Real Estate Agent Tax Deductions Worksheet Form

What is the Real Estate Agent Tax Deductions Worksheet

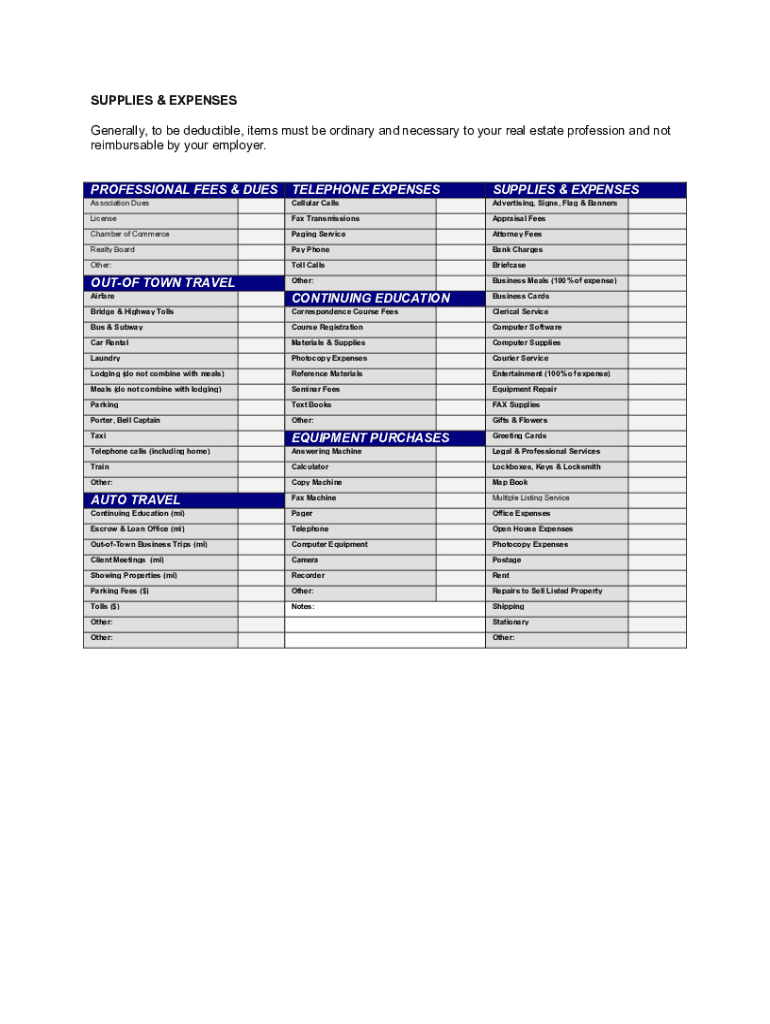

The Real Estate Agent Tax Deductions Worksheet is a tool designed to help real estate professionals track and calculate their eligible tax deductions. This worksheet provides a structured format for documenting various expenses incurred during the course of their business. These deductions may include costs related to marketing, office supplies, travel, and other business-related expenses that can significantly reduce taxable income. By using this worksheet, agents can ensure they capture all potential deductions, which can lead to substantial tax savings.

How to Use the Real Estate Agent Tax Deductions Worksheet

Using the Real Estate Agent Tax Deductions Worksheet involves several straightforward steps. First, gather all relevant receipts and documentation for your business expenses. Next, categorize these expenses according to the sections provided in the worksheet, such as advertising, vehicle expenses, and professional services. Enter the amounts in the corresponding fields, ensuring accuracy to avoid issues during tax filing. Finally, review the completed worksheet to ensure all deductions are accounted for before submitting them with your tax return.

Steps to Complete the Real Estate Agent Tax Deductions Worksheet

Completing the Real Estate Agent Tax Deductions Worksheet effectively requires attention to detail. Start by listing your business income at the top of the worksheet. Then, proceed to fill in each section with the relevant expenses:

- Advertising: Include costs for online ads, brochures, and signage.

- Vehicle Expenses: Document mileage or actual expenses related to your vehicle used for business purposes.

- Office Supplies: Record costs for items like paper, pens, and other necessary supplies.

- Professional Services: Note fees paid to accountants, legal consultants, or other professionals.

After entering all data, double-check for accuracy and completeness before filing your taxes.

Legal Use of the Real Estate Agent Tax Deductions Worksheet

The Real Estate Agent Tax Deductions Worksheet is legally recognized as a valid method for documenting business expenses for tax purposes. It adheres to IRS guidelines, which require taxpayers to maintain accurate records of their expenses. By using this worksheet, real estate agents can substantiate their claims for deductions, ensuring compliance with tax regulations. This legal backing is crucial for avoiding potential audits or penalties from the IRS.

Key Elements of the Real Estate Agent Tax Deductions Worksheet

Several key elements make up the Real Estate Agent Tax Deductions Worksheet. These include:

- Income Section: A space to record total business income.

- Expense Categories: Clearly defined sections for different types of expenses.

- Total Deductions: A calculation area to summarize total deductible amounts.

- Signature Line: A place for the agent's signature to affirm the accuracy of the information provided.

These elements ensure that the worksheet is comprehensive and user-friendly, facilitating accurate tax reporting.

IRS Guidelines

The IRS provides specific guidelines regarding the types of deductions available to real estate agents. These guidelines outline what constitutes a legitimate business expense and the documentation required to support these deductions. Agents should familiarize themselves with IRS Publication 535, which details business expenses and provides examples relevant to real estate professionals. Adhering to these guidelines is essential for maximizing deductions while ensuring compliance with tax laws.

Quick guide on how to complete tax deductions for a realtor form

Discover how to smoothly navigate the Real Estate Agent Tax Deductions Worksheet process with this straightforward guide

Online filing and form completion are gaining popularity and have become the preferred choice for numerous users. This method offers several advantages over conventional printed documents, such as convenience, time savings, increased precision, and security.

With solutions like airSlate SignNow, you can locate, modify, authenticate, enhance, and send your Real Estate Agent Tax Deductions Worksheet without the hassle of constant printing and scanning. Follow this brief guide to begin and complete your document.

Make use of these steps to obtain and fill out Real Estate Agent Tax Deductions Worksheet

- Begin by clicking the Get Form button to launch your form in our editor.

- Pay attention to the green tag on the left that highlights required fields so you don’t miss them.

- Utilize our professional features to annotate, edit, sign, secure, and enhance your document.

- Safeguard your file or convert it into a fillable form using the appropriate tab options.

- Review the form for any mistakes or inconsistencies.

- Click DONE to complete the editing process.

- Rename your document or retain its original name.

- Select the storage option you prefer to keep your form, send it via USPS, or click the Download Now button to save your form.

If Real Estate Agent Tax Deductions Worksheet is not what you were looking for, feel free to explore our extensive library of pre-uploaded templates that you can complete with ease. Visit our platform today!

Create this form in 5 minutes or less

FAQs

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the tax deductions for a realtor form

How to make an eSignature for your Tax Deductions For A Realtor Form online

How to make an electronic signature for your Tax Deductions For A Realtor Form in Google Chrome

How to generate an eSignature for putting it on the Tax Deductions For A Realtor Form in Gmail

How to create an eSignature for the Tax Deductions For A Realtor Form from your smart phone

How to make an electronic signature for the Tax Deductions For A Realtor Form on iOS devices

How to create an eSignature for the Tax Deductions For A Realtor Form on Android devices

People also ask

-

What is a real estate agent tax deductions worksheet PDF?

A real estate agent tax deductions worksheet PDF is a document designed to help real estate professionals track their deductible expenses throughout the tax year. This worksheet simplifies tax preparation by providing a structured format to record various deductions, ensuring that agents maximize their tax benefits.

-

How can airSlate SignNow help me with my real estate agent tax deductions worksheet PDF?

With airSlate SignNow, you can easily upload, edit, and eSign your real estate agent tax deductions worksheet PDF. Our platform ensures your important documents are securely stored and accessible anytime, making tax filing more efficient and stress-free for real estate agents.

-

Is there a cost associated with using airSlate SignNow for my real estate agent tax deductions worksheet PDF?

airSlate SignNow offers a variety of pricing plans that cater to different needs, including features for managing your real estate agent tax deductions worksheet PDF. We provide a free trial so you can explore our platform and determine which plan best suits your business requirements.

-

What features does airSlate SignNow offer for managing tax documents?

AirSlate SignNow includes features such as document templates, cloud storage, eSignature capabilities, and real-time collaboration tools. These features enhance the management of your real estate agent tax deductions worksheet PDF and other essential documents, streamlining your workflow.

-

Can I integrate airSlate SignNow with other software I use for my business?

Yes, airSlate SignNow offers several integrations with popular tools that real estate agents often use, such as CRM systems and accounting software. This allows for seamless data transfer and efficient management of your real estate agent tax deductions worksheet PDF alongside other business activities.

-

How does airSlate SignNow ensure the security of my documents?

AirSlate SignNow prioritizes document security by using advanced encryption methods and secure cloud storage. This means that your real estate agent tax deductions worksheet PDF and other sensitive documents are protected against unauthorized access and data bsignNowes.

-

What are the benefits of using airSlate SignNow for real estate agents?

By using airSlate SignNow, real estate agents can save time, reduce paperwork, and enhance document accuracy. Our solution simplifies the management of your real estate agent tax deductions worksheet PDF, ensuring you can focus more on closing deals rather than handling administrative tasks.

Get more for Real Estate Agent Tax Deductions Worksheet

Find out other Real Estate Agent Tax Deductions Worksheet

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free