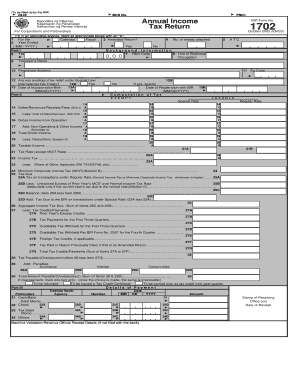

1702 Annual Income Tax Return Form

What is the 1702 Annual Income Tax Return

The 1702 Annual Income Tax Return is a form used by businesses in the United States to report their income, expenses, and other financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax laws and is typically required for various business entities, including corporations and partnerships. The information provided on the 1702 form helps determine the amount of tax owed or any potential refunds due to the business.

Steps to complete the 1702 Annual Income Tax Return

Completing the 1702 Annual Income Tax Return involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including income statements, expense reports, and prior tax returns. Next, fill out the form with accurate information regarding your business income, deductions, and credits. It is crucial to double-check all entries for accuracy to avoid any discrepancies. Once completed, review the form for completeness and ensure all required signatures are included. Finally, submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1702 Annual Income Tax Return is essential for maintaining compliance. Typically, the deadline for submitting this form is the fifteenth day of the fourth month following the end of the business's tax year. For businesses operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Businesses should also be aware of any extensions that may be available for filing if additional time is needed.

Legal use of the 1702 Annual Income Tax Return

The legal use of the 1702 Annual Income Tax Return is governed by federal tax laws, which stipulate the requirements for accurate reporting and compliance. When filled out correctly, the form serves as a legally binding document that reflects the financial status of the business. It is important to ensure that all information is truthful and complete, as inaccuracies can lead to penalties or audits by the IRS. Utilizing a reliable platform for electronic signatures can further enhance the legal standing of the submitted form.

Required Documents

To complete the 1702 Annual Income Tax Return, several documents are required. These typically include financial statements, such as profit and loss statements, balance sheets, and records of all income and expenses throughout the tax year. Additionally, businesses may need to provide documentation for any deductions or credits claimed, including receipts and invoices. Having these documents organized and readily available can streamline the process of filling out the form and ensure compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The 1702 Annual Income Tax Return can be submitted through various methods, depending on the preferences of the business. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt. Businesses can also choose to mail the completed form to the appropriate IRS address, ensuring it is postmarked by the filing deadline. In-person submission is less common but may be an option for businesses that require direct interaction with IRS representatives. Regardless of the method chosen, it is important to retain proof of submission.

Quick guide on how to complete 1702 annual income tax return

Complete 1702 Annual Income Tax Return seamlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools essential for creating, modifying, and electronically signing your documents efficiently without delays. Handle 1702 Annual Income Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and electronically sign 1702 Annual Income Tax Return effortlessly

- Find 1702 Annual Income Tax Return and click on Get Form to initiate.

- Make use of the tools provided to complete your form.

- Highlight crucial sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign 1702 Annual Income Tax Return and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1702 annual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income tax return sample and why is it important?

An income tax return sample is a representation of the completed forms required to file your taxes. It is important because it helps individuals understand how to properly fill out their taxes, ensuring compliance with regulations and potentially maximizing their returns.

-

How can airSlate SignNow assist with the preparation of an income tax return sample?

airSlate SignNow allows you to easily eSign and send documents, making the preparation of an income tax return sample more streamlined. By using our platform, you can gather signatures from tax professionals or clients quickly, ensuring your documents are ready to file on time.

-

What features does airSlate SignNow offer for managing income tax return samples?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and document tracking for your income tax return samples. These features facilitate easy edits and quick sharing, enhancing your overall document management process.

-

Is there a cost associated with using airSlate SignNow for income tax return samples?

Yes, airSlate SignNow offers various pricing plans designed to meet different business needs. Whether you're an individual or a larger organization, you can find a cost-effective solution that includes features tailored to managing income tax return samples.

-

Can I integrate airSlate SignNow with other software for my income tax return sample workflow?

Absolutely! airSlate SignNow integrates with popular software tools like Google Drive, Salesforce, and more. This enables you to create a seamless workflow for handling income tax return samples, enhancing efficiency and productivity.

-

How secure is airSlate SignNow when handling income tax return samples?

Security is a top priority at airSlate SignNow. We utilize industry-standard encryption methods to protect your income tax return samples, ensuring that sensitive information remains safe and secure throughout the signing and storage process.

-

Can airSlate SignNow help speed up the signature process for income tax return samples?

Yes, airSlate SignNow signNowly speeds up the signature process by allowing you to send your income tax return samples directly to stakeholders for eSignature. This reduces the time spent waiting for physical signatures, allowing for quicker submissions and filings.

Get more for 1702 Annual Income Tax Return

- Construction contract cost plus or fixed fee oregon form

- Painting contract for contractor oregon form

- Trim carpenter 497323478 form

- Oregon contract contractor form

- Hvac contract for contractor oregon form

- Landscape contract for contractor oregon form

- Commercial contract for contractor oregon form

- Excavator contract for contractor oregon form

Find out other 1702 Annual Income Tax Return

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe