Fillable Irs Form 941

What is the Fillable IRS Form 941

The 2009 IRS Form 941 is a quarterly tax return used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for businesses to ensure compliance with federal tax regulations. By accurately completing the fillable 941, employers provide the IRS with information about their tax liabilities and payments for each quarter. Understanding the purpose of this form helps businesses maintain proper records and meet their tax obligations.

Steps to Complete the Fillable IRS Form 941

Completing the 2009 Form 941 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your employer identification number (EIN), total wages paid, and taxes withheld. Next, follow these steps:

- Fill out the identification section, including your business name and address.

- Report the number of employees and total wages paid during the quarter.

- Calculate the total taxes withheld for Social Security and Medicare.

- Complete the payment section, indicating any deposits made during the quarter.

- Sign and date the form to certify its accuracy.

By following these steps, you can ensure that your fillable 941 is completed correctly and submitted on time.

Legal Use of the Fillable IRS Form 941

The 2009 Form 941 holds legal significance as it is a required document for employers to report payroll taxes to the IRS. To ensure its legal validity when submitted electronically, it is crucial to comply with eSignature regulations. Using a reliable eSignature solution can provide a legally binding signature, meeting the requirements set forth by the ESIGN Act and UETA. This ensures that your electronically submitted form is recognized as legitimate and enforceable.

How to Obtain the Fillable IRS Form 941

Employers can obtain the 2009 Form 941 through several channels. The most straightforward method is to visit the IRS website, where the form is available for download in a fillable PDF format. Additionally, businesses can request physical copies from the IRS or use authorized tax software that includes the form. Ensuring you have the correct version of the fillable 941 is essential for accurate reporting and compliance.

Filing Deadlines / Important Dates

Timely filing of the 2009 Form 941 is crucial to avoid penalties. The IRS requires that this form be submitted quarterly, with specific deadlines for each quarter:

- First Quarter (January - March): Due by April 30

- Second Quarter (April - June): Due by July 31

- Third Quarter (July - September): Due by October 31

- Fourth Quarter (October - December): Due by January 31 of the following year

Staying aware of these deadlines helps businesses avoid late fees and maintain compliance with federal tax laws.

Form Submission Methods (Online / Mail / In-Person)

Employers have multiple options for submitting the 2009 Form 941. The form can be filed electronically through the IRS e-file system, which is often the fastest and most efficient method. Alternatively, businesses can mail the completed form to the appropriate IRS address based on their location. In-person submission is generally not an option for this form, but ensuring that it is sent via certified mail can provide proof of submission. Choosing the right method depends on your business's needs and preferences.

Quick guide on how to complete 2009 fillable irs form 941

Effortlessly Prepare Fillable Irs Form 941 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and seamlessly. Manage Fillable Irs Form 941 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Change and Electronically Sign Fillable Irs Form 941 with Ease

- Locate Fillable Irs Form 941 and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Formulate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device of your choice. Revise and electronically sign Fillable Irs Form 941 and guarantee effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How long does it take the IRS to accept or reject an IRS Form 941 return?

If you e-file, you should get your e-file acknowledgement back within the hour. Your software provider should provide you with your ack code, which they receive from the IRS.The IRS servers are lightning fast now after they upgraded them a few years ago after the Russians hacked into them back in 2015. (IRS believes Russians are behind tax return data bsignNow - CNNPolitics). No more waiting 24 -48 hours for an ack code, even though they still tell you officially that’s how long it will take.If you paper file, the whole process slows down to a crawl, and if you make a mistake, the interest and penalties add up before you even know there’s a problem.

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

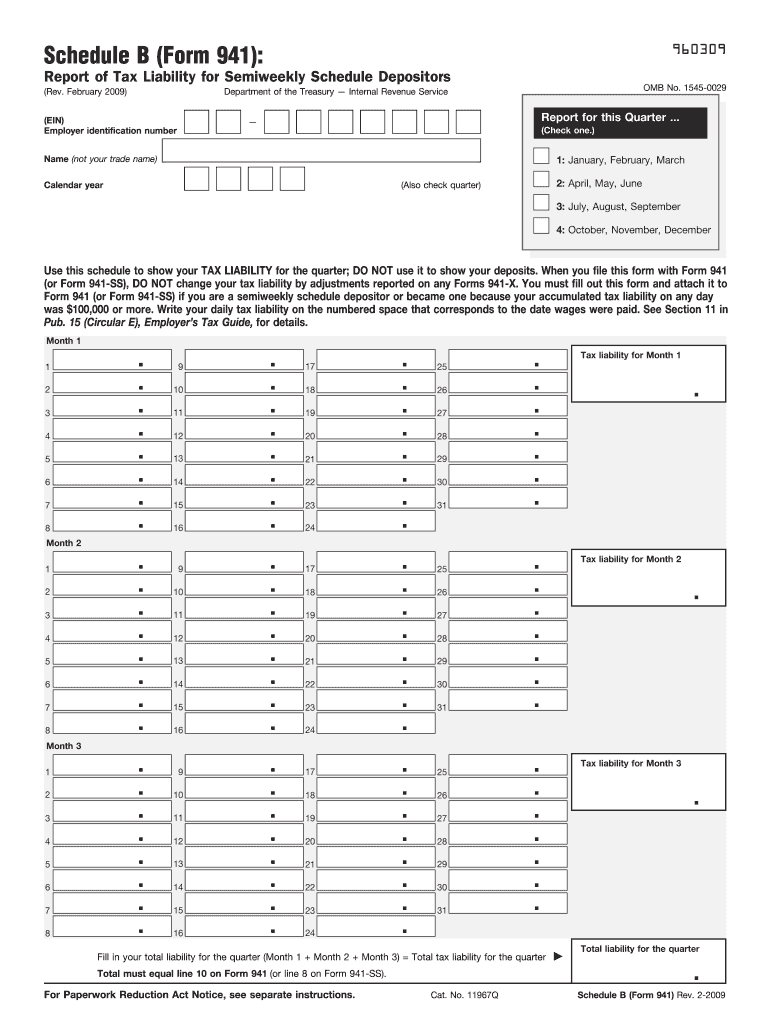

What do you put on Schedule B when filling out Form 941?

Form 941 Schedule B can be filled out in 5 steps:1. Enter business info (Name and EIN)2. Choose tax year/quarter3. Select the quarter you’re filing for4. Enter your tax liability by semi-weekly & total liability for the quarter5. Attach to Form 941 & transmit to the IRS(these instructions work best when paired with TaxBandits e-filing)

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

Create this form in 5 minutes!

How to create an eSignature for the 2009 fillable irs form 941

How to generate an eSignature for the 2009 Fillable Irs Form 941 online

How to create an eSignature for your 2009 Fillable Irs Form 941 in Google Chrome

How to make an electronic signature for putting it on the 2009 Fillable Irs Form 941 in Gmail

How to generate an electronic signature for the 2009 Fillable Irs Form 941 right from your smart phone

How to make an eSignature for the 2009 Fillable Irs Form 941 on iOS

How to create an electronic signature for the 2009 Fillable Irs Form 941 on Android devices

People also ask

-

What is a 2009 form 941, and why is it important?

The 2009 form 941 is the Employer’s QUARTERLY Federal Tax Return, required for businesses to report payroll taxes withheld from employee wages. It is essential for complying with IRS regulations, ensuring that you remain in good standing as an employer. Accurately filing this form helps avoid penalties and provides a clear financial picture for your business.

-

How can airSlate SignNow help in managing the 2009 form 941?

airSlate SignNow simplifies the process of signing and sending the 2009 form 941 by offering an intuitive eSignature solution. With airSlate SignNow, you can quickly collect signatures and securely store documents, ensuring your forms are completed and filed on time. This reduces the stress of paperwork and streamlines tax compliance.

-

What features does airSlate SignNow offer for eSigning the 2009 form 941?

airSlate SignNow offers robust features for eSigning the 2009 form 941, including customizable workflows, document templates, and secure storage. Users can easily tag signers, track document statuses, and access completed forms anytime. This increases efficiency and enhances your team's productivity when dealing with IRS filings.

-

Are there any special pricing plans for businesses needing to file the 2009 form 941?

Yes, airSlate SignNow offers affordable pricing plans tailored to businesses of all sizes, making it cost-effective for those needing to file the 2009 form 941. Pricing is based on the number of users and features required, allowing you to choose a plan that best fits your budget. Additionally, a free trial is available to evaluate the services.

-

Can I integrate airSlate SignNow with my existing accounting software for the 2009 form 941?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, helping you manage your 2009 form 941 more effectively. By connecting your tools, you can automate workflows, reduce manual entry, and ensure that all your documents are synchronized, making the filing process smooth and effortless.

-

Is airSlate SignNow compliant with federal regulations for the 2009 form 941?

Yes, airSlate SignNow is fully compliant with federal regulations for the 2009 form 941, providing a secure platform for eSigning and submitting documents. Our solution adheres to the highest standards of data protection and electronic signature laws, ensuring that your tax documents are handled with utmost confidentiality and legality.

-

How does electronic signing of the 2009 form 941 benefit my business?

Electronic signing of the 2009 form 941 can signNowly reduce turnaround time and improve efficiency in your tax filing process. By using airSlate SignNow, you eliminate the need for paper documents, postal delays, and cumbersome signing processes. This not only saves time but also enhances record-keeping and reduces the likelihood of errors.

Get more for Fillable Irs Form 941

Find out other Fillable Irs Form 941

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast