Are 1 Form

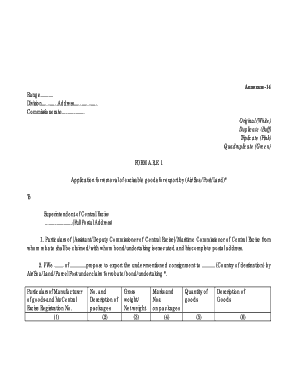

What is the Are 1 Form

The Are 1 form is a crucial document used in the United States for reporting excise taxes related to certain goods and services. This form is specifically designed for businesses engaged in activities that are subject to federal excise taxes, such as manufacturers, importers, and retailers. The Are 1 form helps ensure compliance with tax obligations and provides a structured way to report the necessary information to the Internal Revenue Service (IRS).

How to use the Are 1 Form

Using the Are 1 form involves several steps to ensure accurate reporting of excise taxes. First, businesses must gather all relevant financial data related to the goods or services subject to excise tax. This includes sales figures, production quantities, and any applicable exemptions. Next, the form must be filled out meticulously, ensuring that all sections are completed with accurate information. Once completed, the form can be submitted electronically or by mail, depending on the preferred method of filing.

Steps to complete the Are 1 Form

Completing the Are 1 form requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents related to excise tax.

- Fill out the form with accurate information, including business details and tax amounts.

- Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the completed form electronically through the IRS website or send it via mail to the appropriate address.

Legal use of the Are 1 Form

The Are 1 form is legally binding and must be used in accordance with IRS regulations. It is essential for businesses to ensure that they comply with all legal requirements when filing this form. Failure to do so can result in penalties, including fines and interest on unpaid taxes. The form serves as a record of compliance and is important for audits or reviews by tax authorities.

Key elements of the Are 1 Form

Several key elements must be included in the Are 1 form to ensure its validity. These include:

- Business identification information, including the name and address.

- Details of the goods or services subject to excise tax.

- The amount of excise tax owed for the reporting period.

- Signature of the authorized person certifying the accuracy of the information.

Form Submission Methods

The Are 1 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Electronic submission via the IRS e-file system, which is often faster and more efficient.

- Mailing a paper form to the designated IRS address, which may take longer for processing.

- In-person submission at local IRS offices, if available, for immediate assistance.

Quick guide on how to complete are 1 form

Effortlessly Handle Are 1 Form on Any Device

Digital document management has gained traction with companies and individuals alike. It offers an excellent eco-conscious substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without setbacks. Manage Are 1 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-based workflow today.

How to Modify and Electronically Sign Are 1 Form with Ease

- Obtain Are 1 Form and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that task.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Adjust and electronically sign Are 1 Form while ensuring exceptional communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the are 1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 1 features of airSlate SignNow?

airSlate SignNow offers a range of features that simplify the signing process. These features include customizable templates, in-person signing, and advanced document tracking. With these tools, users can manage their documents efficiently and streamline their workflows.

-

How much are 1 subscriptions for airSlate SignNow?

The pricing for airSlate SignNow varies based on the subscription plan chosen. Generally, the plans cater to different business needs, ranging from individual users to large teams. Explore our pricing page to find a plan that best suits your budget and requirements.

-

What benefits are 1 associated with using airSlate SignNow?

By using airSlate SignNow, businesses can signNowly reduce turnaround time for document signing. The platform enhances productivity by allowing users to send, receive, and track documents seamlessly. Additionally, it provides a secure environment for document management.

-

Which applications are 1 integrated with airSlate SignNow?

airSlate SignNow integrates with a variety of applications to enhance functionality. Some popular integrations include Google Drive, Salesforce, and Microsoft Office. These integrations allow users to leverage existing tools and create a more cohesive workflow.

-

Are 1 signatures legally binding with airSlate SignNow?

Yes, signatures obtained through airSlate SignNow are legally binding. The platform complies with eSignature laws and regulations, ensuring that your documents hold legal weight. This provides users with the confidence they need when sending important documents.

-

How secure are 1 documents stored in airSlate SignNow?

Document security is a top priority for airSlate SignNow. The platform employs advanced encryption technology and follows strict compliance standards to protect your data. Users can rest assured that their documents are stored securely.

-

What support options are 1 available for airSlate SignNow users?

airSlate SignNow provides multiple support options to assist users. This includes a comprehensive knowledge base, live chat support, and email assistance. Users can access these resources whenever they have questions or encounter issues.

Get more for Are 1 Form

- New york report new york form

- New york workers compensation form

- New resident guide new york form

- Claimant action form

- Ny request form 497321893

- Satisfaction release of mortgage by mortgagee by corporate lender new york form

- Mortgage holder 497321895 form

- Partial release of property from mortgage for corporation new york form

Find out other Are 1 Form

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple