Form 13614 C

What is the Form 13614 C?

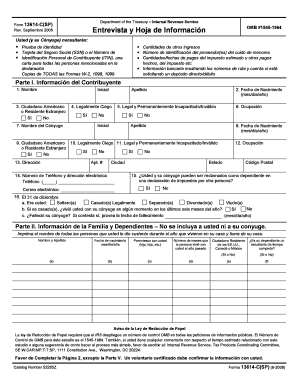

The Form 13614 C, also known as the formulario 13614 c, is a crucial document used by taxpayers in the United States, particularly for those seeking assistance with their tax returns. This form serves as a client intake sheet for tax preparation services, allowing tax professionals to gather essential information from clients. It is designed to streamline the tax filing process by ensuring that all necessary details are collected efficiently.

How to use the Form 13614 C

Using the Form 13614 C involves a few straightforward steps. First, taxpayers should download or request the form from a tax preparation service. Once obtained, the form needs to be filled out with accurate personal and financial information, including income sources, deductions, and credits. After completing the form, it should be submitted to the tax preparer, who will use the information to prepare the tax return. This form is particularly beneficial for ensuring that no critical details are overlooked during the tax preparation process.

Steps to complete the Form 13614 C

Completing the Form 13614 C requires careful attention to detail. Here are the steps to follow:

- Download or obtain the form: Ensure you have the latest version of the form available.

- Fill in personal information: Provide your name, address, Social Security number, and filing status.

- List income sources: Include all sources of income, such as wages, self-employment income, and investment earnings.

- Detail deductions and credits: Identify any deductions or credits you may qualify for, such as education credits or mortgage interest deductions.

- Review for accuracy: Double-check all entries to ensure accuracy before submission.

- Submit to your tax preparer: Provide the completed form to your tax professional for processing.

Legal use of the Form 13614 C

The Form 13614 C is legally binding when filled out correctly and used in compliance with IRS regulations. It serves as a formal declaration of the information provided by the taxpayer, which the IRS may reference during audits or inquiries. Ensuring that the form is completed accurately and honestly is essential, as any discrepancies may lead to penalties or legal issues.

Key elements of the Form 13614 C

Several key elements are crucial to the Form 13614 C, ensuring it serves its purpose effectively:

- Personal Information: This section captures the taxpayer's identity, including name, address, and Social Security number.

- Income Details: A comprehensive list of all income sources, which is vital for accurate tax calculation.

- Deductions and Credits: This part outlines potential tax benefits that the taxpayer may claim, impacting the overall tax liability.

- Signature: The taxpayer's signature certifies that the information provided is true and accurate, making it legally binding.

How to obtain the Form 13614 C

The Form 13614 C can be obtained through various channels. Taxpayers may download it directly from the IRS website or request it from a local tax preparation office. Many tax professionals also provide this form to their clients as part of the tax preparation process. Ensuring you have the correct version of the form is essential for compliance and accurate filing.

Quick guide on how to complete form 13614 c

Finish Form 13614 C effortlessly on any device

Digital document handling has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents swiftly without delays. Manage Form 13614 C on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Form 13614 C without any hassle

- Obtain Form 13614 C and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight signNow sections of your documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searching, or mistakes that require printing new copies. airSlate SignNow meets all your requirements in document management in just a few clicks from a device of your choice. Modify and eSign Form 13614 C and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 13614 c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 13614 c spanish, and how is it used?

The form 13614 c spanish is a tax form used by taxpayers to gather information on their tax situation, specifically for Spanish-speaking individuals. This form facilitates communication between taxpayers and tax preparers, helping ensure that all relevant information is accurately captured and processed for tax filings.

-

How can airSlate SignNow help with the form 13614 c spanish?

airSlate SignNow provides a platform to easily upload, send, and eSign the form 13614 c spanish securely. With its user-friendly interface, you can streamline the signing process, ensuring that all parties have quick access to the necessary documentation.

-

What are the pricing plans for using airSlate SignNow for the form 13614 c spanish?

airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes, allowing you to choose a plan that fits your needs while managing the form 13614 c spanish efficiently. You can start with a free trial to explore features before committing to a paid plan.

-

Are there any features specifically designed for the form 13614 c spanish in airSlate SignNow?

Yes, airSlate SignNow includes features like customizable templates and real-time tracking, specifically aimed at facilitating the processing of the form 13614 c spanish. These features enhance usability and ensure documents are efficiently signed and returned.

-

Can I integrate other tools with airSlate SignNow for processing the form 13614 c spanish?

Absolutely! airSlate SignNow offers seamless integrations with various applications, like Google Drive and Dropbox, allowing you to access and manage the form 13614 c spanish easily. This versatility helps streamline workflows and enhances team collaboration.

-

What benefits does airSlate SignNow provide for handling the form 13614 c spanish?

airSlate SignNow offers numerous benefits, including enhanced security and compliance, making it ideal for handling sensitive documents like the form 13614 c spanish. Additionally, the platform's ease of use reduces time spent on paperwork, increasing overall productivity.

-

Is airSlate SignNow suitable for individuals needing the form 13614 c spanish?

Yes, airSlate SignNow is user-friendly and suitable for individuals as well as businesses needing to manage the form 13614 c spanish. Its straightforward design allows users of all skill levels to navigate and utilize its eSigning capabilities with ease.

Get more for Form 13614 C

Find out other Form 13614 C

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe