SignNow to manage documents. Regularly revising your financial information can help ensure that you are well-prepared come tax time.

Get more for Income Tax Preparation For Your Mary Kay Business Facts 5

- Quitclaim deed for five individuals to one individual michigan form

- Quitclaim deed for four individuals to one individual michigan form

- Quitclaim deed from husband and wife to three individuals as joint tenants with the right of survivorship michigan form

- Michigan deed trust 497311775 form

- Legal last will and testament form for single person with no children michigan

- Legal last will and testament form for a single person with minor children michigan

- Legal last will and testament form for single person with adult and minor children michigan

- Legal last will and testament form for single person with adult children michigan

Find out other Income Tax Preparation For Your Mary Kay Business Facts 5

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free