Pps Profit Share Withdrawal Form

What is the Pps Profit Share Withdrawal Form

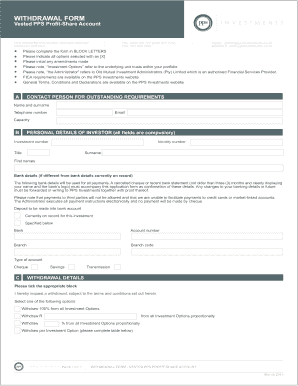

The Pps profit share withdrawal form is a specific document used by individuals to request the withdrawal of funds from their profit-sharing accounts. This form is essential for ensuring that the withdrawal process is documented and complies with relevant legal and financial regulations. It typically includes personal information, account details, and the amount being withdrawn. Understanding the purpose and requirements of this form is crucial for a smooth withdrawal process.

Steps to Complete the Pps Profit Share Withdrawal Form

Completing the Pps profit share withdrawal form involves several important steps:

- Gather necessary personal information, such as your name, address, and Social Security number.

- Provide details about your profit-sharing account, including the account number and the financial institution managing it.

- Specify the amount you wish to withdraw and ensure it adheres to any limits set by the profit-sharing plan.

- Review the form for accuracy and completeness before signing and dating it.

- Submit the form according to the instructions provided, whether online, by mail, or in person.

Legal Use of the Pps Profit Share Withdrawal Form

The legal use of the Pps profit share withdrawal form is governed by various regulations that ensure the legitimacy of the withdrawal process. It is essential to comply with the Employee Retirement Income Security Act (ERISA) and other relevant laws that protect the rights of participants in profit-sharing plans. Proper use of this form helps safeguard both the account holder's interests and the financial institution's obligations.

Required Documents

When submitting the Pps profit share withdrawal form, certain documents may be required to validate your request. These typically include:

- A copy of a government-issued ID to verify your identity.

- Any relevant account statements or documentation that support your withdrawal request.

- Additional forms or paperwork as specified by the financial institution managing your profit-sharing account.

Form Submission Methods

The Pps profit share withdrawal form can be submitted through various methods, depending on the policies of the financial institution. Common submission methods include:

- Online submission through the institution's secure portal.

- Mailing the completed form to the designated address.

- In-person submission at a local branch or office.

Eligibility Criteria

Eligibility to withdraw funds using the Pps profit share withdrawal form typically depends on several factors, including:

- Your status as a participant in the profit-sharing plan.

- The specific terms and conditions outlined in the profit-sharing agreement.

- Any waiting periods or age requirements established by the plan.

Quick guide on how to complete pps profit share withdrawal form

Effortlessly prepare Pps Profit Share Withdrawal Form on any device

Digital document management has gained popularity among companies and individuals. It serves as an excellent sustainable alternative to conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without hassle. Manage Pps Profit Share Withdrawal Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to easily modify and electronically sign Pps Profit Share Withdrawal Form

- Locate Pps Profit Share Withdrawal Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Pps Profit Share Withdrawal Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pps profit share withdrawal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PPS cancellation form?

A PPS cancellation form is a document that allows users to formally request the cancellation of a Personal Pension Scheme. This form facilitates the smooth processing of your cancellation request and ensures that all necessary information is provided. Understanding how to fill out the PPS cancellation form correctly can help expedite your cancellation process.

-

How do I access the PPS cancellation form using airSlate SignNow?

You can easily access the PPS cancellation form by logging into your airSlate SignNow account and navigating to the document management section. From there, you can either upload your existing form or utilize our templates designed specifically for this purpose. Our platform streamlines the process of filling out and signing the PPS cancellation form.

-

Is there a fee associated with submitting a PPS cancellation form through airSlate SignNow?

AirSlate SignNow offers a cost-effective solution for processing documents, including the PPS cancellation form. While there are subscription plans available, submitting your PPS cancellation form typically does not incur extra fees on our platform. It's best to review our pricing page to find a plan that suits your needs.

-

What are the benefits of using airSlate SignNow for my PPS cancellation form?

Using airSlate SignNow for your PPS cancellation form offers several benefits, including easy document management and secure electronic signatures. Additionally, our platform ensures compliance with legal standards, making your cancellation process hassle-free. You'll also save time and reduce paperwork with our straightforward, user-friendly interface.

-

Can I integrate airSlate SignNow with other software for processing the PPS cancellation form?

Yes, airSlate SignNow offers integrations with various software applications, which can enhance your experience when processing the PPS cancellation form. This allows you to streamline workflows, reduce manual data entry, and increase overall efficiency. Check our integration options to see what systems can work seamlessly with your PPS cancellation form.

-

How secure is my information when I submit a PPS cancellation form with airSlate SignNow?

AirSlate SignNow prioritizes your privacy and data security. When you submit your PPS cancellation form, all information is encrypted and stored safely on our servers. Additionally, our compliance with industry-standard security protocols ensures that your personal data remains confidential and protected during the entire process.

-

What should I do if I encounter issues with my PPS cancellation form on airSlate SignNow?

If you encounter any issues while filling out or submitting your PPS cancellation form on airSlate SignNow, our customer support team is here to help. You can signNow out through live chat, email, or by phone, and we’ll assist you in resolving any problems. Our support specialists are trained to guide you through the cancellation process seamlessly.

Get more for Pps Profit Share Withdrawal Form

- Colorado expungement form

- Protest to revised abandonment list colorado form

- Petition for expungement of dui conviction while under the age of 21 colorado form

- Co expungement dui form

- 18 13 122 form

- 18 13 122 crs form

- Oath of affirmation of confidentiality regarding motion to open adoption and relinquish files by chief ci colorado form

- Adoption files form

Find out other Pps Profit Share Withdrawal Form

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile