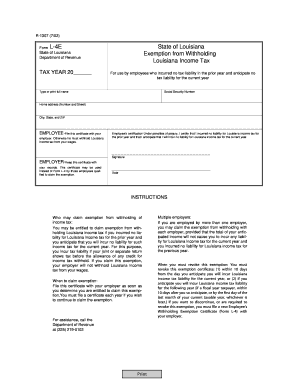

Louisiaa Tax Form L 4e

What is the Louisiana Tax Form L 4e

The Louisiana Tax Form L 4e is a state-specific tax document used for reporting certain income and tax obligations. This form is primarily utilized by individuals and businesses in Louisiana to ensure compliance with state tax regulations. It serves as an important tool for accurately reporting earnings, deductions, and credits applicable to the taxpayer's situation. Understanding the purpose and requirements of the L 4e form is essential for anyone looking to file their taxes correctly in Louisiana.

Steps to Complete the Louisiana Tax Form L 4e

Completing the Louisiana Tax Form L 4e involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements, prior tax returns, and any relevant receipts. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay close attention to the instructions provided with the form, as they outline specific requirements for different income types and deductions. After completing the form, review it thoroughly for any errors before submitting it to the appropriate state tax authority.

How to Obtain the Louisiana Tax Form L 4e

The Louisiana Tax Form L 4e can be obtained through multiple channels. The most straightforward method is to visit the official Louisiana Department of Revenue website, where the form is available for download. Additionally, taxpayers may request a physical copy by contacting their local tax office. It is advisable to obtain the form well in advance of the filing deadline to ensure ample time for completion and submission.

Legal Use of the Louisiana Tax Form L 4e

The legal use of the Louisiana Tax Form L 4e is governed by state tax laws and regulations. To be considered valid, the form must be completed accurately and submitted by the designated deadline. Failure to comply with these legal requirements can result in penalties or fines. It is crucial for taxpayers to understand their obligations under Louisiana law, including any specific rules related to the types of income reported and the deductions claimed on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Louisiana Tax Form L 4e are critical to ensure compliance with state tax regulations. Generally, the form must be submitted by May fifteenth of the tax year. However, taxpayers should verify specific deadlines each year, as they may vary based on state directives or changes in tax law. Marking these important dates on a calendar can help avoid late submissions and potential penalties.

Required Documents

To complete the Louisiana Tax Form L 4e, several documents are typically required. These may include:

- Income statements, such as W-2s or 1099s

- Receipts for deductible expenses

- Previous tax returns for reference

- Any supporting documentation for credits claimed

Having these documents readily available can streamline the process of filling out the form and ensure that all necessary information is included.

Quick guide on how to complete louisiaa tax form l 4e

Effortlessly Prepare Louisiaa Tax Form L 4e on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Louisiaa Tax Form L 4e on any device with the airSlate SignNow Android or iOS apps and enhance any document-related process today.

How to Modify and eSign Louisiaa Tax Form L 4e with Ease

- Obtain Louisiaa Tax Form L 4e and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Louisiaa Tax Form L 4e and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the louisiaa tax form l 4e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an L 4 form and why is it important?

The L 4 form is a crucial document used for reporting income in certain states. It provides both employees and employers with essential information regarding earnings and tax deductions. Understanding the L 4 form ensures compliance and accurate reporting.

-

How can airSlate SignNow help with the L 4 form?

airSlate SignNow streamlines the process of creating, sending, and signing the L 4 form. Our platform simplifies document management, allowing users to quickly fill out and eSign necessary forms, ensuring timely submission for tax purposes. This saves time and reduces errors.

-

Is airSlate SignNow affordable for small businesses needing to manage L 4 forms?

Yes, airSlate SignNow offers cost-effective solutions that cater to businesses of all sizes, including small businesses. Our pricing plans are designed to ensure that even budget-conscious companies can manage their L 4 forms efficiently without sacrificing quality. You'll find competitive rates that fit your needs.

-

Are there any integrations available for processing L 4 forms with airSlate SignNow?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enhancing your experience when handling L 4 forms. Whether you use CRM systems, project management tools, or accounting software, our integrations facilitate smooth workflow and reduce data entry redundancies.

-

Can I track the status of my L 4 form with airSlate SignNow?

Yes! airSlate SignNow provides robust tracking features that allow you to monitor the status of your L 4 form. You’ll receive notifications when documents are viewed, signed, or completed, giving you peace of mind that your submissions are handled promptly.

-

What security measures does airSlate SignNow implement for L 4 forms?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the L 4 form. We employ advanced encryption, multi-factor authentication, and secure storage to protect your information from unauthorized access and data bsignNowes.

-

Can multiple users collaborate on the L 4 form using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the L 4 form, making teamwork easier. You can invite team members to edit, review, and eSign forms in real time, ensuring that everyone is aligned and that the document is completed accurately and efficiently.

Get more for Louisiaa Tax Form L 4e

- Colorado individual form 497299955

- Assignment of lien form

- Colorado demand 497299957 form

- Co llc 497299958 form

- Colorado lis form

- Colorado lis pendens form

- Demand of supplier of materials machinery tools laborers or services for information regarding owner disburser and principal

- Co llc 497299962 form

Find out other Louisiaa Tax Form L 4e

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter