Fin 312 2017

What is the Fin 312

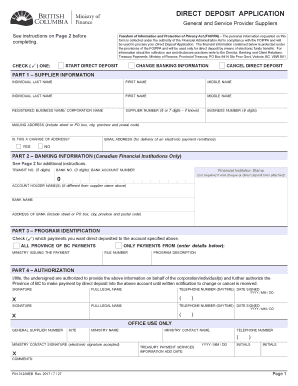

The Fin 312 form is a specific document used in the context of financial reporting and compliance. It serves as a crucial tool for individuals and businesses to report certain financial information to the relevant authorities. Understanding the purpose and requirements of the Fin 312 is essential for ensuring compliance and avoiding potential penalties. This form typically includes sections for detailing income, expenses, and other financial activities pertinent to the reporting period.

How to use the Fin 312

Using the Fin 312 form involves several straightforward steps. First, gather all necessary financial documentation, including income statements and expense records. Next, accurately fill out each section of the form, ensuring that all information is complete and truthful. After completing the form, review it for any errors or omissions. Finally, submit the Fin 312 to the appropriate authority by the designated deadline, ensuring that you retain a copy for your records.

Steps to complete the Fin 312

Completing the Fin 312 form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all relevant financial documents.

- Fill in your personal or business information at the top of the form.

- Detail your income sources in the designated sections.

- List all allowable deductions and expenses.

- Review the completed form for accuracy.

- Sign and date the form before submission.

Legal use of the Fin 312

The legal use of the Fin 312 form is governed by various regulations and guidelines. To ensure that the form is legally valid, it must be filled out accurately and submitted on time. Compliance with federal and state laws is crucial, as any discrepancies or inaccuracies can lead to penalties or audits. Additionally, electronic submission of the Fin 312 is permissible, provided that it meets the necessary legal standards for eSignatures and data protection.

Required Documents

To complete the Fin 312 form, several documents are typically required. These may include:

- Income statements from all sources.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any relevant financial statements or reports.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the Fin 312 form are critical to avoid penalties. Generally, the form must be submitted by the designated date set by the IRS or relevant state authority. It is important to mark these dates on your calendar and plan your filing accordingly. Late submissions can result in fines and interest on any owed amounts, making timely filing essential for compliance.

Quick guide on how to complete fin 312

Effortlessly Prepare Fin 312 on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Fin 312 on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Fin 312 with Ease

- Acquire Fin 312 and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign Fin 312 and ensure excellent communication at any point in your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fin 312

Create this form in 5 minutes!

How to create an eSignature for the fin 312

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is fin 312?

Fin 312 refers to a specific financial strategy or product that emphasizes efficient document management within organizations. Using airSlate SignNow, businesses can streamline their workflows, which is essential for implementing effective financial practices like those in fin 312.

-

How does airSlate SignNow support fin 312?

airSlate SignNow facilitates the execution of fin 312 by allowing users to easily create, send, and manage documents electronically. This solution reduces the time and effort involved in traditional document processes, aligning perfectly with the principles of fin 312.

-

What features of airSlate SignNow are most relevant to fin 312?

Key features of airSlate SignNow relevant to fin 312 include advanced eSignature capabilities, template management, and automated workflows. These features help organizations maintain compliance, improve efficiency, and focus on their financial objectives, including those outlined in fin 312.

-

Is there a cost-effective pricing plan for airSlate SignNow aimed at fin 312 users?

Yes, airSlate SignNow offers a variety of pricing plans that cater to businesses utilizing fin 312. These plans are designed to be affordable while providing extensive features that enhance document management and signing processes, making it accessible to all types of organizations.

-

What are the benefits of using airSlate SignNow for fin 312?

Utilizing airSlate SignNow for fin 312 delivers numerous benefits, including increased efficiency, reduced paper waste, and improved document security. Businesses can transact faster and mitigate risks associated with manual processes, thus achieving their financial goals more effectively.

-

Can I integrate airSlate SignNow with other tools while implementing fin 312?

Absolutely! airSlate SignNow seamlessly integrates with various tools commonly used in financial management, allowing users to enhance their fin 312 implementation. The integrations help create a more cohesive workflow, saving time and boosting productivity.

-

How can airSlate SignNow enhance collaboration in fin 312 processes?

airSlate SignNow enhances collaboration in fin 312 processes by allowing multiple users to work on documents simultaneously and track changes in real time. This feature ensures that all stakeholders can participate in the workflow, improving communication and accelerating decision-making.

Get more for Fin 312

Find out other Fin 312

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template