How to Fill Pmmy Loan Form

Understanding the Mudra Loan Application

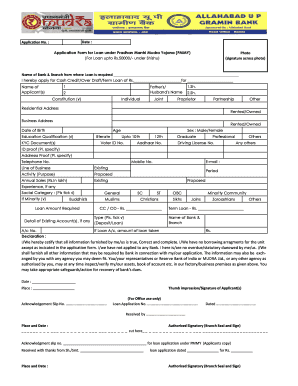

The Mudra loan application is a crucial step for individuals seeking financial assistance under the Pradhan Mantri Mudra Yojana. This initiative aims to provide loans to small businesses and entrepreneurs. Understanding the application process can enhance your chances of approval. The application typically requires personal information, business details, and financial projections. It is essential to gather all necessary documents before starting the application to ensure a smooth experience.

Steps to Complete the Mudra Loan Application

Filling out the Mudra loan application form involves several steps:

- Gather required documents, including identity proof, address proof, and business details.

- Visit the official website or designated bank branch to access the application form.

- Fill in personal information accurately, ensuring all details match your official documents.

- Provide comprehensive information about your business, including its nature, location, and financial history.

- Attach all necessary documents as specified in the application guidelines.

- Review the completed form for accuracy before submission.

- Submit the application either online or at the bank branch as per your preference.

Required Documents for the Mudra Loan

To successfully fill out the Mudra loan application form, you will need to prepare several documents:

- Identity Proof: A government-issued ID such as a passport, driver's license, or Aadhaar card.

- Address Proof: Utility bills, rental agreements, or bank statements showing your current address.

- Business Plan: A detailed plan outlining your business model, target market, and financial projections.

- Financial Statements: Previous years' income statements and balance sheets, if applicable.

- Bank Statements: Recent bank statements to demonstrate financial stability.

Legal Use of the Mudra Loan Application

The Mudra loan application form is legally binding once submitted. To ensure compliance, it is vital to provide accurate information and adhere to the guidelines set forth by the lending institution. Misrepresentation or incomplete information can lead to rejection or legal consequences. Additionally, using a reliable platform for e-signatures, such as airSlate SignNow, ensures that your application is securely submitted and legally recognized.

Application Process and Approval Time

The application process for the Mudra loan typically involves several stages:

- Submission: After filling out the application form and attaching the necessary documents, submit it online or in person.

- Verification: The lending institution will verify the provided information and documents.

- Approval: Once verified, the loan application will be approved or rejected based on eligibility criteria.

- Disbursement: If approved, the loan amount will be disbursed to your bank account within a specified timeframe, usually ranging from a few days to a few weeks.

Eligibility Criteria for the Mudra Loan

To qualify for a Mudra loan, applicants must meet specific eligibility criteria:

- Applicants must be Indian citizens.

- The business should be a non-farm enterprise.

- Individuals must demonstrate a viable business plan with potential for growth.

- Loan amounts are typically available in three categories: Shishu (up to INR 50,000), Kishore (INR 50,001 to INR 5,00,000), and Tarun (INR 5,00,001 to INR 10,00,000).

Quick guide on how to complete how to fill pmmy loan

Complete How To Fill Pmmy Loan effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage How To Fill Pmmy Loan on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

How to modify and eSign How To Fill Pmmy Loan with ease

- Find How To Fill Pmmy Loan and then click Get Form to begin.

- Utilize the resources we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes only a few seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Select how you wish to share your form—via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign How To Fill Pmmy Loan to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to fill pmmy loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Mudra loan application form?

The Mudra loan application form is a document required to apply for a Micro Units Development and Refinance Agency (MUDRA) loan. Understanding how to fill the Mudra loan application form correctly is crucial for ensuring your eligibility and securing funds to start or expand your small business.

-

How do I begin filling out the Mudra loan application form?

To fill the Mudra loan application form, start by gathering all necessary documents, including business identity proof and financial statements. It’s important to understand how to fill the Mudra loan application form step by step, ensuring accuracy in the details provided to avoid processing delays.

-

What documents are required for the Mudra loan application form?

Typically, you will need your business registration documents, KYC details, and financial history. Knowing how to fill the Mudra loan application form includes being prepared with these documents to streamline your application process.

-

What common mistakes should I avoid when filling out the Mudra loan application form?

Common mistakes include providing incorrect personal information or insufficient financial details. It is essential to know how to fill the Mudra loan application form accurately to enhance your chances of loan approval.

-

Can I fill the Mudra loan application form online?

Yes, many banks and financial institutions now offer the option to fill the Mudra loan application form online. Ensure to follow the portal's guidelines on how to fill the Mudra loan application form to facilitate a smooth submission process.

-

How does airSlate SignNow help with the Mudra loan application form?

airSlate SignNow allows you to securely eSign and send the Mudra loan application form quickly. By using airSlate SignNow, you can ensure that your application is filled out, signed, and submitted without the hassle of physical paperwork.

-

What are the fees associated with the Mudra loan application process?

There may be nominal fees associated with processing the loan application, depending on the lender. Understanding how to fill the Mudra loan application form fully can help clarify any potential costs involved.

Get more for How To Fill Pmmy Loan

Find out other How To Fill Pmmy Loan

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself