M9 Form 2017

What is the M9 Form

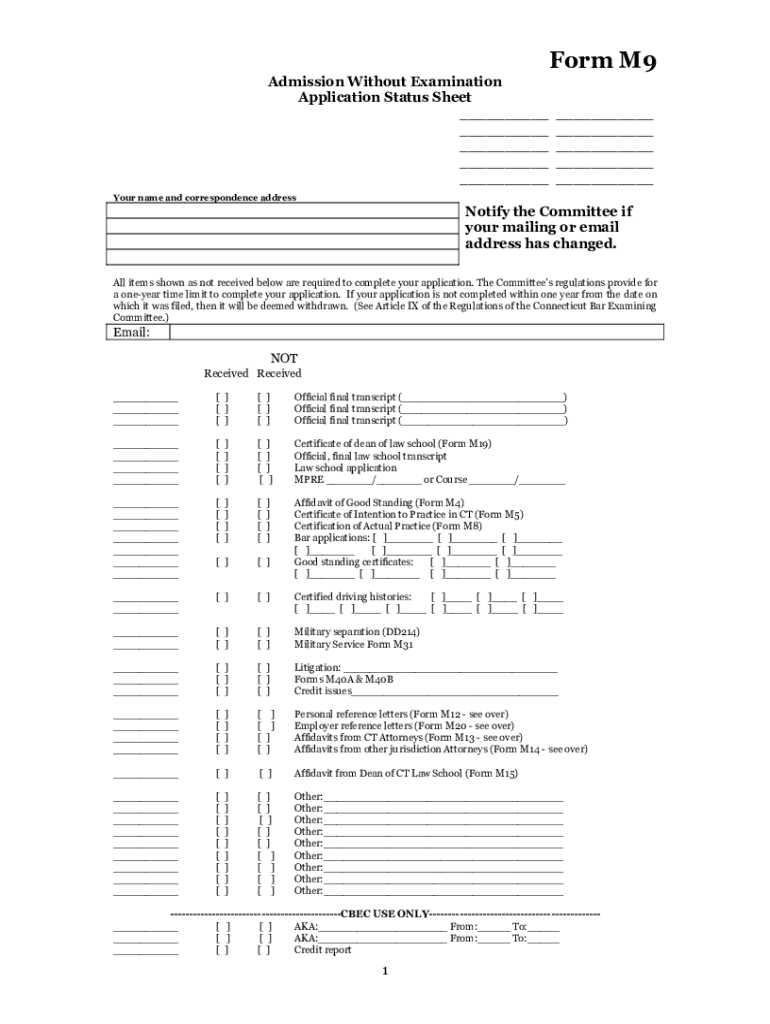

The M9 form is a tax document used primarily by businesses and individuals to report certain types of income and expenses. It is essential for ensuring compliance with tax regulations in the United States. The form collects information necessary for the Internal Revenue Service (IRS) to assess tax liabilities accurately. Understanding the purpose of the M9 form is crucial for anyone involved in financial reporting or tax preparation.

How to use the M9 Form

Using the M9 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents that pertain to the income or expenses being reported. Next, fill out the form with accurate information, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions. Finally, submit the form according to the guidelines provided by the IRS, which may include online submission or mailing a physical copy.

Steps to complete the M9 Form

Completing the M9 form requires careful attention to detail. Follow these steps:

- Gather relevant financial documents, such as income statements and expense receipts.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Enter the specific income and expense details as required by the form.

- Review the completed form for accuracy and completeness.

- Submit the form according to IRS guidelines, either online or by mail.

Legal use of the M9 Form

The M9 form is legally binding when completed and submitted in accordance with IRS regulations. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or audits. Compliance with legal requirements, such as those outlined in the Internal Revenue Code, ensures that the form is valid and enforceable in a legal context.

Key elements of the M9 Form

Several key elements are essential for the proper completion of the M9 form. These include:

- Taxpayer Information: Accurate personal and business details.

- Income Reporting: Detailed reporting of all income sources.

- Expense Reporting: Comprehensive listing of deductible expenses.

- Signature: Required signature to validate the form.

Form Submission Methods

The M9 form can be submitted through various methods, depending on individual preferences and IRS guidelines. Common submission methods include:

- Online Submission: Using IRS-approved electronic filing systems.

- Mail: Sending a physical copy of the completed form to the appropriate IRS address.

- In-Person: Delivering the form directly to a local IRS office, if applicable.

Quick guide on how to complete m9 form

Complete M9 Form effortlessly on any device

Web-based document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the correct format and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without interruptions. Manage M9 Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign M9 Form with ease

- Find M9 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Indicate important parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and hit the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign M9 Form and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct m9 form

Create this form in 5 minutes!

How to create an eSignature for the m9 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an m9 form and how is it used?

An m9 form is a tax form used primarily by contractors and freelancers to provide their taxpayer information to clients. It helps clients report payments made to the contractor for tax purposes. Using the m9 form ensures compliance with tax regulations, making it a crucial document for any independent worker.

-

How can airSlate SignNow help with signing m9 forms?

airSlate SignNow simplifies the process of signing m9 forms by allowing users to electronically sign and send documents securely. This eliminates the need for printing and faxing, speeding up the process signNowly. With its user-friendly interface, managing your m9 forms becomes a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for m9 forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide unlimited access to e-signature features, including the ability to send and manage m9 forms. By investing in airSlate SignNow, you gain a cost-effective solution for handling essential documentation.

-

What features are available for managing m9 forms with airSlate SignNow?

With airSlate SignNow, users can easily create, edit, and manage m9 forms online. Features include templates, customizable fields, and secure storage options for completed forms. Additionally, the platform offers reminders and notifications for outstanding signatures, streamlining the workflow.

-

Can I integrate airSlate SignNow with other tools for managing m9 forms?

Yes, airSlate SignNow can be integrated with numerous third-party applications, making it easier to manage m9 forms alongside other business tools. Integrations with CRM systems, cloud storage services, and project management software enhance the usability of your workflow. This flexibility ensures that your m9 forms fit seamlessly into your existing processes.

-

How secure is the signing process for m9 forms with airSlate SignNow?

The signing process for m9 forms with airSlate SignNow is highly secure, employing industry-standard encryption to protect sensitive data. Each document is secured with extensive audit trails and verification measures to ensure authenticity. Users can trust that their m9 forms and personal information are kept confidential.

-

What are the benefits of using airSlate SignNow for m9 forms?

Using airSlate SignNow for m9 forms provides several benefits, including increased efficiency and reduced turnaround times. The electronic signing process eliminates paperwork and helps streamline communication. With its user-friendly design, businesses can focus on their core operations rather than getting bogged down by administrative tasks.

Get more for M9 Form

- Warranty deed from limited partnership or llc is the grantor or grantee pennsylvania form

- Warranty deed executors deed pennsylvania form

- Warranty deed wife 497324898 form

- Warranty deed from individual to four individuals pennsylvania form

- Pa husband wife form

- Pennsylvania quitclaim form

- Pennsylvania limited form

- Special limited warranty deed from individual to individual pennsylvania form

Find out other M9 Form

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement