Ct 8822 Form

What is the Ct 8822

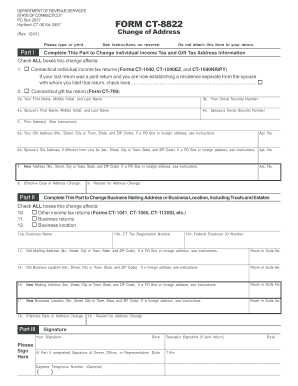

The Ct 8822 form, also known as the Change of Address form, is a document used by taxpayers in the United States to notify the Internal Revenue Service (IRS) of a change in their address. This form is essential for ensuring that the IRS has the correct contact information for taxpayers, which is crucial for receiving important tax documents and correspondence. Failing to update your address can lead to missed notifications about tax obligations, refunds, or other critical information.

How to use the Ct 8822

Using the Ct 8822 form involves a straightforward process. Taxpayers must fill out the form with their current information, including their old address and new address. It is important to ensure that all details are accurate to avoid any issues with the IRS. Once completed, the form can be submitted either by mail or electronically, depending on the taxpayer's preference. Utilizing electronic submission can expedite the update process and provide confirmation of receipt.

Steps to complete the Ct 8822

Completing the Ct 8822 form requires several key steps:

- Obtain the Ct 8822 form from the IRS website or a local IRS office.

- Fill in your personal details, including your name, Social Security number, and both your old and new addresses.

- Review the form for accuracy, ensuring all information is correct.

- Sign and date the form to validate it.

- Submit the form via mail or electronically, as preferred.

Legal use of the Ct 8822

The Ct 8822 form is legally recognized as a valid method for notifying the IRS of a change of address. It complies with IRS regulations, ensuring that taxpayers maintain accurate records with the agency. Proper use of this form helps prevent complications related to tax filings and correspondence, reinforcing the importance of keeping personal information up to date with the IRS.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the Ct 8822 form, it is advisable to submit it as soon as you change your address. Doing so ensures that the IRS has your updated information in time for any upcoming tax filings or communications. Keeping track of tax deadlines, such as the annual filing date for tax returns, is also important to avoid penalties.

Required Documents

When completing the Ct 8822 form, no additional documents are required for submission. However, it may be helpful to have your previous tax returns on hand to verify your old address and ensure consistency. Having your Social Security number readily available is also essential for accurately filling out the form.

Quick guide on how to complete ct 8822 104765

Effortlessly prepare Ct 8822 on any device

Digital document management has gained immense traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and safely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and efficiently. Manage Ct 8822 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to amend and eSign Ct 8822 effortlessly

- Obtain Ct 8822 and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or redact sensitive details with specialized tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your edits.

- Select your preferred method to send your form: by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Ct 8822 and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 8822 104765

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 8822 and how does it relate to airSlate SignNow?

CT 8822 is a critical form for submitting information about tax-exempt organizations. airSlate SignNow enables businesses to easily eSign and send CT 8822 forms, streamlining the process and ensuring compliance with IRS requirements.

-

How much does airSlate SignNow cost for handling ct 8822 forms?

airSlate SignNow offers competitive pricing plans that include features tailored for handling forms like CT 8822. Customers can choose from monthly or annual subscriptions to fit their budget while benefiting from the efficiency of eSigning.

-

What features of airSlate SignNow make it suitable for CT 8822 submissions?

airSlate SignNow provides features such as customizable templates, audit trails, and secure document storage which are essential for managing CT 8822 submissions effectively. These features enhance compliance and facilitate faster processing.

-

How does airSlate SignNow enhance the eSignature experience for CT 8822?

With airSlate SignNow, eSigning CT 8822 forms is straightforward and intuitive. Users can sign documents from anywhere, reducing the time taken to complete tax-related submissions, thus ensuring timely compliance.

-

Are there integrations available between airSlate SignNow and other tools for CT 8822 processing?

Yes, airSlate SignNow integrates seamlessly with various platforms such as CRM and document management systems, making it easy to manage CT 8822 submissions within your existing workflow. This integration ensures that you can streamline document processes efficiently.

-

What benefits can businesses expect when using airSlate SignNow for CT 8822?

Using airSlate SignNow for CT 8822 provides businesses with enhanced efficiency, reduced paper usage, and improved tracking capabilities. By automating the signing process, organizations can save time and reduce the risk of errors in tax submissions.

-

Is airSlate SignNow secure for submitting sensitive CT 8822 information?

Absolutely! airSlate SignNow employs top-notch security protocols, including encryption and secure cloud storage, ensuring that sensitive information submitted through CT 8822 is kept safe from unauthorized access.

Get more for Ct 8822

- Satisfaction release or cancellation of deed of trust by corporation colorado form

- Colorado trust 497300747 form

- Partial release of property from deed of trust for corporation colorado form

- Colorado release deed trust form

- Colorado tenancy joint form

- Colorado child form

- Warranty deed for separate or joint property to joint tenancy colorado form

- Warranty deed to separate property of one spouse to both as joint tenants colorado form

Find out other Ct 8822

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim