Cr Q1 Form

What is the Cr Q1?

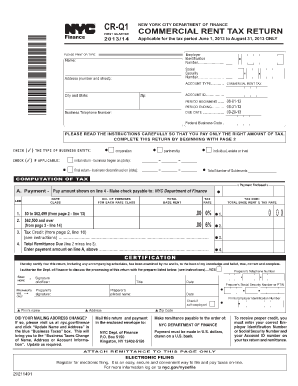

The Cr Q1 form, also known as the printable Q1 form, is a tax document used in New York City for reporting commercial rent tax. This form is essential for businesses that lease commercial space within the city limits and are subject to the city's commercial rent tax regulations. The Cr Q1 helps landlords and tenants accurately report their rental income and calculate the applicable tax owed to the city.

How to Use the Cr Q1

Using the Cr Q1 form involves a straightforward process. First, gather all necessary information regarding your commercial lease, including the total rent paid during the reporting period. Next, download the printable Q1 form from a reliable source. Fill in the required fields, ensuring that all information is accurate and complete. Once the form is filled out, it can be submitted electronically or printed for mailing, depending on your preference and the submission guidelines provided by the city.

Steps to Complete the Cr Q1

Completing the Cr Q1 requires careful attention to detail. Follow these steps:

- Download the printable Q1 form from a trusted source.

- Fill in your business name, address, and other identifying information.

- Report the total rent paid during the specified period.

- Calculate the commercial rent tax based on the provided rates.

- Review the form for accuracy before submission.

- Submit the form either online or by mail, as per the guidelines.

Legal Use of the Cr Q1

The legal use of the Cr Q1 form is crucial for compliance with New York City tax laws. The form must be filled out accurately to avoid penalties. Electronic signatures are acceptable, provided they meet the requirements set forth by eSignature laws. Using a reliable platform for signing and submitting the form can enhance its legal standing and ensure that all necessary regulations are followed.

Filing Deadlines / Important Dates

Filing deadlines for the Cr Q1 are typically set by the New York City Department of Finance. It is important for businesses to be aware of these dates to avoid late fees or penalties. Generally, the Cr Q1 form must be submitted quarterly, with specific due dates that correspond to the end of each quarter. Keeping a calendar of these deadlines can help ensure timely submissions.

Required Documents

To complete the Cr Q1 form, certain documents are necessary. These include:

- Your commercial lease agreement.

- Records of rent payments made during the reporting period.

- Any previous correspondence with the New York City Department of Finance regarding your commercial rent tax.

Having these documents readily available will facilitate a smooth completion of the form.

Quick guide on how to complete cr q1

Complete Cr Q1 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for standard printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Cr Q1 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Cr Q1 with minimal effort

- Obtain Cr Q1 and click Get Form to initiate.

- Utilize the tools provided to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that function.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Cr Q1 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cr q1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a printable Q1 form?

A printable Q1 form is a document that businesses can use to report their quarterly financials. It is essential for companies to accurately submit this form for tax purposes and ensure compliance with financial regulations. The printable Q1 form can be downloaded and customized for easy integration into your accounting processes.

-

How does airSlate SignNow simplify the process of creating a printable Q1 form?

airSlate SignNow simplifies the creation of a printable Q1 form by providing intuitive templates that can be easily customized. Users can fill out and adjust the fields necessary for their specific financial reporting needs. This reduces the time spent on paperwork, allowing businesses to focus on their operations.

-

Is there a cost associated with using airSlate SignNow for printable Q1 forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. Each plan provides access to features that facilitate the creation and signing of printable Q1 forms. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools to manage my printable Q1 form?

Absolutely! airSlate SignNow supports integrations with various popular business applications like Google Drive, Dropbox, and accounting software. This means you can seamlessly manage your printable Q1 form alongside your other essential documents and workflows.

-

What are the benefits of using airSlate SignNow for my printable Q1 form?

Using airSlate SignNow for your printable Q1 form offers numerous benefits, including faster turnaround times, reduced errors, and enhanced security. The platform allows for easy collaboration and ensures that your forms are eSigned quickly and securely, improving your document workflow.

-

How can I ensure my printable Q1 form is compliant with tax regulations?

To ensure compliance, it's essential to use the latest versions of the printable Q1 form provided by airSlate SignNow. The platform regularly updates its templates to reflect the latest tax regulations. Additionally, consulting with a tax professional can provide further assurance regarding compliance.

-

Can I share my printable Q1 form with clients or stakeholders using airSlate SignNow?

Yes, you can easily share your printable Q1 form with clients or stakeholders using airSlate SignNow. The platform allows you to send documents securely via email or share links directly, ensuring that only authorized users have access to your important financial information.

Get more for Cr Q1

- Interrogatories to plaintiff for motor vehicle occurrence new hampshire form

- Interrogatories to defendant for motor vehicle accident new hampshire form

- Llc notices resolutions and other operations forms package new hampshire

- Residential real estate sales disclosure statement new hampshire form

- Notice of dishonored check civil keywords bad check bounced check new hampshire form

- Mutual wills containing last will and testaments for unmarried persons living together with no children new hampshire form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children new hampshire form

- Mutual wills or last will and testaments for unmarried persons living together with minor children new hampshire form

Find out other Cr Q1

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now