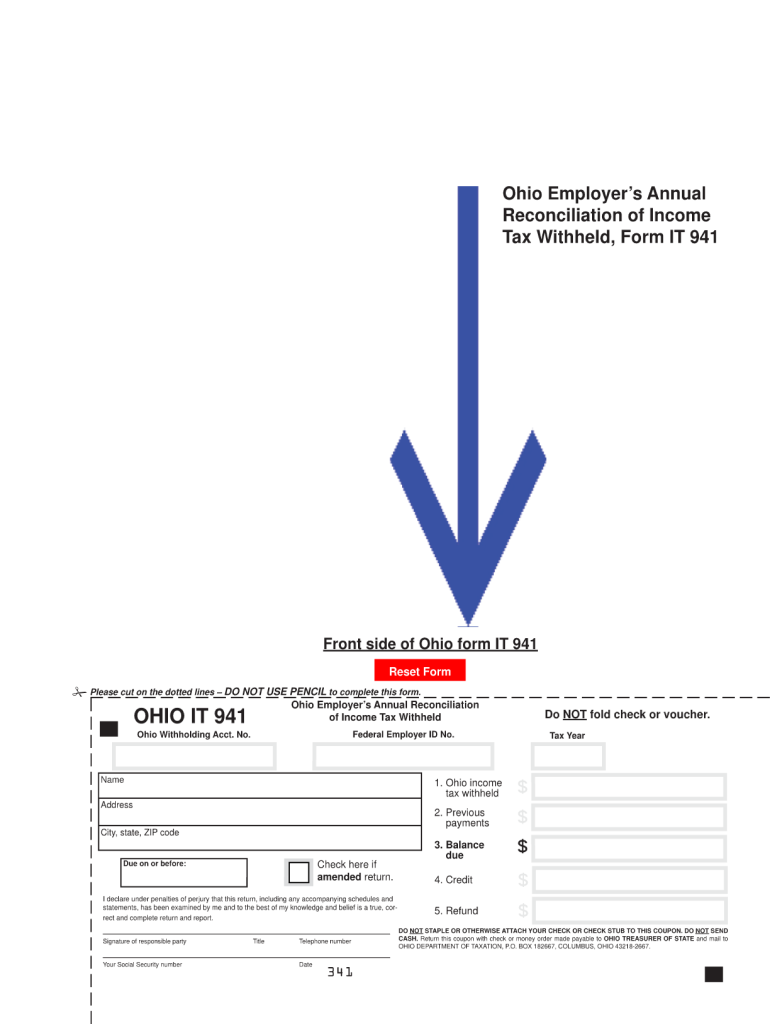

Ohio it 941 Form

What is the Ohio IT 941?

The Ohio IT 941 is a tax form used by employers in Ohio to report and reconcile their state income tax withholding. This form is essential for businesses that withhold income tax from employee wages and is submitted quarterly. The Ohio IT 941 helps ensure compliance with state tax regulations and provides a summary of the total amount withheld during the reporting period. Employers must accurately complete this form to avoid potential penalties and ensure that their tax obligations are met.

Steps to Complete the Ohio IT 941

Completing the Ohio IT 941 involves several key steps:

- Gather necessary information: Collect employee wage data, tax withholding amounts, and any adjustments from previous periods.

- Fill out the form: Enter the required information in the designated fields, including total wages paid and total tax withheld.

- Review for accuracy: Double-check all entries to ensure that they are correct and complete.

- Sign and date the form: Ensure that the form is signed by an authorized individual within the business.

- Submit the form: Choose your submission method, whether online, by mail, or in person.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Ohio IT 941. The form is typically due on the last day of the month following the end of each quarter. The deadlines are as follows:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Legal Use of the Ohio IT 941

The Ohio IT 941 is legally required for employers who withhold state income taxes from employee wages. It must be filed accurately and on time to comply with Ohio tax laws. Failure to submit the form or inaccuracies in reporting can result in penalties, including fines and interest on unpaid taxes. Employers should ensure they are familiar with the legal requirements surrounding this form to maintain compliance and avoid legal issues.

Form Submission Methods (Online / Mail / In-Person)

Employers have multiple options for submitting the Ohio IT 941:

- Online submission: Many employers choose to file electronically through the Ohio Department of Taxation's online portal, which is often the fastest method.

- Mail: Employers can print the completed form and send it via postal service to the appropriate state tax office.

- In-person: Some employers may prefer to deliver the form directly to their local tax office for immediate processing.

Key Elements of the Ohio IT 941

Understanding the key elements of the Ohio IT 941 is crucial for accurate completion. Important sections of the form include:

- Employer information: Name, address, and identification number of the employer.

- Employee wage details: Total wages paid during the reporting period.

- Tax withheld: Total state income tax withheld from employee wages.

- Adjustments: Any necessary adjustments for over- or under-withholding from previous periods.

Quick guide on how to complete ohio form it 941

Your assistance manual on how to prepare your Ohio It 941

If you’re interested in understanding how to fill out and submit your Ohio It 941, here are some concise guidelines to facilitate the tax declaration process.

Initially, you simply need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, create, and finalize your tax paperwork effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to modify responses as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to complete your Ohio It 941 within moments:

- Create your account and begin working on PDFs in a matter of minutes.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Ohio It 941 in our editor.

- Input the needed fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if required).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper can lead to errors in returns and postpone reimbursements. Importantly, before e-filing your taxes, check the IRS website for filing guidelines specific to your state.

Create this form in 5 minutes or less

FAQs

-

What do you put on Schedule B when filling out Form 941?

Form 941 Schedule B can be filled out in 5 steps:1. Enter business info (Name and EIN)2. Choose tax year/quarter3. Select the quarter you’re filing for4. Enter your tax liability by semi-weekly & total liability for the quarter5. Attach to Form 941 & transmit to the IRS(these instructions work best when paired with TaxBandits e-filing)

-

How long does it take the IRS to accept or reject an IRS Form 941 return?

If you e-file, you should get your e-file acknowledgement back within the hour. Your software provider should provide you with your ack code, which they receive from the IRS.The IRS servers are lightning fast now after they upgraded them a few years ago after the Russians hacked into them back in 2015. (IRS believes Russians are behind tax return data bsignNow - CNNPolitics). No more waiting 24 -48 hours for an ack code, even though they still tell you officially that’s how long it will take.If you paper file, the whole process slows down to a crawl, and if you make a mistake, the interest and penalties add up before you even know there’s a problem.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How much would an accountant charge me for filling out a Quarterly Federal Tax Return (941) in Texas?

For full service payroll I charge $100 per month for up to 5 employees. That includes filing the federal and state quarterly returns and year end W2's.If you just need the 941 completed and you have all of your payroll records in order, then the fee would be $50 to prepare the form for you. Note that you also need to file a quarterly return with TWC if you have Texas employees.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

Create this form in 5 minutes!

How to create an eSignature for the ohio form it 941

How to generate an eSignature for your Ohio Form It 941 online

How to make an eSignature for the Ohio Form It 941 in Chrome

How to make an electronic signature for putting it on the Ohio Form It 941 in Gmail

How to generate an electronic signature for the Ohio Form It 941 straight from your mobile device

How to create an eSignature for the Ohio Form It 941 on iOS

How to create an eSignature for the Ohio Form It 941 on Android devices

People also ask

-

What is Ohio IT 941 and how can airSlate SignNow help?

Ohio IT 941 refers to the state tax form used for reporting income tax withholding. With airSlate SignNow, businesses can easily eSign and send completed Ohio IT 941 documents, ensuring compliance and efficient filing. Our platform streamlines the process, making it straightforward for companies to manage their tax documentation securely.

-

How much does airSlate SignNow cost for Ohio IT 941 users?

airSlate SignNow offers flexible pricing plans tailored for Ohio IT 941 users, starting from a competitive monthly subscription. Each plan includes essential features for document eSigning and management, ensuring businesses have access to all the tools they need at an affordable rate. Visit our pricing page for detailed information on all available plans.

-

What features does airSlate SignNow provide for managing Ohio IT 941 forms?

airSlate SignNow offers robust features for Ohio IT 941 management, including customizable templates, easy document sharing, and secure eSigning. You can track the status of your sent forms, ensuring that your Ohio IT 941 is signed and returned promptly. Our user-friendly interface makes it simple to navigate through your tax documents.

-

Are there any integrations available for Ohio IT 941 processing?

Yes, airSlate SignNow integrates seamlessly with various software solutions that can aid in Ohio IT 941 processing. Whether you're using accounting software, CRM systems, or cloud storage services, our platform allows for smooth data transfer and document management. This enhances your workflow and ensures all necessary tools are connected.

-

Can I use airSlate SignNow to store my Ohio IT 941 documents securely?

Absolutely! airSlate SignNow provides secure cloud storage for all your Ohio IT 941 documents. Our platform ensures that your sensitive tax information is protected with advanced security measures, allowing you to access and manage your documents safely and efficiently whenever you need them.

-

Is it easy to eSign Ohio IT 941 forms using airSlate SignNow?

Yes, eSigning Ohio IT 941 forms with airSlate SignNow is incredibly easy. Our intuitive platform allows users to sign documents electronically with just a few clicks, eliminating the hassle of printing and scanning. You can also invite multiple signers, making the process quick and efficient.

-

What are the benefits of using airSlate SignNow for my Ohio IT 941 filings?

Using airSlate SignNow for your Ohio IT 941 filings offers numerous benefits, including time savings, increased efficiency, and reduced errors. Our platform simplifies the eSigning process, helping you stay organized and compliant with tax regulations. Additionally, you can ensure timely submissions to avoid any penalties.

Get more for Ohio It 941

- Form 1120 excel template

- Endoassocaz net form

- United methodist church audit forms

- Title defense rubrics form

- Change in lease terms addendum to residential lease form

- Dekalb business license renewal form

- Notice of non responsibility california 8444 form

- Jv 121 failure to protect300b judical council forms

Find out other Ohio It 941

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice