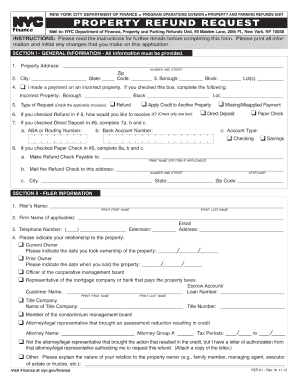

Nyc Property Tax Refund Form

What is the NYC Property Tax Refund?

The NYC property tax refund is a financial mechanism allowing eligible property owners to reclaim overpaid property taxes. This refund is applicable to those who have paid more than their fair share due to various reasons, such as assessment errors or changes in property value. Understanding the specifics of this refund can help homeowners ensure they are not losing money unnecessarily.

Eligibility Criteria for the NYC Property Tax Refund

To qualify for the NYC property tax refund, property owners must meet certain criteria. Generally, eligibility includes:

- Ownership of the property during the tax year in question.

- Proof of overpayment, which may require documentation of assessments and payments.

- Compliance with any specific guidelines set by the NYC Department of Finance.

It is crucial for applicants to gather all necessary documentation to support their claim for a refund.

Steps to Complete the NYC Property Tax Refund Form

Filling out the NYC property tax refund form involves several steps. Begin by gathering all required documents, including proof of ownership and payment records. Next, follow these steps:

- Download the NYC property tax refund form from the official website.

- Fill in the required personal and property information accurately.

- Attach any supporting documentation that verifies your claim.

- Review the form for completeness and accuracy before submission.

Completing these steps carefully can help ensure a smooth processing of your refund request.

Required Documents for the NYC Property Tax Refund

When applying for the NYC property tax refund, specific documents must be submitted to validate your claim. These typically include:

- Proof of property ownership, such as a deed or title.

- Payment history for property taxes, including receipts or statements.

- Any correspondence with the NYC Department of Finance regarding assessments.

Having these documents ready will facilitate the application process and help avoid delays.

Form Submission Methods for the NYC Property Tax Refund

Property owners can submit the NYC property tax refund form through various methods. These include:

- Online submission via the NYC Department of Finance website, which offers a streamlined process.

- Mailing the completed form and documents to the appropriate department address.

- In-person submission at designated NYC Department of Finance locations.

Choosing the most convenient submission method can help expedite the processing of your refund.

Legal Use of the NYC Property Tax Refund

The legal framework surrounding the NYC property tax refund ensures that property owners have a right to reclaim overpaid taxes. Compliance with local laws and regulations is essential for a successful claim. This includes adhering to deadlines and providing accurate information on the refund form. Understanding these legal aspects can help property owners navigate the refund process more effectively.

Quick guide on how to complete nyc property tax refund

Effortlessly manage Nyc Property Tax Refund on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without complications. Manage Nyc Property Tax Refund on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Nyc Property Tax Refund with ease

- Find Nyc Property Tax Refund and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Select important sections of the documents or disguise confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Decide how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and electronically sign Nyc Property Tax Refund to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc property tax refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a property tax refund form?

A property tax refund form is a document used by homeowners to request a refund on overpaid property taxes. By completing this form accurately, residents can ensure they receive the funds they are entitled to. Utilizing airSlate SignNow simplifies the process of signing and submitting your property tax refund form.

-

How do I fill out a property tax refund form using airSlate SignNow?

To fill out a property tax refund form using airSlate SignNow, simply upload your document and use our intuitive tools to add necessary details. You can sign electronically or invite others to sign securely. Our platform ensures that your property tax refund form is completed accurately and quickly.

-

Are there any costs associated with using airSlate SignNow for property tax refund forms?

airSlate SignNow offers a variety of pricing plans tailored to different needs, including affordable options for individuals and businesses. While there may be costs associated with premium features, creating and signing a basic property tax refund form is often included in lower-tier subscriptions. Explore our pricing plans to find the best fit for your needs.

-

What features does airSlate SignNow offer for handling property tax refund forms?

airSlate SignNow provides robust features for managing property tax refund forms, including templates, eSignature capabilities, and real-time tracking. Users can collaborate easily and automate the workflow, making it simpler to handle multiple refund requests. Our user-friendly interface ensures a smooth experience when processing your forms.

-

Can I integrate airSlate SignNow with other software to manage property tax refund forms?

Yes, airSlate SignNow offers integrations with various tools and software, such as CRM systems and cloud storage platforms. This allows seamless management of your property tax refund forms alongside your other business processes. Check out our integrations page to see compatible applications that enhance your workflow.

-

What benefits can I expect from using airSlate SignNow for property tax refund forms?

Using airSlate SignNow for your property tax refund forms provides several benefits, including increased efficiency and reduced turnaround times. The electronic signature feature ensures that you can easily obtain approvals from necessary parties, while automated reminders keep your forms on track. Overall, you can expect a more organized and hassle-free process.

-

Is my information secure when using airSlate SignNow for property tax refund forms?

Absolutely! airSlate SignNow prioritizes the security of your data with state-of-the-art encryption and compliance with data protection regulations. When you submit your property tax refund form through our platform, you can rest assured that your information is kept safe and confidential throughout the process.

Get more for Nyc Property Tax Refund

- Letter from landlord to tenant returning security deposit less deductions massachusetts form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return massachusetts form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return form

- Letter from tenant to landlord containing request for permission to sublease massachusetts form

- Ma sublease form

- Massachusetts rent paid form

- Massachusetts tenant landlord form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration 497309701 form

Find out other Nyc Property Tax Refund

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure