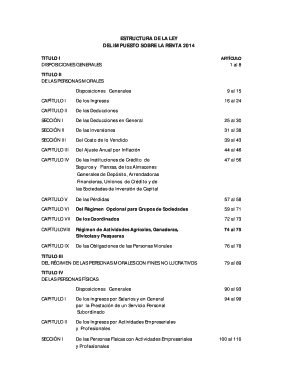

Estructura De La Ley Del Isr Form

What is the estructura de la ley del ISR?

The estructura de la ley del ISR refers to the framework and organization of the Income Tax Law in the United States. It outlines the various components that govern income taxation, including definitions, taxable income categories, deductions, and tax rates. Understanding this structure is crucial for individuals and businesses to comply with tax obligations and to effectively plan their financial strategies.

Key elements of the estructura de la ley del ISR

Several key elements form the foundation of the estructura de la ley del ISR. These include:

- Definitions: Clear definitions of terms such as gross income, adjusted gross income, and taxable income.

- Tax Rates: The applicable tax rates for different income brackets, which can vary based on filing status.

- Deductions: A list of allowable deductions that can reduce taxable income, including standard and itemized deductions.

- Credits: Tax credits that can directly reduce tax liability, such as education credits or child tax credits.

- Filing Requirements: Guidelines on who must file, what forms to use, and deadlines for submission.

Steps to complete the estructura de la ley del ISR

Completing the requirements outlined in the estructura de la ley del ISR involves several steps:

- Gather Documentation: Collect all necessary documents, including income statements, receipts for deductions, and prior year tax returns.

- Determine Filing Status: Identify your filing status, as it affects tax rates and eligibility for certain deductions and credits.

- Calculate Taxable Income: Use the gathered documentation to calculate your total income and apply any deductions.

- Apply Tax Rates: Determine your tax liability by applying the appropriate tax rates to your taxable income.

- Complete Required Forms: Fill out the necessary tax forms accurately, ensuring all information is correct.

- Review and Submit: Double-check your forms for accuracy before submitting them by the deadline.

Legal use of the estructura de la ley del ISR

The legal use of the estructura de la ley del ISR requires adherence to the regulations set forth by the Internal Revenue Service (IRS). This includes understanding the implications of various tax provisions and ensuring compliance with filing requirements. Failure to comply can result in penalties, interest on unpaid taxes, and potential legal action.

Filing deadlines / Important dates

Staying informed about filing deadlines is essential for compliance with the estructura de la ley del ISR. Key dates include:

- Tax Day: Typically falls on April 15 each year, marking the deadline for individual tax returns.

- Extension Deadline: If an extension is filed, the deadline is usually extended to October 15.

- Quarterly Estimated Payments: Due dates for estimated tax payments, which are generally April 15, June 15, September 15, and January 15 of the following year.

Required documents

To comply with the estructura de la ley del ISR, individuals and businesses must prepare specific documents, including:

- W-2 Forms: Provided by employers, detailing annual wages and taxes withheld.

- 1099 Forms: For reporting various types of income received outside of employment.

- Receipts: Documentation for deductions, such as medical expenses, charitable contributions, and business expenses.

- Previous Tax Returns: Useful for reference and ensuring consistency in reporting.

Quick guide on how to complete estructura de la ley del isr

Effortlessly Prepare Estructura De La Ley Del Isr on Any Device

The management of online documents has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it in the cloud. airSlate SignNow provides all the essential tools to create, alter, and electronically sign your documents quickly and without delays. Handle Estructura De La Ley Del Isr on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and Electronically Sign Estructura De La Ley Del Isr with Ease

- Locate Estructura De La Ley Del Isr and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sharing your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Estructura De La Ley Del Isr and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the estructura de la ley del isr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the indice de la ley del isr?

The 'indice de la ley del isr' refers to the index used to calculate the income tax in Mexico. Understanding this index is crucial for businesses to comply with tax regulations effectively. airSlate SignNow can assist in automating document workflows related to tax documentation.

-

How does airSlate SignNow help with documents related to the indice de la ley del isr?

airSlate SignNow facilitates the signing and management of documents pertinent to the 'indice de la ley del isr'. Our platform enables users to create, send, and eSign essential tax-related documents securely and efficiently, helping businesses streamline their compliance efforts.

-

What features does airSlate SignNow offer for managing tax-related documents?

Our platform provides features such as custom templates, automated reminders, and secure eSignature capabilities. These functionalities ensure that all documents related to the 'indice de la ley del isr' are handled timely and securely, simplifying your tax processes.

-

Is airSlate SignNow cost-effective for small businesses dealing with the indice de la ley del isr?

Absolutely! airSlate SignNow offers flexible pricing plans designed to suit businesses of all sizes, including small enterprises. Our affordable solutions enable you to manage documents related to the 'indice de la ley del isr' without straining your budget.

-

Can airSlate SignNow integrate with accounting software for tax documents?

Yes, airSlate SignNow seamlessly integrates with various accounting and bookkeeping software. This integration allows users to manage their documents related to the 'indice de la ley del isr' in conjunction with their existing financial systems, enhancing overall efficiency.

-

What benefits does airSlate SignNow provide for compliance with the indice de la ley del isr?

Using airSlate SignNow enhances compliance by ensuring that all documents related to the 'indice de la ley del isr' are signed and stored securely. This not only improves organization but also provides an audit trail that is invaluable during tax season.

-

How can I get started with airSlate SignNow for my tax document needs?

Getting started with airSlate SignNow is easy! Simply sign up for a free trial on our website, and you can begin creating and managing documents related to the 'indice de la ley del isr' instantly. Our user-friendly interface will guide you through the entire process.

Get more for Estructura De La Ley Del Isr

- Barber application form

- Weights amp measures device registration application form

- Soonercare 12 month profit amp loss worksheet form

- Application for contractors prequalification certificate city of okc form

- The canine carnival vendor agreement form

- Property tax exemption application for organizations pt 401o form

- Mdrr form 5739300

- Form 8862 rev november irs irs

Find out other Estructura De La Ley Del Isr

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast