W 1 Ree Form

What is the W-1 Ree?

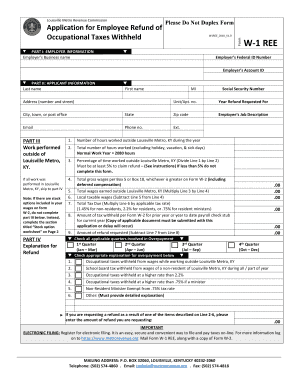

The W-1 Ree is a specific form used in the United States for reporting certain types of income and tax information. This form is essential for both individuals and businesses to ensure compliance with federal tax regulations. It is typically utilized by entities that need to report payments made to contractors or other service providers. Understanding the purpose and requirements of the W-1 Ree is crucial for accurate tax reporting and avoiding potential penalties.

Steps to complete the W-1 Ree

Completing the W-1 Ree involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the recipient's name, address, and taxpayer identification number. Next, accurately report the amounts paid during the tax year. It is important to double-check all entries for correctness before submission. Finally, sign and date the form to validate it. Ensuring that all information is complete and accurate will help prevent delays or issues with the IRS.

Legal use of the W-1 Ree

The legal use of the W-1 Ree is governed by IRS regulations. This form must be filled out accurately to ensure that the reported income aligns with IRS requirements. When used correctly, the W-1 Ree serves as a legal document that can support tax filings and provide necessary information for audits. It is vital to maintain compliance with all applicable tax laws to avoid penalties and ensure that the form is accepted by the IRS.

How to obtain the W-1 Ree

The W-1 Ree can be obtained directly from the IRS website or through authorized tax professionals. It is available in a downloadable format, allowing users to print and fill it out manually. Additionally, many tax preparation software programs include the W-1 Ree, making it easier for users to complete the form electronically. Ensuring that you have the most current version of the form is important for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the W-1 Ree are crucial to adhere to avoid penalties. Typically, the form must be submitted by January thirty-first of the year following the tax year in which payments were made. It is essential to keep track of these dates to ensure timely filing and compliance with IRS regulations. Failure to meet these deadlines can result in fines and complications with tax reporting.

Examples of using the W-1 Ree

Common examples of using the W-1 Ree include reporting payments made to freelance contractors, consultants, or service providers. For instance, if a business hires a graphic designer for a project and pays them more than six hundred dollars in a calendar year, the business is required to report this payment using the W-1 Ree. These examples illustrate the importance of accurately reporting income to maintain compliance with tax laws.

Key elements of the W-1 Ree

The W-1 Ree includes several key elements that must be accurately completed. These elements consist of the payer’s information, the recipient’s details, and the total amount paid. Additionally, the form requires the payer's signature and date, affirming the validity of the information provided. Understanding these components is essential for ensuring that the form is filled out correctly and meets IRS standards.

Quick guide on how to complete w 1 ree

Manage W 1 Ree effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed materials, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle W 1 Ree on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and eSign W 1 Ree with ease

- Find W 1 Ree and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes seconds and has the exact legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow fulfills your needs in document management in just a few clicks from any device of your preference. Edit and eSign W 1 Ree and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 1 ree

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is w 1 ree and how does it relate to airSlate SignNow?

The term 'w 1 ree' refers to the seamless integration of workflows and electronic signatures within airSlate SignNow. This solution empowers businesses to manage their document signing process efficiently, saving time and resources.

-

How much does airSlate SignNow cost for users looking for w 1 ree functionalities?

Pricing for airSlate SignNow varies based on the plan selected, but it is designed to be cost-effective for users needing 'w 1 ree' features. Plans offer different levels of functionality, ensuring that businesses of all sizes can find an option that meets their budget and needs.

-

What features does airSlate SignNow offer that are beneficial for w 1 ree?

airSlate SignNow offers a variety of features tailored for 'w 1 ree' users including customizable workflows, templates, and advanced signing options. These features enhance the document management process, making it easier to engage clients and streamline operations.

-

Can I integrate airSlate SignNow with other applications to enhance w 1 ree?

Yes, airSlate SignNow offers robust integrations with popular applications, allowing for a comprehensive 'w 1 ree' experience. Users can connect their existing tools to optimize workflow and ensure a smooth transition between apps.

-

How does airSlate SignNow ensure security for w 1 ree document management?

Security is a top priority with airSlate SignNow, especially for users leveraging 'w 1 ree' features. The platform implements advanced encryption and complies with industry standards to protect sensitive data throughout the eSigning process.

-

Is airSlate SignNow user-friendly for those unfamiliar with w 1 ree solutions?

Absolutely, airSlate SignNow is designed with user experience in mind, making it easy for even those new to 'w 1 ree' to navigate the platform. The intuitive interface and helpful resources ensure a smooth learning curve.

-

What are the benefits of using airSlate SignNow for businesses focused on w 1 ree?

Using airSlate SignNow for 'w 1 ree' provides numerous benefits, such as increased efficiency, reduced paperwork, and quicker turnaround times for document signing. Businesses can signNowly enhance productivity and client satisfaction.

Get more for W 1 Ree

Find out other W 1 Ree

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy