Fatca Full Form

What is the Fatca Full Form

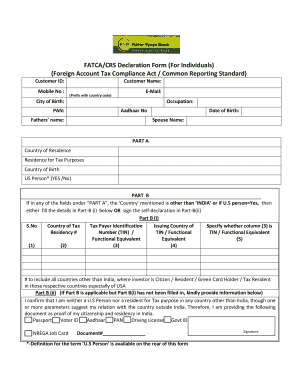

The FATCA full form is the Foreign Account Tax Compliance Act. This U.S. legislation was enacted in 2010 to combat tax evasion by U.S. citizens and residents holding accounts and assets outside the United States. FATCA requires foreign financial institutions to report information about financial accounts held by U.S. taxpayers to the Internal Revenue Service (IRS). This reporting helps ensure that U.S. taxpayers comply with their tax obligations on foreign income and assets.

How to Use the Fatca Full Form

To use the FATCA full form, individuals must first determine if they meet the criteria for reporting under FATCA. U.S. taxpayers with foreign financial assets exceeding specific thresholds must fill out the FATCA form, typically using IRS Form 8938. This form is submitted along with the annual tax return. It is essential to accurately report all foreign assets to avoid penalties for non-compliance.

Steps to Complete the Fatca Full Form

Completing the FATCA form involves several key steps:

- Identify if you are required to file based on your foreign asset holdings.

- Gather necessary documentation, including account statements and asset valuations.

- Fill out IRS Form 8938, providing detailed information about each foreign account.

- Review the completed form for accuracy before submission.

- File the form with your annual tax return by the designated deadline.

Legal Use of the Fatca Full Form

The legal use of the FATCA form is critical for compliance with U.S. tax laws. Failure to report foreign financial assets can lead to significant penalties, including fines and interest on unpaid taxes. The FATCA form serves as a legal declaration of foreign income and assets, ensuring that U.S. taxpayers fulfill their obligations under the law.

Required Documents

When completing the FATCA form, several documents are necessary to provide accurate information:

- Foreign bank statements showing account balances and transactions.

- Documentation of foreign investments, such as brokerage statements.

- Valuation statements for any foreign real estate or other assets.

- Tax identification numbers from foreign financial institutions, if applicable.

Filing Deadlines / Important Dates

The filing deadlines for the FATCA form align with the annual tax return deadlines. For most U.S. taxpayers, this means the FATCA form must be submitted by April 15 each year. If additional time is needed, taxpayers can file for an extension, which typically extends the deadline to October 15. It is crucial to adhere to these deadlines to avoid penalties.

Penalties for Non-Compliance

Non-compliance with FATCA reporting requirements can result in severe penalties. If a taxpayer fails to file the FATCA form when required, they may face a penalty of up to $10,000 for each failure to report. Additionally, if the IRS determines that the failure was willful, the penalties can increase significantly, potentially reaching up to 40% of the unreported income. Therefore, understanding and adhering to FATCA requirements is essential for U.S. taxpayers with foreign financial assets.

Quick guide on how to complete fatca full form

Effortlessly Prepare Fatca Full Form on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed papers, allowing you to access the needed form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Fatca Full Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to Modify and Electronically Sign Fatca Full Form with Ease

- Find Fatca Full Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Fatca Full Form to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fatca full form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FATCA full form?

The FATCA full form is the Foreign Account Tax Compliance Act. It is a U.S. federal law aimed at combating tax evasion by U.S. persons holding assets in foreign accounts. Understanding the FATCA full form is essential for compliance in financial services.

-

How does airSlate SignNow support FATCA compliance?

airSlate SignNow helps businesses ensure FATCA compliance by providing secure eSigning solutions that streamline document management. With its intuitive interface, users can quickly send and sign necessary forms related to FATCA, safeguarding sensitive information while remaining compliant.

-

Is airSlate SignNow cost-effective for businesses dealing with FATCA forms?

Yes, airSlate SignNow is a cost-effective solution for businesses managing FATCA forms. With its affordable pricing plans, companies can easily budget for electronic signatures, reducing both time and resources spent on traditional paperwork for FATCA compliance.

-

What features does airSlate SignNow offer for managing FATCA documents?

airSlate SignNow offers features like customizable templates, bulk sending, and in-app notifications specifically for managing FATCA documents. These features streamline the process of handling FATCA compliance paperwork, making it easier for businesses to stay organized and efficient.

-

Can airSlate SignNow integrate with existing systems for FATCA compliance?

Yes, airSlate SignNow provides seamless integration with various existing systems to enhance FATCA compliance workflows. By integrating with CRMs, document management systems, and more, businesses can ensure that their FATCA forms are efficiently processed.

-

What benefits does airSlate SignNow provide for electronic signing of FATCA forms?

The benefits of using airSlate SignNow for electronic signing of FATCA forms include increased speed, improved accuracy, and enhanced security. With eSigning, businesses can expedite the signing process, minimize errors, and protect sensitive information related to FATCA compliance.

-

Are there any specific regulatory considerations for FATCA when using airSlate SignNow?

When using airSlate SignNow, it's essential to understand that while the platform aids in processing FATCA-related documents, businesses still must comply with relevant regulations. Ensuring that all eSigned documents meet legal standards for FATCA compliance is crucial for businesses managing international accounts.

Get more for Fatca Full Form

- Sc lien search form

- Quitclaim deed from individual to llc south carolina form

- Warranty deed from individual to llc south carolina form

- Assignment of claim of lien corporation or llc south carolina form

- South carolina waiver lien form

- Sc husband wife 497325625 form

- Warranty deed from husband and wife to corporation south carolina form

- Unconditional waiver and release of claim of lien upon progress payment south carolina form

Find out other Fatca Full Form

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF