Chuna Sacco Loan Forms

What is the Chuna Sacco Loan Forms

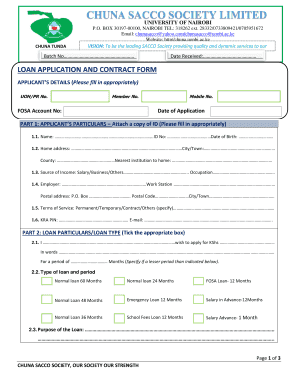

The Chuna Sacco loan forms are essential documents used for applying for loans within the Chuna Sacco system. These forms are designed to capture necessary information about the applicant, including personal details, financial status, and the specific loan amount requested. The Chuna Sacco operates as a savings and credit cooperative, allowing members to access loans under specific terms and conditions. Understanding the purpose and structure of these forms is crucial for a successful application process.

How to Use the Chuna Sacco Loan Forms

Using the Chuna Sacco loan forms involves several straightforward steps. First, ensure you have all required information, such as identification details and financial statements. Next, download or access the forms through the Chuna Sacco's official channels. Carefully fill out each section, ensuring accuracy and completeness. After completing the forms, review them for any errors before submission. This careful approach helps ensure that your application is processed smoothly and efficiently.

Steps to Complete the Chuna Sacco Loan Forms

Completing the Chuna Sacco loan forms requires attention to detail. Start by gathering all necessary documents, including proof of income and identification. Follow these steps:

- Access the loan forms from the Chuna Sacco website or office.

- Fill in your personal information accurately, including your full name, address, and contact details.

- Provide financial information such as your income, expenses, and any existing debts.

- Specify the loan amount you wish to apply for and the purpose of the loan.

- Sign and date the form, confirming that all information is correct.

Once completed, submit the forms according to the instructions provided, either online, by mail, or in person.

Eligibility Criteria

To qualify for a loan through the Chuna Sacco, applicants must meet specific eligibility criteria. Generally, these criteria include being a member of the Sacco, demonstrating a stable source of income, and having a good credit history. Some Saccos may also require a minimum savings balance or additional documentation to assess your financial stability. Understanding these requirements can help streamline your application process.

Legal Use of the Chuna Sacco Loan Forms

The Chuna Sacco loan forms must be completed and submitted in accordance with applicable laws and regulations. These forms are legally binding documents, meaning that the information provided must be truthful and accurate. Misrepresentation or failure to disclose relevant information can lead to penalties, including denial of the loan application or legal consequences. Therefore, it is essential to understand the legal implications of completing these forms.

Form Submission Methods

Submitting the Chuna Sacco loan forms can be done through various methods, depending on the Sacco's guidelines. Common submission methods include:

- Online: Many Saccos provide a digital platform for submitting loan applications directly through their website.

- Mail: Completed forms can often be sent via postal service to the Sacco's designated address.

- In-Person: Applicants may also choose to submit their forms in person at the nearest Sacco branch.

Choosing the right submission method can enhance the efficiency of your application process.

Quick guide on how to complete chuna sacco loan forms

Complete Chuna Sacco Loan Forms effortlessly on any device

Digital document management has become favored by both companies and individuals. It offers an excellent environmentally friendly substitute to conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Chuna Sacco Loan Forms on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Chuna Sacco Loan Forms without hassle

- Obtain Chuna Sacco Loan Forms and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that task.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to finalize your changes.

- Decide how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device you prefer. Edit and eSign Chuna Sacco Loan Forms and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chuna sacco loan forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are chuna sacco loan forms and why are they important?

Chuna sacco loan forms are essential documents required to apply for loans from Chuna Savings and Credit Cooperative Organizations (SACCOs). These forms help streamline the application process, ensuring that all necessary information is collected for loan assessments and approvals. Properly completed chuna sacco loan forms can signNowly enhance the chances of a successful loan application.

-

How can airSlate SignNow help with chuna sacco loan forms?

airSlate SignNow simplifies the process of managing chuna sacco loan forms by allowing users to easily create, send, and eSign documents online. This ensures that all parties can quickly review and sign the necessary forms, reducing delays in the loan application process. With its user-friendly interface, airSlate SignNow makes handling chuna sacco loan forms straightforward and efficient.

-

Are there any costs associated with using airSlate SignNow for chuna sacco loan forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. The costs may vary depending on the features you choose, but the platform generally provides a cost-effective solution for managing chuna sacco loan forms. By investing in airSlate SignNow, you can save time and resources in the documentation process.

-

What features does airSlate SignNow offer for managing chuna sacco loan forms?

airSlate SignNow provides a range of features for managing chuna sacco loan forms, including document templates, electronic signatures, and real-time tracking. These features streamline the loan documentation process, eliminate paperwork, and ensure a seamless experience for both lenders and borrowers. Additionally, advanced security measures ensure that sensitive information is well-protected.

-

Can I use airSlate SignNow to integrate with other applications when handling chuna sacco loan forms?

Absolutely! airSlate SignNow offers integrations with various applications, enabling you to efficiently handle chuna sacco loan forms alongside your existing software. This flexibility allows for smoother workflows and better organization, as you can connect with CRM systems, cloud storage solutions, and other essential tools to enhance your documentation process.

-

What are the benefits of using airSlate SignNow for chuna sacco loan forms?

Using airSlate SignNow for chuna sacco loan forms offers numerous benefits, including increased efficiency, reduced processing times, and improved accuracy. The platform eliminates the need for physical paperwork, allowing faster transactions and more streamlined communication among parties. Furthermore, eSigning features ensure that documents are signed securely and promptly, enhancing the overall customer experience.

-

How secure is airSlate SignNow when handling chuna sacco loan forms?

airSlate SignNow prioritizes security and uses advanced encryption protocols to protect all data and documents, including chuna sacco loan forms. It also complies with industry standards and regulations to safeguard sensitive information, ensuring peace of mind for both businesses and clients. You can trust airSlate SignNow to keep your loan forms secure throughout the signing process.

Get more for Chuna Sacco Loan Forms

- Audio systems contractor agreement self employed form

- Acoustical contractor agreement self employed form

- Air filtration contractor agreement self employed form

- Fireplace contractor agreement self employed form

- Concrete agreement contract form

- Stone contractor agreement self employed form

- Agreement independent contractor sample form

- Window contractor agreement self employed form

Find out other Chuna Sacco Loan Forms

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney