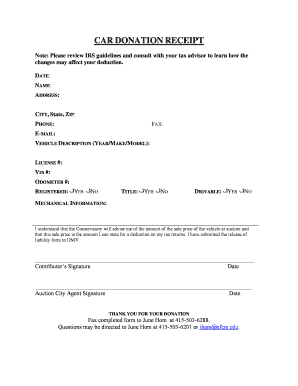

Car Donation Receipt Form

What is the car donation receipt?

A car donation receipt is a document provided by a charitable organization to acknowledge the receipt of a vehicle donation. This receipt serves as proof of the donation for both the donor and the charity. It typically includes essential details such as the donor's name, the vehicle's make and model, the date of the donation, and the charity's information. This receipt is crucial for tax purposes, as it allows the donor to claim a tax deduction for their charitable contribution.

Key elements of the car donation receipt

When creating a vehicle donation receipt, certain key elements must be included to ensure it meets legal requirements and serves its purpose effectively. These elements include:

- Donor information: The full name and address of the individual donating the vehicle.

- Charity information: The name and address of the charitable organization receiving the donation.

- Vehicle details: Description of the vehicle, including make, model, year, and VIN (Vehicle Identification Number).

- Date of donation: The exact date when the vehicle was donated.

- Value of the vehicle: A good faith estimate of the vehicle's fair market value at the time of donation.

- Signature: The signature of an authorized representative from the charity, confirming the receipt.

How to obtain the car donation receipt

To obtain a car donation receipt, a donor should follow these steps:

- Choose a qualified charity: Ensure that the organization is recognized as a tax-exempt charity by the IRS.

- Complete the donation: Donate the vehicle to the charity, either by delivering it in person or arranging for the charity to pick it up.

- Request the receipt: After the donation is made, ask the charity for a written receipt. Most organizations will provide this immediately or shortly after the donation.

Steps to complete the car donation receipt

Completing a vehicle donation receipt involves several straightforward steps to ensure all necessary information is captured accurately:

- Gather information: Collect all relevant details about the donor, the charity, and the vehicle.

- Fill out the receipt: Input the gathered information into the receipt template, ensuring accuracy and clarity.

- Review for accuracy: Double-check the completed receipt for any errors or missing information.

- Sign and date: The authorized representative from the charity should sign and date the receipt to validate it.

Legal use of the car donation receipt

The car donation receipt is not only a record of the transaction but also serves a legal purpose. It is essential for the donor to retain this document for tax filing purposes. Under IRS regulations, donors can claim a tax deduction based on the fair market value of the donated vehicle, provided they have a valid receipt. The receipt must be kept with the donor's tax records and may be required if the IRS requests documentation for the claimed deduction.

IRS guidelines

The IRS provides specific guidelines regarding vehicle donations. Donors should be aware of the following key points:

- Deduction limits: The amount that can be deducted depends on the vehicle's value and how the charity uses it.

- Form 8283: If the vehicle's value exceeds $500, the donor must complete Form 8283 and attach it to their tax return.

- Documentation requirements: Donors must have a written acknowledgment from the charity for any donation valued at $250 or more.

Quick guide on how to complete car donation receipt

Effortlessly Prepare Car Donation Receipt on Any Device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Car Donation Receipt on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Edit and Electronically Sign Car Donation Receipt with Ease

- Obtain Car Donation Receipt and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which only takes seconds and has the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether it be via email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Car Donation Receipt to guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the car donation receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Can you donate a car with expired registration in California?

01Tell us about your car But don't sweat it, because we accept all kinds of vehicles- even those without a pink slip, in a non-operational state, or with expired registration. Kars4Kids doesn't discriminate!

-

How do I write off a donated car on my taxes?

How much can I deduct? Once your vehicle is sold, the selling price determines the amount of your donation. If your vehicle sells for more than $500, you may deduct the full selling price. If your vehicle sells for $500 or less, you can deduct the “fair market value” of your vehicle, up to $500.

-

How do you write a receipt for donations?

Here's a list of what to include in each of your receipts: Your organization's name. Your donor's name. Your recorded date of the donation. Your recorded amount of the donation. Your organization's 501(c)(3) status. Your acknowledgment no goods/services were exchanged for the donation.

-

Is donating a car a good tax write off?

Donating your car to charity can result in signNow tax savings if you include it in your charitable contribution deduction. However, doing a little planning will ensure that you maximize the tax savings of your donation.

-

How do I donate a car to charity in California?

Call 1-877-646-1976 or fill out an online donation form. A member of our staff will contact you within 24 hours of the next business day. Receive free pick up or towing of your vehicle, whether the vehicle runs or not.

-

Can you deduct state and local taxes on Schedule A?

Summary. An individual may claim an itemized deduction on Schedule A (Form 1040) for state and local general sales tax in lieu of state and local income tax, even if those taxes are not incurred in connection with a trade or business or for the production of income.

-

Which of the following state and local income taxes are deductible on Schedule A?

Deductions for state and local sales tax (SALT), income, and property taxes can be itemized on Schedule A. The total amount you are claiming for state and local sales, income, and property taxes cannot exceed $10,000.

-

What is the IRS publication on car donation?

An increasingly popular fundraising program is the sale of donated cars. Through this Publication 4302, the Internal Revenue Service (IRS) and state charity officials provide general guidelines for charities operating car donation programs.

Get more for Car Donation Receipt

- Dependent sholarship jefferson form

- Wood badge training recognition form

- Nc dhhs voluntary self audit form

- Irs form 14402

- Lsu official transcript request form pdf

- National american university transcript request 2009 form

- Exempt application northwest indian college nwic form

- South dakota iep technical assistance guide form

Find out other Car Donation Receipt

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free