Mw507m Form

What is the mw507m?

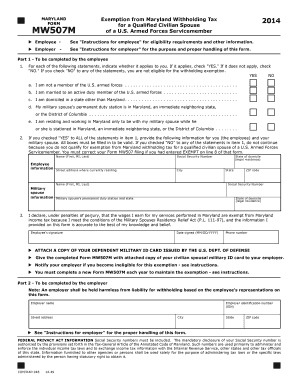

The mw507m is a Maryland withholding form used by employers to determine the correct amount of state income tax to withhold from employees' wages. This form is essential for ensuring compliance with Maryland's tax regulations. It helps employers calculate the state income tax based on the employee's earnings, filing status, and any additional allowances claimed. Understanding the mw507m is crucial for both employers and employees to ensure accurate tax withholding and reporting.

How to use the mw507m

To use the mw507m, employers must first provide the form to their employees for completion. Employees fill out the form by providing their personal information, including name, address, and Social Security number, along with their withholding allowances. Once completed, employees submit the mw507m to their employer, who then uses the information to calculate the appropriate withholding amount from each paycheck. It is important for employees to review their withholding status periodically, especially after major life events such as marriage or the birth of a child.

Steps to complete the mw507m

Completing the mw507m involves several straightforward steps:

- Obtain the mw507m form from your employer or download it from the Maryland State website.

- Fill in your personal details, including your name, address, and Social Security number.

- Indicate your filing status and the number of allowances you are claiming.

- Sign and date the form to certify the information provided is accurate.

- Submit the completed form to your employer for processing.

Key elements of the mw507m

The mw507m includes several key elements that are essential for accurate tax withholding:

- Personal Information: Name, address, and Social Security number of the employee.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances claimed affects the withholding amount.

- Signature: The employee must sign and date the form to validate it.

Legal use of the mw507m

The mw507m is legally binding when completed accurately and submitted to the employer. It complies with Maryland tax laws, ensuring that employers withhold the correct amount of state income tax from employees' wages. Failure to use the mw507m properly can result in penalties for both the employer and the employee, including under-withholding or over-withholding of taxes. Employers are required to keep the mw507m on file for record-keeping and tax reporting purposes.

Filing Deadlines / Important Dates

It is important to be aware of key deadlines related to the mw507m. Employees should submit their completed mw507m to their employer as soon as they start a new job or experience a change in their tax situation. Employers are required to implement the withholding changes as soon as possible, typically by the next payroll period. Additionally, employees should review their withholding status annually or whenever significant life changes occur, ensuring compliance with Maryland tax regulations.

Quick guide on how to complete mw507m

Effortlessly Prepare Mw507m on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to acquire the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly without interruptions. Handle Mw507m on any device with the airSlate SignNow apps available for Android or iOS and enhance any document-related workflow today.

The Easiest Way to Edit and Electronically Sign Mw507m with Ease

- Obtain Mw507m and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information carefully and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Edit and electronically sign Mw507m and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mw507m

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mw507m and how does it work with airSlate SignNow?

The mw507m is a crucial feature within airSlate SignNow that enhances the document signing process. It streamlines workflows by enabling users to send, sign, and manage documents efficiently. This means that businesses can adopt a more organized approach to eSigning and document management.

-

What are the pricing plans for using mw507m with airSlate SignNow?

airSlate SignNow offers various pricing plans that are competitive and cater to different business needs. With the mw507m feature, users can expect a range of affordable options that suit both small and large enterprises. You can choose a plan that aligns perfectly with your company's budget and requirements.

-

What features does mw507m include for document management?

The mw507m includes several powerful features, such as templates, automated workflows, and real-time tracking. These capabilities allow users to create and manage documents more effectively, ensuring quicker turnaround times. Discovering these features can signNowly enhance the overall user experience.

-

What benefits does mw507m offer for businesses?

By utilizing mw507m with airSlate SignNow, businesses can improve their efficiency, reduce costs, and enhance productivity. The ability to sign documents electronically reduces the need for paper, streamlining the entire signing process. This newfound efficiency can ultimately lead to increased customer satisfaction and help your business grow.

-

Can mw507m be integrated with other applications?

Yes, mw507m is designed for seamless integration with various applications that businesses commonly use. This includes CRMs, cloud storage systems, and more, making it a versatile choice for organizations looking to enhance their document management workflows. Integration fosters a more cohesive and productive working environment.

-

Is there a mobile app for mw507m on airSlate SignNow?

Absolutely! airSlate SignNow provides a mobile app that incorporates the mw507m feature, allowing users to manage and sign documents on the go. This flexibility helps busy professionals complete tasks from anywhere, increasing the convenience and effectiveness of document management. Stay connected and efficient with the mobile solution.

-

What industries can benefit from using mw507m?

A wide range of industries can leverage the mw507m features of airSlate SignNow, including real estate, finance, healthcare, and education. The document signing capabilities streamline processes in these sectors, helping organizations operate more efficiently. Whether you are in a corporate setting or a small business, mw507m can bring substantial value.

Get more for Mw507m

Find out other Mw507m

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document