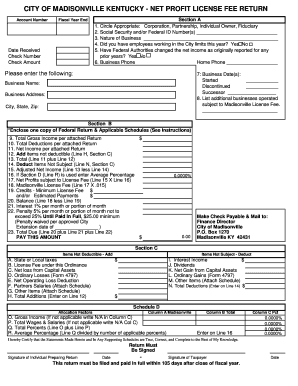

Net Profit License Fee Return City of Madisonville, Kentucky Form

Understanding the Net Profit License Fee Return in Madisonville, Kentucky

The Net Profit License Fee Return for the city of Madisonville, Kentucky, is a crucial document for businesses operating within the city. This form is designed to calculate the occupational tax owed based on the net profits of the business. It ensures that local businesses contribute fairly to the city's revenue, which supports community services and infrastructure. The form requires detailed financial information, including gross receipts and allowable deductions, to determine the taxable amount accurately.

Steps to Complete the Net Profit License Fee Return

Completing the Net Profit License Fee Return involves several important steps:

- Gather Financial Records: Collect all necessary financial documents, including income statements and expense reports.

- Calculate Net Profit: Determine your net profit by subtracting allowable expenses from gross income.

- Fill Out the Form: Enter the required information on the form, ensuring accuracy in all calculations.

- Review for Accuracy: Double-check all entries for any errors or omissions.

- Submit the Form: File the completed form by the specified deadline, either online or via mail.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the Net Profit License Fee Return to avoid penalties. Typically, the return must be filed annually, with specific due dates set by the city. Businesses should mark their calendars for these important dates to ensure timely submission and compliance with local tax laws.

Form Submission Methods

Businesses in Madisonville have several options for submitting the Net Profit License Fee Return. These methods include:

- Online Submission: Many businesses prefer to file electronically for convenience and speed.

- Mail: Completed forms can be sent via postal service to the designated city office.

- In-Person: Businesses may also choose to deliver their forms directly to the city tax office.

Legal Use of the Net Profit License Fee Return

The Net Profit License Fee Return is a legally binding document. It must be completed accurately to ensure compliance with local tax regulations. Falsifying information on the form can lead to significant penalties, including fines and legal repercussions. Understanding the legal implications of this document is crucial for all business owners in Madisonville.

Penalties for Non-Compliance

Failure to file the Net Profit License Fee Return on time or inaccuracies in the submitted information can result in penalties. These may include monetary fines or interest on unpaid taxes. It is important for businesses to stay informed about their obligations and ensure timely compliance to avoid these consequences.

Quick guide on how to complete net profit license fee return city of madisonville kentucky

Effortlessly Prepare Net Profit License Fee Return City Of Madisonville, Kentucky on Any Gadget

Online document handling has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary format and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without any delays. Manage Net Profit License Fee Return City Of Madisonville, Kentucky on any device with airSlate SignNow Android or iOS applications and enhance any document-centric activity today.

How to Modify and eSign Net Profit License Fee Return City Of Madisonville, Kentucky with Ease

- Find Net Profit License Fee Return City Of Madisonville, Kentucky and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark signNow sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and select the Done button to save your adjustments.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Net Profit License Fee Return City Of Madisonville, Kentucky and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the net profit license fee return city of madisonville kentucky

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Madisonville KY occupational tax?

The city of Madisonville KY occupational tax is a tax levied on individuals and businesses operating within the city. It is calculated based on the total income earned and is used to fund local services and infrastructure. Understanding this tax is essential for compliance and to avoid penalties.

-

How does airSlate SignNow simplify managing the city of Madisonville KY occupational tax documents?

airSlate SignNow streamlines the process of managing documents related to the city of Madisonville KY occupational tax by allowing users to easily create, send, and eSign forms. This digital solution reduces paperwork, ensuring that all tax-related documents are securely stored and easily retrievable. With features like templates and reminders, tracking deadlines becomes effortless.

-

What features does airSlate SignNow offer for handling city of Madisonville KY occupational tax filings?

AirSlate SignNow provides features like document templates tailored for the city of Madisonville KY occupational tax filings, eSignature capabilities, and automated workflow management. These tools help ensure that all documents are accurately filled and submitted on time. Additionally, real-time tracking and notifications keep you informed about the status of your tax documents.

-

Is there a cost associated with using airSlate SignNow for city of Madisonville KY occupational tax documentation?

Yes, airSlate SignNow offers affordable pricing plans tailored for businesses handling the city of Madisonville KY occupational tax documentation. By providing a cost-effective solution, businesses can efficiently manage their tax documents without incurring excessive costs. Different plans ensure that users can choose one that best fits their needs.

-

Can I integrate airSlate SignNow with other tools for managing city of Madisonville KY occupational tax?

Absolutely! airSlate SignNow integrates seamlessly with various tools and software that can assist in managing the city of Madisonville KY occupational tax. These integrations enhance productivity by allowing users to synchronize data from different platforms, ensuring that all tax-related information is consistent and up-to-date.

-

What are the benefits of using airSlate SignNow for city of Madisonville KY occupational tax purposes?

Using airSlate SignNow for city of Madisonville KY occupational tax purposes offers numerous benefits, including increased efficiency, cost savings, and enhanced compliance. The platform digitizes your tax documentation process, reducing the risk of errors and ensuring timely submissions. Additionally, the ease of eSigning documents minimizes delays associated with traditional methods.

-

How secure is airSlate SignNow when handling sensitive city of Madisonville KY occupational tax information?

AirSlate SignNow prioritizes security by implementing advanced encryption methods and secure access controls to protect sensitive city of Madisonville KY occupational tax information. Compliance with industry standards ensures that your data remains confidential and secure throughout the document management process. Users can have peace of mind knowing their information is safe.

Get more for Net Profit License Fee Return City Of Madisonville, Kentucky

- Planning engineering ampamp permitsthe official website forplanning engineering and permits faqthe official planning form

- Tennessee contract for sale and purchase of real estate with no broker for residential home sale agreement 495361727 form

- State of tennessee electrical permit form

- Save footprint forrest foxborough of montvaleplann form

- Njhfma form

- Oppenheimer fillable application form

- Emery county building department form

- Town of leeds 218 north main street po box 460879 form

Find out other Net Profit License Fee Return City Of Madisonville, Kentucky

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple