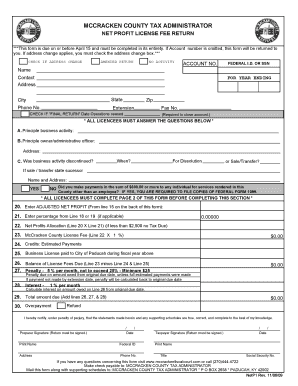

Mccracken County Tax Administrator Form

What is the Mccracken County Tax Administrator

The Mccracken County Tax Administrator is a designated official responsible for overseeing tax collection and administration within Mccracken County. This role includes managing various tax-related processes, such as the Mccracken County net profit license fee return, ensuring compliance with local tax laws, and providing guidance to taxpayers. The Tax Administrator plays a crucial part in maintaining accurate tax records and facilitating communication between the county government and its residents regarding tax obligations.

Steps to complete the Mccracken County Tax Administrator form

Completing the Mccracken County Tax Administrator form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including financial records and identification. Next, fill out the form with precise information, paying close attention to details such as income sources and deductions. After completing the form, review it thoroughly to avoid errors. Finally, submit the form through the appropriate channel, whether online, by mail, or in person, ensuring that you meet any specified deadlines.

Legal use of the Mccracken County Tax Administrator

To ensure the legal validity of the Mccracken County Tax Administrator form, it must adhere to specific regulations governing electronic signatures and document submissions. Compliance with laws such as the ESIGN Act and UETA is essential when submitting forms electronically. Utilizing a reliable eSignature solution can enhance the legal standing of your submission, providing necessary authentication and security measures. This includes features like audit trails and encryption to protect sensitive information.

Filing Deadlines / Important Dates

Awareness of filing deadlines is critical for taxpayers dealing with the Mccracken County Tax Administrator. Typically, tax returns are due annually, with specific dates set by the county. It is advisable to check the official county website or consult the Tax Administrator's office for the most current deadlines. Missing these dates can result in penalties or interest charges, making timely submission essential for compliance.

Required Documents

When preparing to submit the Mccracken County Tax Administrator form, several documents are necessary to support your application. These may include proof of income, identification, previous tax returns, and any relevant licenses or permits. Having these documents ready can streamline the process and ensure that your submission is complete, reducing the likelihood of delays or additional requests for information.

Form Submission Methods (Online / Mail / In-Person)

The Mccracken County Tax Administrator form can typically be submitted through various methods, including online, by mail, or in person. Online submissions are often the most efficient, allowing for quicker processing times. If choosing to submit by mail, ensure that you send the form to the correct address and consider using a trackable mailing option. For in-person submissions, check the office hours and any specific requirements for visiting the Tax Administrator's office.

Penalties for Non-Compliance

Failure to comply with the requirements set forth by the Mccracken County Tax Administrator can lead to various penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to understand their obligations and adhere to all filing requirements to avoid these consequences. Regularly consulting with the Tax Administrator’s office can provide clarity on compliance and help mitigate risks associated with non-compliance.

Quick guide on how to complete mccracken county tax administrator

Easily Prepare Mccracken County Tax Administrator on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow provides all the necessary tools to swiftly create, edit, and eSign your documents without delay. Handle Mccracken County Tax Administrator on any device with the airSlate SignNow applications for Android or iOS and enhance your document-based workflows today.

How to Alter and eSign Mccracken County Tax Administrator Effortlessly

- Find Mccracken County Tax Administrator and click on Get Form to initiate the process.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invite link, or download to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Mccracken County Tax Administrator and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mccracken county tax administrator

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the McCracken County Tax Administrator offer?

The McCracken County Tax Administrator provides essential services such as property tax assessments, collections, and the management of tax records. They ensure accurate billing and compliance with state regulations to help residents and businesses meet their tax obligations effectively.

-

How can airSlate SignNow streamline my interactions with the McCracken County Tax Administrator?

Using airSlate SignNow, you can easily eSign and send documents directly related to your tax filings. This cost-effective solution simplifies the process of submitting required paperwork to the McCracken County Tax Administrator, saving you time and ensuring accuracy.

-

What are the pricing options available for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans designed to suit various business needs, whether you're an individual or a larger organization. You can explore tiered pricing structures that provide value while facilitating your interactions with local agencies, including the McCracken County Tax Administrator.

-

Are there any integrations available with airSlate SignNow for tax-related services?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your workflow. This includes integrations that allow you to sync documents and manage data between airSlate SignNow and the tools you use to interact with the McCracken County Tax Administrator.

-

What features does airSlate SignNow provide for document management?

AirSlate SignNow offers a robust set of features including document templates, real-time tracking, and automated reminders, all aimed at making your document management easier. These features help ensure you never miss a deadline related to the McCracken County Tax Administrator.

-

Can airSlate SignNow help in ensuring compliance with the McCracken County Tax Administrator's requirements?

Absolutely! AirSlate SignNow is designed to assist you with maintaining compliance by providing secure and legally binding eSignatures. This means every document sent to the McCracken County Tax Administrator is handled according to regulatory standards.

-

Is it safe to use airSlate SignNow for tax-related documents?

Yes, airSlate SignNow prioritizes the security and confidentiality of your documents. Utilizing industry-leading encryption and security protocols, you can confidently manage your tax documents and submissions to the McCracken County Tax Administrator without worry.

Get more for Mccracken County Tax Administrator

Find out other Mccracken County Tax Administrator

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT