Form 8862 Rev November IRS Irs 2023

What is the Form 8862 Rev November IRS Irs

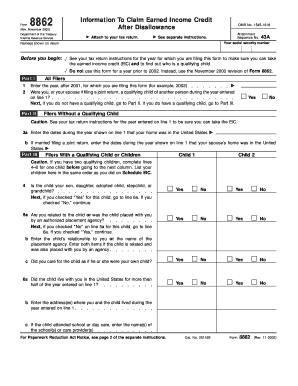

The Form 8862, titled "Information to Claim Certain Refundable Credits After Disallowance," is a crucial document for taxpayers in the United States who have previously had their claims for certain tax credits disallowed. This form allows individuals to re-establish their eligibility for credits such as the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC). The revised version from November includes updates that reflect changes in tax law and IRS guidelines, ensuring that taxpayers have the most accurate information when claiming these credits.

How to use the Form 8862 Rev November IRS Irs

Using Form 8862 involves several steps to ensure that taxpayers can successfully claim their credits. First, individuals must fill out the form accurately, providing necessary personal information and details about the credits being claimed. It is essential to review the instructions carefully to avoid errors that could lead to further disallowance. Once completed, the form should be submitted with the tax return for the year in which the credits are being claimed. It is important to keep a copy of the form for personal records.

Steps to complete the Form 8862 Rev November IRS Irs

Completing Form 8862 requires careful attention to detail. Here are the steps to follow:

- Begin by entering your name, Social Security number, and filing status at the top of the form.

- Indicate the tax year for which you are claiming the credits.

- Complete the sections regarding the credits you are eligible for, ensuring that all information is accurate and matches your tax return.

- Answer any questions related to previous disallowances of credits, providing explanations where necessary.

- Review the form for completeness and accuracy before submitting it with your tax return.

Eligibility Criteria

To use Form 8862, taxpayers must meet specific eligibility criteria. Generally, individuals who have had their claims for refundable credits disallowed in the past must file this form to re-establish their eligibility. Key criteria include:

- Having a valid Social Security number.

- Meeting income requirements for the credits claimed.

- Providing accurate information about dependents and their qualifications.

Filing Deadlines / Important Dates

Filing deadlines for Form 8862 align with the standard tax return due dates. Typically, individual tax returns must be filed by April 15 of the following tax year. If additional time is needed, taxpayers can request an extension, but it is crucial to ensure that Form 8862 is submitted with the tax return by the deadline to avoid penalties or further disallowance of credits.

Required Documents

When completing Form 8862, it is essential to gather all necessary documentation to support your claims. Required documents may include:

- Proof of income, such as W-2 forms or 1099 statements.

- Documentation for any dependents claimed, including Social Security numbers and birth certificates.

- Previous tax returns that may show disallowed credits or other relevant information.

Quick guide on how to complete form 8862 rev november irs irs

Prepare Form 8862 Rev November IRS Irs effortlessly on any device

Online document management has gained traction among organizations and individuals. It serves as a perfect eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow offers you all the tools to create, modify, and eSign your documents swiftly without delays. Manage Form 8862 Rev November IRS Irs on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-based procedure today.

The easiest way to edit and eSign Form 8862 Rev November IRS Irs with ease

- Obtain Form 8862 Rev November IRS Irs and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to finalize your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 8862 Rev November IRS Irs and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8862 rev november irs irs

Create this form in 5 minutes!

How to create an eSignature for the form 8862 rev november irs irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8862 Rev November IRS Irs?

Form 8862 Rev November IRS Irs is a document used to reclaim the Earned Income Tax Credit after certain disqualifications. It provides taxpayers with the opportunity to demonstrate their eligibility and regain access to the credit. Understanding and properly utilizing Form 8862 Rev November IRS Irs can enhance your tax filing experience.

-

How can airSlate SignNow help with Form 8862 Rev November IRS Irs?

airSlate SignNow simplifies the process of preparing and signing Form 8862 Rev November IRS Irs. With our easy-to-use platform, you can quickly fill out and eSign the form electronically, ensuring a seamless experience. Embracing airSlate SignNow means less hassle and more efficiency in handling crucial tax documents.

-

Is there a cost associated with using airSlate SignNow for Form 8862 Rev November IRS Irs?

Yes, there is a cost, but airSlate SignNow offers tiered pricing plans to cater to different business needs. Each plan provides access to our comprehensive features that make managing Form 8862 Rev November IRS Irs efficient and cost-effective. Investing in airSlate SignNow can potentially save you time and reduce paperwork errors.

-

What features does airSlate SignNow offer for handling Form 8862 Rev November IRS Irs?

airSlate SignNow includes features such as document templates, streamlined eSigning, and status tracking for Form 8862 Rev November IRS Irs. These tools help you manage your tax documents more effectively and ensure compliance. The intuitive interface also aids in avoiding common mistakes associated with paper forms.

-

Can airSlate SignNow integrate with other tax software for Form 8862 Rev November IRS Irs?

Absolutely! airSlate SignNow offers seamless integrations with popular tax software, facilitating easy handling of Form 8862 Rev November IRS Irs. By integrating your tax solutions, you can streamline your workflow and avoid duplicate data entry, ensuring a more efficient process.

-

What are the benefits of eSigning Form 8862 Rev November IRS Irs with airSlate SignNow?

ESigning Form 8862 Rev November IRS Irs with airSlate SignNow provides benefits like quick turnaround times and enhanced security. Our platform ensures your documents are encrypted and legally binding, giving you peace of mind. Plus, the convenience of signing from anywhere makes it easier to meet deadlines.

-

Is airSlate SignNow user-friendly for filing Form 8862 Rev November IRS Irs?

Yes, airSlate SignNow is designed for all users, regardless of technical expertise. The straightforward, user-friendly interface makes it easy to navigate while completing Form 8862 Rev November IRS Irs. You'll find that preparing and signing documents is a hassle-free experience with our platform.

Get more for Form 8862 Rev November IRS Irs

Find out other Form 8862 Rev November IRS Irs

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim