Ok Frx 200 Form

What is the Oklahoma FRX 200?

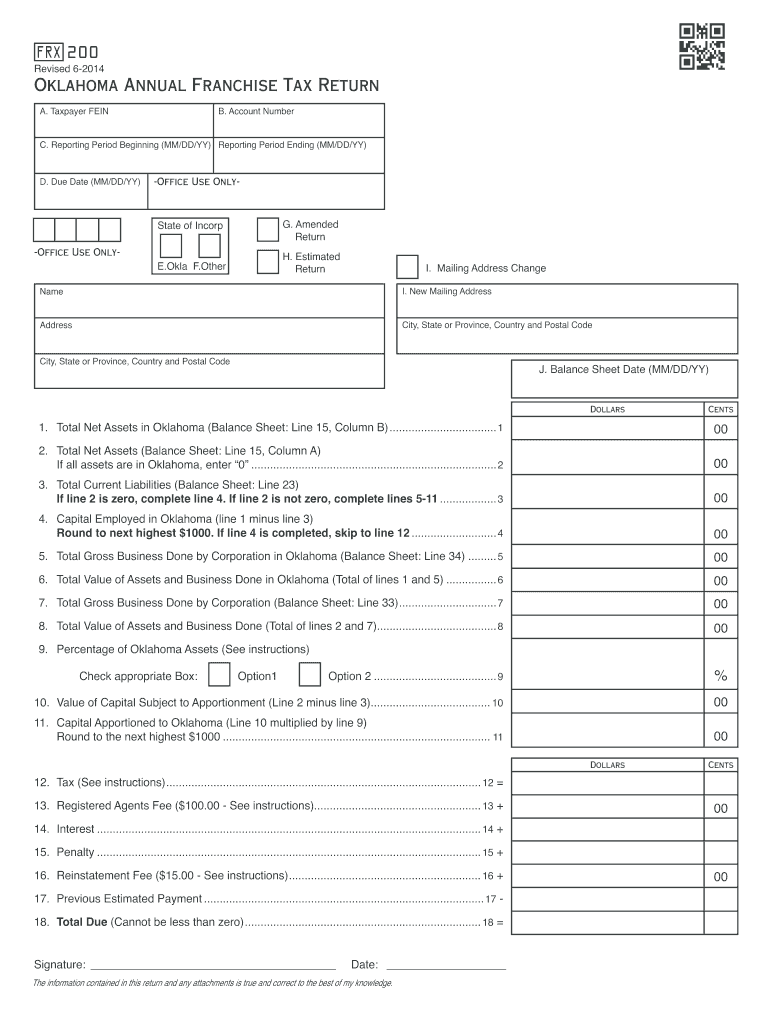

The Oklahoma FRX 200 is a specific form used for reporting certain financial and tax-related information in the state of Oklahoma. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It gathers data that helps the Oklahoma Tax Commission assess tax liabilities and determine eligibility for various tax credits and deductions.

How to use the Oklahoma FRX 200

Using the Oklahoma FRX 200 involves several steps to ensure accurate completion. First, obtain the form from the official Oklahoma Tax Commission website or authorized sources. Next, fill in the required information, including personal details, financial data, and any applicable deductions or credits. It is crucial to review the form for accuracy before submission, as errors can lead to delays or penalties.

Steps to complete the Oklahoma FRX 200

Completing the Oklahoma FRX 200 requires careful attention to detail. Follow these steps:

- Download or obtain the Oklahoma FRX 200 form.

- Provide your name, address, and taxpayer identification number.

- Input your income details, including wages, business income, and other earnings.

- List any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Oklahoma FRX 200

The Oklahoma FRX 200 is legally binding when filled out correctly and submitted to the appropriate authorities. To ensure its legal validity, it must comply with the relevant state regulations regarding tax reporting. This includes providing accurate information, signing the form, and submitting it by the designated deadlines. Failing to adhere to these guidelines may result in penalties or legal repercussions.

Required Documents

When completing the Oklahoma FRX 200, certain documents may be required to support the information provided. These documents can include:

- W-2 forms for reporting wages.

- 1099 forms for other income sources.

- Receipts for deductible expenses.

- Records of any tax credits claimed.

Having these documents on hand will facilitate a smoother completion process and help ensure compliance with state requirements.

Form Submission Methods

The Oklahoma FRX 200 can be submitted through various methods. Taxpayers may choose to file online through the Oklahoma Tax Commission's e-filing system, which offers a convenient and efficient way to submit forms. Alternatively, the form can be mailed to the appropriate tax office or submitted in person. It is important to check the latest submission guidelines to ensure compliance with state regulations.

Quick guide on how to complete ok frx 200

Effortlessly prepare Ok Frx 200 on any device

The management of online documents has gained signNow traction among both organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Ok Frx 200 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

The easiest way to modify and electronically sign Ok Frx 200 with ease

- Find Ok Frx 200 and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for delivering your form—by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Modify and electronically sign Ok Frx 200 to ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ok frx 200

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the oklahoma frx 200 instructions?

The oklahoma frx 200 instructions include detailed guidelines for efficiently utilizing the software's capabilities. Users can expect features such as streamlined document management, eSignature integration, and customizable templates. These features enhance productivity and ensure compliance for businesses.

-

How can I access the oklahoma frx 200 instructions?

You can access the oklahoma frx 200 instructions directly from the airSlate SignNow platform. Simply navigate to the support section, where you'll find comprehensive guides and resources. This easy accessibility makes it simple for users to upskill and maximize the software's features.

-

Are there any costs associated with the oklahoma frx 200 instructions?

The oklahoma frx 200 instructions are included at no additional cost when you subscribe to airSlate SignNow. This makes it a cost-effective solution for businesses looking to streamline their document signing processes. Free resources ensure that you get the most out of your investment in our platform.

-

What are the benefits of following the oklahoma frx 200 instructions?

Following the oklahoma frx 200 instructions helps you maximize the software's features, enhancing efficiency in document management. By understanding the functionalities outlined in the instructions, you can reduce errors and speed up your workflow. Overall, this leads to a smoother user experience.

-

Can I integrate other tools with the oklahoma frx 200 instructions?

Yes, the oklahoma frx 200 instructions detail how to integrate various tools with airSlate SignNow. You can connect platforms like CRMs, project management systems, and cloud storage services seamlessly. This integration improves workflow and ensures that your documents are always at your fingertips.

-

Is training available for using the oklahoma frx 200 instructions?

Absolutely! airSlate SignNow offers training sessions that focus on the oklahoma frx 200 instructions. These sessions cover the essential features and best practices, providing valuable insights to help users enhance their experience and utilize the platform effectively.

-

What types of documents can I manage using the oklahoma frx 200 instructions?

With the oklahoma frx 200 instructions, you can manage various document types, including contracts, agreements, and forms. The instructions provide detailed guidance on how to prepare, send, and sign these documents efficiently. This versatility ensures you can handle all your document needs in one place.

Get more for Ok Frx 200

- Summary administration oklahoma form

- Oklahoma personal representative form

- Sec 514011 mn statutes form

- 19 printable acknowledgement of receipt of payment forms

- Ok llc company 497322988 form

- Warranty deed from individual to llc oklahoma form

- Do i have to sign a lien waiver to get paid on a construction form

- Oklahoma pre lien form

Find out other Ok Frx 200

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure