Tax Credit Form Marana Unified School District

What is the unified tax credit form?

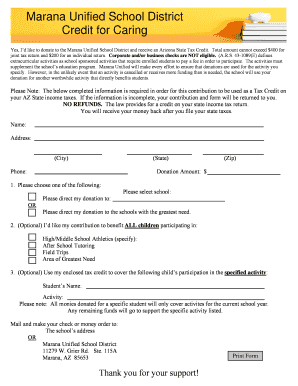

The unified tax credit form is a document used primarily to claim tax credits associated with various educational and charitable contributions. In the context of the Marana Unified School District, this form allows taxpayers to receive credits for donations made to support local schools. Understanding the purpose and implications of this form is essential for maximizing tax benefits while contributing to community education.

Steps to complete the unified tax credit form

Completing the unified tax credit form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including proof of donations and personal identification information. Next, fill out the form by providing details such as your name, address, and the amount donated. It is crucial to double-check all entries for accuracy before submitting. Finally, sign and date the form to validate your claim. This careful approach helps avoid delays or issues with processing your tax credit.

Eligibility criteria for the unified tax credit

To qualify for the unified tax credit, taxpayers must meet specific eligibility criteria. Generally, individuals must be residents of the state where the tax credit is being claimed. Additionally, the contributions must be made to eligible organizations, such as public schools or certain non-profits, as defined by state regulations. It is important to review these criteria thoroughly to ensure that your contributions qualify for the credit, thereby maximizing your potential tax benefits.

IRS guidelines for the unified tax credit

The IRS provides comprehensive guidelines regarding the unified tax credit, outlining the requirements for claiming this benefit. Taxpayers should familiarize themselves with the specific forms and documentation needed to substantiate their claims. This includes maintaining records of all contributions and ensuring that they are made to qualifying entities. Adhering to IRS guidelines is essential for a smooth filing process and to avoid potential penalties or disallowance of the credit.

Form submission methods for the unified tax credit

There are several methods available for submitting the unified tax credit form, allowing flexibility based on individual preferences. Taxpayers can choose to submit the form online through designated state tax portals, which often provide a streamlined process. Alternatively, forms can be mailed directly to the appropriate tax authority or submitted in person at local tax offices. Each method has its own processing times, so it is advisable to choose the one that best fits your timeline for tax filing.

Filing deadlines for the unified tax credit

Filing deadlines for the unified tax credit are crucial for ensuring that taxpayers do not miss out on potential benefits. Typically, these deadlines align with the overall tax filing deadlines set by the IRS. It is important to be aware of any specific dates related to the unified tax credit, as late submissions may result in the loss of the credit. Keeping track of these deadlines helps taxpayers plan their contributions and submissions effectively.

Key elements of the unified tax credit form

The unified tax credit form contains several key elements that are vital for successful completion. These include personal identification information, details of the contributions made, and a declaration of eligibility. Additionally, the form may require signatures from both the taxpayer and the recipient organization to validate the claim. Understanding these elements ensures that all necessary information is provided, reducing the likelihood of processing delays.

Quick guide on how to complete tax credit form marana unified school district

Complete Tax Credit Form Marana Unified School District smoothly on any gadget

Web-based document management has gained traction with businesses and individuals. It offers a great eco-conscious option to traditional printed and signed papers, as you can locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle Tax Credit Form Marana Unified School District on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

The easiest method to alter and eSign Tax Credit Form Marana Unified School District without hassle

- Acquire Tax Credit Form Marana Unified School District and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to keep your modifications.

- Choose how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Tax Credit Form Marana Unified School District and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax credit form marana unified school district

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a unified tax credit?

A unified tax credit is a tax benefit that allows individuals to offset their tax liabilities through various credits. This mechanism helps reduce the amount of taxes owed and can signNowly improve financial planning. It's essential to understand the details of the unified tax credit to maximize benefits and ensure compliance.

-

How can airSlate SignNow help with managing documents related to unified tax credit?

AirSlate SignNow offers an easy-to-use platform for eSigning and managing documents related to your unified tax credit. By streamlining document workflows, you can efficiently prepare and submit tax-related documents without the hassle of paper forms. This efficiency is crucial during tax season when time is of the essence.

-

What are the pricing options for airSlate SignNow when handling unified tax credit documents?

AirSlate SignNow provides several pricing tiers, ensuring that businesses of all sizes can access solutions for managing unified tax credit documentation. Each tier offers distinct features tailored to meet different needs, allowing you to choose the best option for your specific circumstances. Transparent pricing helps you budget effectively while enhancing your tax credit processes.

-

Are there any integrations to help with the unified tax credit process?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage documents related to the unified tax credit. These integrations simplify data transfer and help ensure that all your tax-related information is organized and easily accessible. This functionality saves time and reduces errors in your tax filing process.

-

What features make airSlate SignNow a good choice for unified tax credit documentation?

AirSlate SignNow offers features like customizable templates, audit trails, and secure cloud storage that enhance the management of unified tax credit documents. These features ensure that your documents are signed, stored, and accessible, ensuring compliance with tax regulations. With a focus on security and efficiency, airSlate SignNow is an ideal solution for any business.

-

Can I use airSlate SignNow to collaborate with my tax advisor on unified tax credit matters?

Absolutely! AirSlate SignNow allows for seamless collaboration with your tax advisor on documents related to the unified tax credit. You can share files securely, receive feedback quickly, and ensure that all stakeholders are on the same page. This collaborative approach enhances your overall tax preparation experience.

-

What benefits does airSlate SignNow provide when dealing with the unified tax credit?

Using airSlate SignNow for your unified tax credit documentation offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By digitizing your documents and streamlining processes, you can focus more on optimizing your tax situation. This not only saves time but also minimizes the risk of errors.

Get more for Tax Credit Form Marana Unified School District

- Sample letter social security form

- Estate closing form

- Sample letter to withdraw offer on house form

- Bank request to release funds of deceased letter form

- Letter invitation to form

- Letter of renunciation of executorship form

- Payoff request template form

- Probate court statement of creditors claim oconee sc form

Find out other Tax Credit Form Marana Unified School District

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free