Fuel Reimbursement Form

What is the fuel reimbursement form?

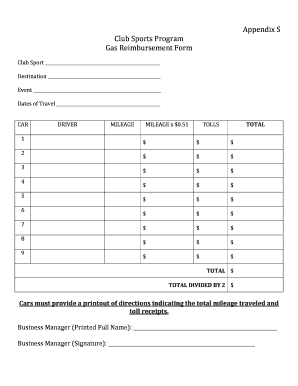

The fuel reimbursement form is a document used by employees to request reimbursement for fuel expenses incurred while performing work-related duties. This form is essential for tracking and managing fuel costs, ensuring that employees are compensated fairly for their travel expenses. Typically, the form includes sections for detailing the purpose of the trip, the distance traveled, and the total fuel costs incurred, allowing employers to process reimbursements accurately and efficiently.

How to use the fuel reimbursement form

Using the fuel reimbursement form involves several steps to ensure that the request is complete and accurate. First, employees should fill out their personal information, including name, employee ID, and department. Next, they must provide details about the trip, such as the date, purpose, and starting and ending locations. After calculating the total fuel cost based on mileage and fuel prices, employees should attach any relevant receipts. Finally, the completed form should be submitted to the appropriate department for processing.

Steps to complete the fuel reimbursement form

Completing the fuel reimbursement form requires careful attention to detail. Follow these steps:

- Gather necessary information, including trip details and fuel receipts.

- Fill in personal information accurately.

- Document the trip purpose and distances traveled.

- Calculate total fuel expenses based on mileage and current fuel prices.

- Attach any receipts to support the reimbursement request.

- Review the form for accuracy before submission.

Key elements of the fuel reimbursement form

Several key elements are essential for a fuel reimbursement form to be effective:

- Employee Information: Name, ID, and department.

- Trip Details: Dates, purpose, and locations.

- Mileage: Total distance traveled.

- Fuel Costs: Total expenses incurred.

- Receipts: Supporting documents for reimbursement.

Legal use of the fuel reimbursement form

The legal use of the fuel reimbursement form is governed by company policies and relevant tax regulations. Employers must ensure that the form complies with federal and state laws regarding expense reimbursements. Proper documentation, including receipts and accurate reporting of expenses, is crucial for maintaining compliance. Additionally, employees should be aware of their rights regarding reimbursement claims to avoid any potential disputes.

Form submission methods

The fuel reimbursement form can typically be submitted through various methods, depending on company policy. Common submission methods include:

- Online Submission: Many companies offer digital platforms for submitting forms electronically.

- Mail: Employees may send physical copies of the form and receipts to the finance department.

- In-Person: Some organizations allow employees to submit forms directly to their supervisor or HR department.

Quick guide on how to complete fuel reimbursement form

Effortlessly Prepare Fuel Reimbursement Form on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed forms and signed papers, as you can easily find the appropriate template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Fuel Reimbursement Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and electronically sign Fuel Reimbursement Form without any hassle

- Find Fuel Reimbursement Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with the specialized tools provided by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send the form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Edit and electronically sign Fuel Reimbursement Form and ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fuel reimbursement form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a gas mileage reimbursement form?

A gas mileage reimbursement form is a document used by employees to request compensation for fuel expenses incurred during work-related travel. This form typically includes details such as the purpose of travel, distances traveled, and applicable rates. Utilizing airSlate SignNow allows for the efficient processing of these forms, ensuring employees are reimbursed quickly.

-

How can I create a gas mileage reimbursement form using airSlate SignNow?

Creating a gas mileage reimbursement form with airSlate SignNow is straightforward. You can start by selecting a customizable template and adding your company's branding and relevant fields. Once your form is set up, you can send it out for eSignature, making it easier for employees to submit their claims.

-

What are the benefits of using an electronic gas mileage reimbursement form?

Using an electronic gas mileage reimbursement form streamlines the reimbursement process, eliminates paperwork, and reduces errors. With airSlate SignNow, your team can fill out forms digitally, track submissions, and ensure compliance effortlessly. This leads to quicker reimbursements and enhanced employee satisfaction.

-

Is there a cost associated with using airSlate SignNow for gas mileage reimbursement forms?

Yes, airSlate SignNow offers various pricing plans based on your needs and the size of your organization. Each plan includes features designed to simplify the process of handling gas mileage reimbursement forms, such as integration options and customizable templates. Ensuring you choose the right plan can maximize your business's efficiency.

-

Can I integrate gas mileage reimbursement forms with other applications?

Absolutely! airSlate SignNow provides integration options with various productivity and financial software. This allows you to link your gas mileage reimbursement forms directly with your accounting or HR tools, creating a seamless workflow and simplifying the reimbursement process for all involved parties.

-

How does airSlate SignNow ensure the security of my gas mileage reimbursement forms?

airSlate SignNow places a high priority on security. All gas mileage reimbursement forms processed through the platform are encrypted and stored securely in compliance with industry standards. This means your sensitive information and employee data remain safe while ensuring convenient access for authorized users.

-

How do I track the status of submitted gas mileage reimbursement forms?

With airSlate SignNow, you can easily track the status of submitted gas mileage reimbursement forms in real-time. The platform provides notifications and updates to keep you informed about each form's progress, from submission to approval. This transparency helps streamline your reimbursement process.

Get more for Fuel Reimbursement Form

- Brick mason contractor package delaware form

- Roofing contractor package delaware form

- Electrical contractor package delaware form

- Sheetrock drywall contractor package delaware form

- Flooring contractor package delaware form

- Trim carpentry contractor package delaware form

- Fencing contractor package delaware form

- Hvac contractor package delaware form

Find out other Fuel Reimbursement Form

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document