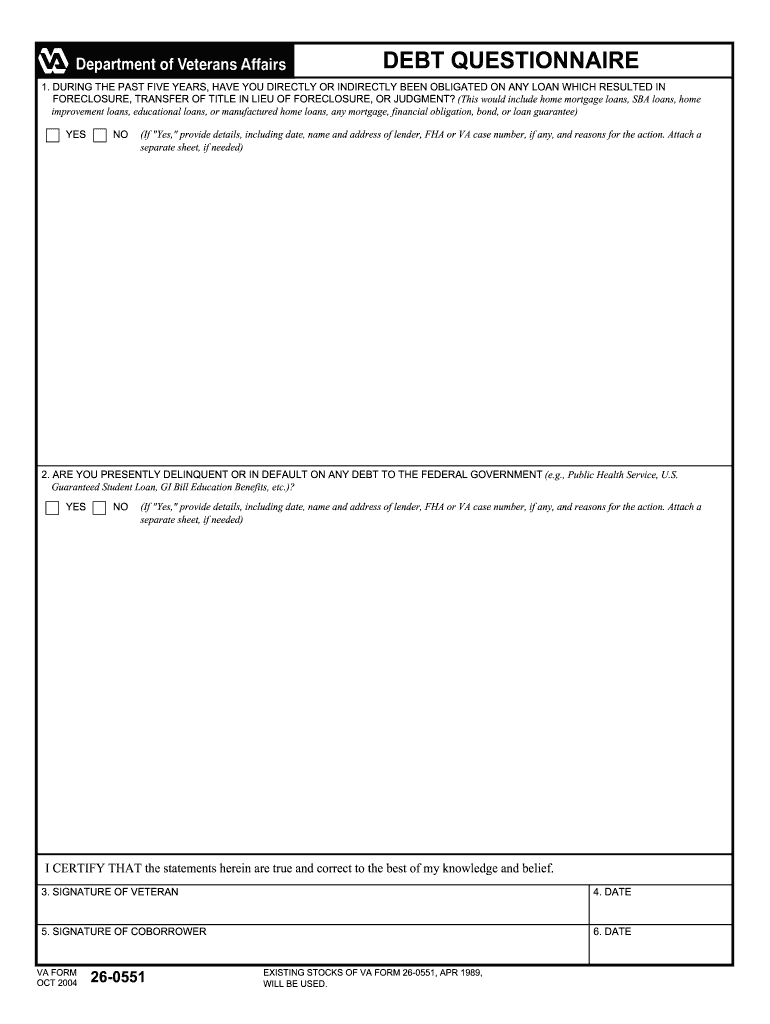

Va Debt Questionnaire Form

What is the VA Debt Questionnaire?

The VA indebtedness questionnaire, often referred to as the VA debt questionnaire or VA form 26-0551, is a crucial document utilized by veterans and service members to provide information regarding their financial obligations. This form is particularly important for those seeking to access VA benefits, as it helps the Department of Veterans Affairs assess the financial status of applicants. The information collected through this questionnaire is used to determine eligibility for various programs, including home loans and other financial assistance options.

How to Obtain the VA Debt Questionnaire

Obtaining the VA debt questionnaire is a straightforward process. Veterans can access the form through the official VA website or by visiting a local VA office. Additionally, the form may be available through various veteran service organizations that assist with VA-related paperwork. It is essential to ensure that you are using the most current version of the form, as updates may occur over time.

Steps to Complete the VA Debt Questionnaire

Completing the VA debt questionnaire involves several key steps:

- Gather necessary financial documents, including income statements, existing debt information, and any relevant financial records.

- Carefully read the instructions provided with the form to understand the requirements and ensure accurate completion.

- Fill out the questionnaire, providing all requested information about your debts and financial obligations.

- Review the completed form for accuracy and completeness before submission.

- Submit the form through the designated method, whether online, by mail, or in person at a VA office.

Legal Use of the VA Debt Questionnaire

The VA debt questionnaire is legally recognized as an essential tool for assessing a veteran's financial situation. When completed accurately, it serves as a formal declaration of financial obligations and is used by the VA to make informed decisions regarding benefits eligibility. Compliance with all legal requirements is crucial to ensure that the form is accepted and processed without issues.

Key Elements of the VA Debt Questionnaire

Understanding the key elements of the VA debt questionnaire is vital for accurate completion. The form typically includes sections that require information on:

- Current income and employment status

- Details of outstanding debts, including loans and credit obligations

- Monthly expenses and financial commitments

- Any additional financial information that may impact eligibility for VA benefits

Form Submission Methods

Submitting the VA debt questionnaire can be done through various methods to accommodate different preferences:

- Online: Many veterans prefer to submit the form electronically through the VA's secure online portal.

- By Mail: The completed form can be printed and mailed to the appropriate VA office.

- In Person: Veterans may also choose to submit the form directly at a local VA office for immediate assistance.

Examples of Using the VA Debt Questionnaire

The VA debt questionnaire is often used in various scenarios, such as:

- Applying for a VA home loan where financial assessment is necessary.

- Seeking financial assistance programs that require a detailed understanding of a veteran's financial situation.

- Updating financial information for existing VA benefits to ensure continued eligibility.

Quick guide on how to complete va debt questionnaire

Complete Va Debt Questionnaire effortlessly on any device

Web-based document management has become widely adopted by organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as one can easily locate the desired form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any delays. Manage Va Debt Questionnaire on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric operations today.

How to edit and electronically sign Va Debt Questionnaire with ease

- Obtain Va Debt Questionnaire and click on Get Form to begin.

- Utilize the features we offer to finalize your document.

- Emphasize important parts of your documents or obscure private information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Va Debt Questionnaire to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the va debt questionnaire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VA indebtedness questionnaire?

A VA indebtedness questionnaire is a form used by the Department of Veterans Affairs to assess the financial obligations of veterans. This questionnaire helps determine the eligibility for benefits and the repayment of any debts owed to the VA. Completing the VA indebtedness questionnaire accurately is essential for receiving the appropriate assistance.

-

How can airSlate SignNow streamline the VA indebtedness questionnaire process?

airSlate SignNow simplifies the process of completing and signing the VA indebtedness questionnaire digitally. With its user-friendly interface, you can easily fill out the form and eSign it without the hassle of printing or mailing. This not only saves time but also ensures secure document handling.

-

What features does airSlate SignNow offer for managing the VA indebtedness questionnaire?

AirSlate SignNow provides several features for managing the VA indebtedness questionnaire, including document templates, automated workflows, and secure storage. Users can also track the progress of their forms in real-time, ensuring that their submissions are timely and organized. These features facilitate a smooth experience for veterans and their representatives.

-

Is airSlate SignNow cost-effective for handling the VA indebtedness questionnaire?

Yes, airSlate SignNow is a cost-effective solution for handling the VA indebtedness questionnaire and other document signing needs. Its competitive pricing plans allow individuals and businesses to access a variety of document management features without breaking the bank. This makes it an ideal choice for those needing to manage VA forms efficiently.

-

How does airSlate SignNow ensure the security of the VA indebtedness questionnaire?

AirSlate SignNow prioritizes security with encryption and secure cloud storage for the VA indebtedness questionnaire and other documents. The platform complies with industry-standard security protocols, ensuring that sensitive information remains protected during the signing and storage process. Users can trust that their data is safe and handled with utmost care.

-

Can I integrate airSlate SignNow with other tools for the VA indebtedness questionnaire?

Absolutely! AirSlate SignNow offers integrations with various tools and platforms, enhancing the workflow for managing the VA indebtedness questionnaire. Whether you're using CRM systems, cloud storage services, or other productivity tools, integrating SignNow can improve your overall efficiency and streamline documentation processes.

-

What are the benefits of using airSlate SignNow for veterans filling out the VA indebtedness questionnaire?

Using airSlate SignNow for the VA indebtedness questionnaire offers veterans numerous benefits, including ease of use, quick turnaround time, and secure handling of their submissions. Veterans can complete their forms from anywhere and receive instant confirmation of submissions, making the process hassle-free. This leads to a more efficient experience for accessing VA benefits.

Get more for Va Debt Questionnaire

- Louisiana cancellation mortgage 497309465 form

- Partial release of property from mortgage for corporation louisiana form

- Partial release of property from mortgage by individual holder louisiana form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy louisiana form

- Warranty deed for parents to child with reservation of life estate louisiana form

- Warranty deed to convert community property to joint tenancy louisiana form

- Warranty deed for separate or joint property to joint tenancy louisiana form

- Property spouse community form

Find out other Va Debt Questionnaire

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word