Form 843

What is the Form 843

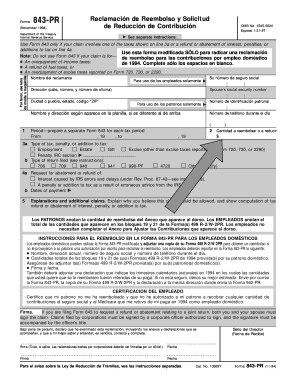

The Form 843 is a request for the abatement of certain taxes, penalties, or interest, or for a refund of overpaid taxes. It is commonly used by taxpayers who believe they have been incorrectly charged or have overpaid their taxes. This form allows individuals and businesses to formally request adjustments to their tax accounts with the Internal Revenue Service (IRS). Understanding the purpose of Form 843 is crucial for ensuring that all tax obligations are met accurately and efficiently.

How to use the Form 843

Using Form 843 involves several steps to ensure that the request is processed smoothly. Taxpayers should first determine their eligibility for filing the form based on the specific tax issues they are facing. After confirming eligibility, the next step is to accurately complete the form, providing all required information, including personal details and a clear explanation of the reason for the request. Once completed, the form must be submitted to the appropriate IRS address, which can vary depending on the nature of the request.

Steps to complete the Form 843

Completing Form 843 requires careful attention to detail. Here are the key steps:

- Gather necessary documentation that supports your claim, such as tax returns and payment records.

- Fill out the form with accurate personal information, including your name, address, and taxpayer identification number.

- Clearly state the reason for your request in the designated section, providing as much detail as possible.

- Sign and date the form to validate your request.

- Submit the completed form to the IRS, ensuring you send it to the correct address based on your state or the type of request.

Legal use of the Form 843

Form 843 is legally binding when it is filled out correctly and submitted according to IRS guidelines. It is important to provide truthful information, as filing a form with false information can lead to penalties. The form must be used for legitimate tax-related issues, such as requesting refunds or abatement of penalties. Compliance with IRS regulations ensures that the request is processed and that the taxpayer's rights are protected.

Required Documents

When filing Form 843, certain documents may be required to support your request. These documents can include:

- Copies of tax returns relevant to the claim.

- Payment records that show overpayment or incorrect charges.

- Any correspondence with the IRS regarding the issue.

- Documentation that substantiates the reason for the request, such as notices from the IRS.

Having these documents ready can help facilitate a smoother review process by the IRS.

Form Submission Methods

Form 843 can be submitted to the IRS through various methods. Taxpayers have the option to file the form by mail, which is the most common method. It is essential to send the form to the correct IRS address based on the nature of the request and the taxpayer's location. In some cases, electronic submission may be available, but it is important to verify the current IRS policies regarding electronic filing for this form. Ensure to keep a copy of the submitted form and any supporting documents for your records.

Quick guide on how to complete form 843

Prepare Form 843 effortlessly on any device

Web-based document management has gained traction with businesses and individuals alike. It offers an ideal environment-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources you need to generate, modify, and eSign your documents promptly without any hold-ups. Handle Form 843 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The simplest way to modify and eSign Form 843 with ease

- Locate Form 843 and then click Get Form to begin.

- Utilize the resources we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Draft your signature using the Sign tool, which takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Form 843 and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 843

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the irs en espaol numero de telefono?

The irs en espaol numero de telefono is the phone number you can call to signNow the IRS for assistance in Spanish. This service is available for Spanish speakers who need help with tax-related questions. Remember to have your tax information ready when you call.

-

How can airSlate SignNow help me with IRS-related documents?

airSlate SignNow provides a seamless way to create, edit, and sign IRS-related documents online. With features like templates and secure eSignature, you can ensure compliance while saving time. It’s an effective solution for managing tax documentation efficiently.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow offers various pricing plans tailored to different business needs. Our plans include cost-effective options for small to large enterprises, ensuring you find the right fit. Each plan comes with a free trial to help you assess the platform's benefits before committing.

-

Is airSlate SignNow easy to integrate with other software?

Absolutely! airSlate SignNow easily integrates with a wide range of software applications, enhancing your workflow. Whether you use CRM tools, document management systems, or other platforms, integrating SignNow can streamline your document signing process.

-

What benefits does airSlate SignNow provide for businesses?

With airSlate SignNow, businesses enjoy enhanced efficiency through automated workflows and fast eSigning. This platform helps reduce paperwork and speeds up the transaction process, ultimately saving time and reducing costs. Users can also track document status in real-time.

-

Can I use airSlate SignNow for international transactions?

Yes, airSlate SignNow is suitable for international transactions and can facilitate cross-border document signing. This is particularly useful for businesses operating in multiple countries. The platform complies with global eSignature regulations, ensuring your documents are legally binding worldwide.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority for airSlate SignNow, which employs encryption and secure access controls to protect your documents. Our platform complies with industry-standard security protocols, ensuring that sensitive information remains safe. This trust is essential when managing vital documents, including those related to taxes.

Get more for Form 843

- Id 44cdl form

- Article 19 a motor carrier accident and conviction notification program application form

- Fs 6t 448096573 form

- Application for new motor bus and permit and renewal application mass form

- Application for change from a junior drivers license to form

- Pa dmv form mv 7 salvage dealer scrap processor

- Non divisible oversizeoverweight permit application form

- Fillable online dot state fl disabled toll permit form

Find out other Form 843

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online