Missouri Form 126 2012

What is the Missouri Form 126

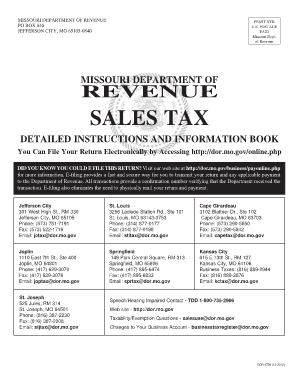

The Missouri Form 126 is a specific tax form utilized by businesses to report and remit sales tax in the state of Missouri. This form is essential for ensuring compliance with state tax regulations and is typically used by sellers who collect sales tax on taxable sales. The form captures vital information regarding the sales made, the tax collected, and any exemptions that may apply. Understanding the purpose and requirements of Form 126 is crucial for businesses to avoid penalties and maintain good standing with the Missouri Department of Revenue.

How to use the Missouri Form 126

Using the Missouri Form 126 involves several key steps to ensure accurate reporting of sales tax. First, gather all necessary sales records for the reporting period. This includes invoices, receipts, and any documentation related to exempt sales. Next, complete the form by entering total sales, the amount of sales tax collected, and any adjustments for exemptions. It is important to double-check all entries for accuracy. Once completed, the form can be submitted electronically or via mail, depending on your preference and compliance requirements.

Steps to complete the Missouri Form 126

Completing the Missouri Form 126 requires careful attention to detail. Follow these steps:

- Gather all sales records for the reporting period.

- Calculate total sales and the corresponding sales tax collected.

- Identify any exempt sales and document them appropriately.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form by the due date, either electronically or by mail.

Legal use of the Missouri Form 126

The Missouri Form 126 is legally binding when completed and submitted in accordance with state regulations. It serves as an official record of sales tax collected and remitted to the state. To ensure the form's legal standing, it must be filled out accurately, with all required information included. Additionally, businesses must adhere to the filing deadlines set by the Missouri Department of Revenue to avoid penalties and interest on late submissions.

Filing Deadlines / Important Dates

Filing deadlines for the Missouri Form 126 vary depending on the business's reporting frequency. Most businesses are required to file monthly, while others may qualify for quarterly or annual filing. It is essential to be aware of the specific deadlines to ensure timely submission. Typically, the form is due on the 20th of the month following the reporting period. Failure to file on time can result in penalties, so keeping track of these important dates is crucial for compliance.

Form Submission Methods (Online / Mail / In-Person)

The Missouri Form 126 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses prefer to file electronically through the Missouri Department of Revenue's online portal.

- Mail: The form can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Businesses may also choose to submit the form in person at designated Department of Revenue offices.

Quick guide on how to complete missouri form 126

Complete Missouri Form 126 seamlessly on any device

Online document management has become popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Missouri Form 126 on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign Missouri Form 126 effortlessly

- Find Missouri Form 126 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing out new document copies. airSlate SignNow caters to your needs in document management in just a few clicks from any device of your choice. Modify and eSign Missouri Form 126 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct missouri form 126

Create this form in 5 minutes!

How to create an eSignature for the missouri form 126

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri Form 126 and how can SignNow help?

The Missouri Form 126 is used for various business-related filings in Missouri. With airSlate SignNow, you can easily complete and eSign this form, ensuring accuracy and compliance while reducing the time spent on paperwork.

-

How much does it cost to use airSlate SignNow for the Missouri Form 126?

airSlate SignNow offers competitive pricing plans that fit various business needs. Utilizing our platform to complete the Missouri Form 126 can save you money by minimizing administrative costs and streamlining the signing process.

-

What features does SignNow provide for completing the Missouri Form 126?

SignNow offers intuitive features such as templates, collaboration tools, and tracking capabilities that allow you to manage the Missouri Form 126 efficiently. These tools make it easier to customize the form, share it with others, and monitor its status.

-

What are the benefits of eSigning the Missouri Form 126 with SignNow?

eSigning the Missouri Form 126 with airSlate SignNow provides you with a legally binding signature while ensuring your documents are securely stored in the cloud. This method reduces the likelihood of errors and provides a faster turnaround time than traditional paper methods.

-

Can I integrate SignNow with other software for handling the Missouri Form 126?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, allowing you to manage your workflows more efficiently. This means you can easily transfer data related to the Missouri Form 126 from your existing systems.

-

Is it easy to use SignNow for filing the Missouri Form 126?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple for anyone to fill out and eSign the Missouri Form 126 without any technical expertise. Our guided interface helps you through the steps effortlessly.

-

What security measures does SignNow have for the Missouri Form 126?

airSlate SignNow prioritizes your document security with industry-standard encryption and authentication. When filling out and signing the Missouri Form 126, you can rest assured that your sensitive information is protected at all times.

Get more for Missouri Form 126

Find out other Missouri Form 126

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe