Bond Application Form

What is the Bond Application Form

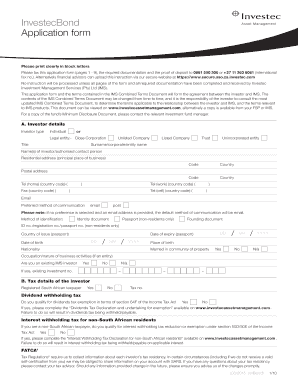

The bond application form is a crucial document used to apply for an investec bond, which is a financial instrument that allows individuals or businesses to borrow funds from Investec. This form collects essential information about the applicant, including personal details, financial status, and the purpose of the loan. It serves as the foundation for the lending process, enabling Investec to assess the applicant's eligibility and creditworthiness.

Steps to Complete the Bond Application Form

Completing the bond application form involves several key steps to ensure accuracy and compliance. Start by gathering necessary documents such as proof of income, credit history, and identification. Next, fill out the form with precise information, ensuring that all sections are completed. Pay special attention to financial details, as these will be scrutinized during the approval process. Once the form is filled, review it for any errors before submission to avoid delays.

Legal Use of the Bond Application Form

The bond application form must adhere to legal standards to be considered valid. This includes compliance with relevant laws governing lending and borrowing in the United States. The form should include necessary disclosures and must be signed by the applicant to confirm that the information provided is accurate. Using a reliable eSignature platform, like airSlate SignNow, ensures that the signed document is legally binding and meets the requirements set forth by the ESIGN Act and UETA.

Required Documents

When applying for an investec bond, several documents are typically required to support the application. These may include:

- Proof of income, such as pay stubs or tax returns

- Credit report to assess creditworthiness

- Identification documents, like a driver's license or passport

- Bank statements to verify financial stability

- Property details if the bond is for a home loan

Gathering these documents in advance can streamline the application process and improve the chances of approval.

Form Submission Methods

The bond application form can be submitted through various methods, depending on the preferences of the applicant and the requirements of Investec. Common submission methods include:

- Online submission via a secure portal, which allows for quick processing

- Mailing a physical copy of the completed form to Investec's office

- In-person submission at a local Investec branch for direct assistance

Choosing the right submission method can enhance the efficiency of the application process.

Eligibility Criteria

To qualify for an investec bond, applicants must meet specific eligibility criteria set by Investec. These criteria typically include:

- A minimum credit score, indicating financial responsibility

- Proof of stable income to ensure the ability to repay the loan

- Age requirements, often needing to be at least eighteen years old

- Residency status, which may require U.S. citizenship or legal residency

Understanding these criteria can help applicants prepare their applications more effectively.

Quick guide on how to complete bond application form

Prepare Bond Application Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Bond Application Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Bond Application Form with ease

- Obtain Bond Application Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you select. Modify and eSign Bond Application Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bond application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Investec Bond?

An Investec Bond is a financial product offered by Investec, designed to help individuals and businesses grow their savings through a fixed-term investment. It provides competitive interest rates and is ideal for those looking for secure, long-term savings solutions.

-

How does the Investec Bond work?

The Investec Bond works by locking in your funds for a predetermined term, during which you earn interest. At the end of the term, you receive your initial investment plus the accrued interest, making it an effective way to save and plan for the future.

-

What are the benefits of an Investec Bond?

The Investec Bond offers several benefits, including guaranteed returns, flexible terms, and a safe investment environment. It's particularly suitable for risk-averse investors looking to achieve predictable growth without the volatility of stock markets.

-

What is the minimum investment amount for an Investec Bond?

The minimum investment amount for an Investec Bond varies depending on the specific product but generally starts at a competitively low threshold, allowing a broader audience to access this secure investment option.

-

Are there any fees associated with the Investec Bond?

Typically, Investec Bonds have minimal fees, allowing you to maximize your investment returns. It’s advisable to review the specific terms and conditions to understand any potential charges before investing.

-

How do I manage my Investec Bond?

Managing your Investec Bond is straightforward, with online access to monitor your investment's performance. You can review your interest earnings and follow up on any essential updates through the Investec platform.

-

Can an Investec Bond be integrated with other financial products?

Yes, an Investec Bond can be integrated with other financial products to enhance your savings strategy. Combined with financial planning tools available on platforms like airSlate SignNow, you can streamline your investment management.

Get more for Bond Application Form

Find out other Bond Application Form

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP