Stone Contractor Agreement Self Employed Form

What is the Stone Contractor Agreement Self Employed

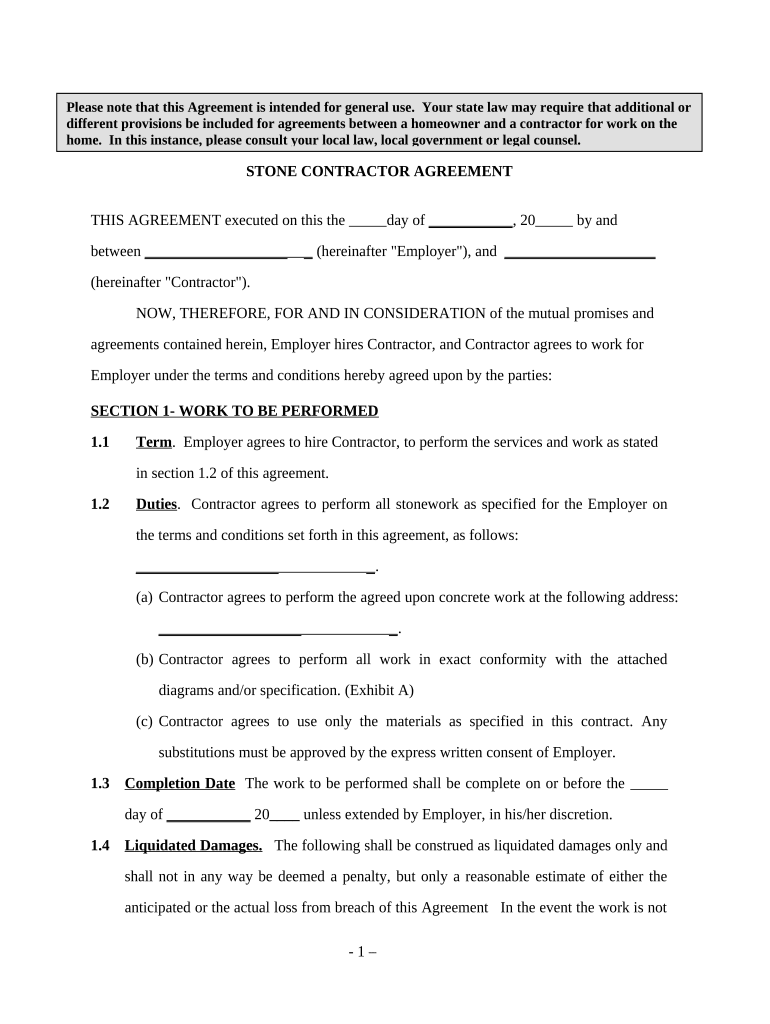

The Stone Contractor Agreement for self-employed individuals is a legal document that outlines the terms and conditions between a contractor and a client for stone-related services. This agreement typically includes details about the scope of work, payment terms, timelines, and responsibilities of both parties. It serves to protect the interests of both the contractor and the client, ensuring clarity and mutual understanding regarding the project. This agreement is crucial for establishing a professional relationship and can help prevent disputes by clearly defining expectations.

Key Elements of the Stone Contractor Agreement Self Employed

A well-crafted Stone Contractor Agreement should include several key elements to ensure comprehensive coverage of the project. These elements typically consist of:

- Scope of Work: A detailed description of the services to be performed, including specific tasks and materials required.

- Payment Terms: Information on how and when the contractor will be compensated, including any deposits or milestones.

- Timeline: A schedule outlining the start date, completion date, and any important deadlines.

- Liability and Insurance: Clauses that address liability for damages and the requirement for insurance coverage.

- Termination Clause: Conditions under which either party may terminate the agreement.

- Dispute Resolution: Methods for resolving conflicts, such as mediation or arbitration.

Steps to Complete the Stone Contractor Agreement Self Employed

Completing the Stone Contractor Agreement involves several important steps to ensure that all necessary information is accurately captured. Here’s a straightforward process to follow:

- Gather Information: Collect all relevant details about the project, including client information, project specifications, and payment terms.

- Draft the Agreement: Use a template or create a document that includes all key elements, ensuring clarity and completeness.

- Review the Agreement: Both parties should carefully review the document to confirm that all terms are acceptable and understood.

- Sign the Agreement: Utilize a digital signing platform to securely sign the agreement, ensuring compliance with eSignature laws.

- Distribute Copies: Provide copies of the signed agreement to all parties involved for their records.

Legal Use of the Stone Contractor Agreement Self Employed

To ensure that the Stone Contractor Agreement is legally binding, it must comply with specific legal requirements. In the United States, this includes adherence to the ESIGN Act and UETA, which govern electronic signatures. It is essential that both parties consent to use electronic means for signing the agreement. Additionally, the document should be clear, unambiguous, and contain all necessary elements to avoid potential disputes. Keeping a record of the agreement and any communications related to it can further strengthen its legal standing.

How to Use the Stone Contractor Agreement Self Employed

Using the Stone Contractor Agreement effectively involves understanding its purpose and how it fits into the overall project management process. Once the agreement is completed and signed, it serves as a reference point throughout the project. Contractors should refer to the agreement to ensure compliance with the outlined terms and conditions. It is advisable to keep open lines of communication with the client, addressing any changes or issues that may arise during the project. This proactive approach can help maintain a positive working relationship and mitigate potential conflicts.

State-Specific Rules for the Stone Contractor Agreement Self Employed

Each state in the U.S. may have specific regulations that impact the Stone Contractor Agreement. These can include licensing requirements, insurance mandates, and local building codes. It is important for contractors to familiarize themselves with the laws applicable in their state to ensure compliance. Consulting with a legal professional or industry expert can provide valuable insights into state-specific rules that may affect the agreement. Adhering to these regulations not only protects the contractor but also ensures that the project meets local standards and requirements.

Quick guide on how to complete stone contractor agreement self employed

Manage Stone Contractor Agreement Self Employed effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the suitable template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Stone Contractor Agreement Self Employed on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Stone Contractor Agreement Self Employed with ease

- Obtain Stone Contractor Agreement Self Employed and then click Get Form to begin.

- Use the tools we offer to complete your template.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all details and then click on the Done button to preserve your changes.

- Decide how you wish to send your template, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious template searches, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Stone Contractor Agreement Self Employed and guarantee excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Stone Contractor Agreement Self Employed?

A Stone Contractor Agreement Self Employed is a legal document that outlines the terms and conditions between stone contractors and their clients. This agreement typically details the scope of work, payment structures, and responsibilities, ensuring both parties are protected. By having a well-defined contract, stone contractors can operate with clarity and confidence.

-

How can I create a Stone Contractor Agreement Self Employed?

Creating a Stone Contractor Agreement Self Employed can be easily accomplished using templates available on platforms like airSlate SignNow. You can customize these templates to fit your specific needs, ensuring all necessary clauses are included. This method streamlines the process, making it accessible even for those new to contract creation.

-

What are the benefits of using a Stone Contractor Agreement Self Employed?

Using a Stone Contractor Agreement Self Employed provides numerous benefits, such as minimizing misunderstandings and legal disputes between contractors and clients. It establishes clear expectations regarding work quality, timelines, and payment. Additionally, having a formal agreement can enhance your professional reputation and trustworthiness.

-

Are there templates available for a Stone Contractor Agreement Self Employed?

Yes, there are numerous templates available for a Stone Contractor Agreement Self Employed on platforms such as airSlate SignNow. These templates can be easily customized to meet the specific needs of your project. Utilizing a template can save time while ensuring that all critical elements are included in your agreement.

-

What features does airSlate SignNow offer for Stone Contractor Agreements Self Employed?

airSlate SignNow offers a variety of features for creating and managing your Stone Contractor Agreement Self Employed. These include an easy-to-use interface for document creation, electronic signing capabilities, and secure cloud storage. With these tools, you can streamline the contract process, making it more efficient and accessible.

-

How much does it cost to use airSlate SignNow for a Stone Contractor Agreement Self Employed?

The cost of using airSlate SignNow can vary based on the subscription plan you choose, offering affordability for self-employed contractors needing a Stone Contractor Agreement. Pricing tiers are designed to suit different business needs, ensuring that even small contractors can access effective solutions. Check the pricing page for the latest offers and plans.

-

Can I integrate airSlate SignNow with other tools for my Stone Contractor Agreement Self Employed?

Yes, airSlate SignNow supports integration with various tools and platforms, enhancing the functionality of your Stone Contractor Agreement Self Employed. You can connect with tools such as CRM systems, cloud storage services, and other business applications. This integration can help streamline your workflow and improve overall efficiency.

Get more for Stone Contractor Agreement Self Employed

- Salesperson exam application formpdf state of california department of real estate exam

- Petition application form and checklist california department

- A disclosure statement is required for the ncrec form

- Examinations forms dre california department of real

- Real estate broker change form

- Lenderpurchaser disclosure statement loan origination form

- Log of appraisal experience form 3004 example

- Referencecan a seller back out of a purchase agreementzillowtypes of listing agreements understanding real estate can a seller form

Find out other Stone Contractor Agreement Self Employed

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT