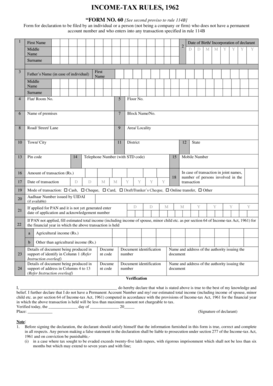

Form No 60

What is the Form No 60

The Form No 60 is a declaration form used in the United States, primarily for individuals who do not have a Permanent Account Number (PAN) but need to undertake certain financial transactions. This form is particularly relevant for tax purposes and is often required by financial institutions when opening accounts or making significant investments. By submitting this form, individuals can ensure compliance with tax regulations while providing the necessary information to facilitate their financial activities.

How to use the Form No 60

Using the Form No 60 involves a straightforward process. First, you need to download the form from an official source or obtain it from a financial institution. Once you have the form, fill it out with accurate personal information, including your name, address, and details of the transaction. After completing the form, submit it to the relevant institution, either in person or through their designated submission method. Ensure that you keep a copy for your records, as it serves as proof of your declaration.

Steps to complete the Form No 60

Completing the Form No 60 requires attention to detail. Follow these steps to ensure accuracy:

- Download or obtain the Form No 60.

- Fill in your personal details, including your full name and address.

- Provide information about the financial transaction you are declaring.

- Sign and date the form to validate your declaration.

- Submit the completed form to the relevant institution.

By following these steps, you can ensure that your Form No 60 is completed correctly and submitted in a timely manner.

Legal use of the Form No 60

The legal use of the Form No 60 is crucial for compliance with tax regulations. When properly filled out and submitted, it serves as a valid declaration for individuals without a PAN. This form helps institutions verify the identity of individuals engaging in financial transactions, thereby minimizing the risk of tax evasion. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies may lead to legal consequences.

Required Documents

When submitting the Form No 60, certain documents may be required to support your declaration. These typically include:

- Proof of identity, such as a government-issued ID.

- Proof of address, like a utility bill or lease agreement.

- Any additional documentation requested by the financial institution.

Having these documents ready can facilitate a smoother submission process and help ensure compliance with regulatory requirements.

Form Submission Methods

The Form No 60 can be submitted through various methods, depending on the requirements of the financial institution. Common submission methods include:

- Online submission through the institution's secure portal.

- Mailing the completed form to the designated address.

- In-person submission at a branch office.

It is advisable to check with the specific institution for their preferred submission method to ensure timely processing of your form.

Quick guide on how to complete form no 60

Complete Form No 60 seamlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly option to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form No 60 on any device using the airSlate SignNow Android or iOS applications to enhance any document-centric process today.

How to edit and eSign Form No 60 effortlessly

- Locate Form No 60 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your selected device. Modify and eSign Form No 60 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 60

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form no 60 and why is it important for businesses?

Form no 60 is a declaration that individuals submit to open bank accounts or financial transactions without PAN. It is crucial for businesses to understand form no 60 to ensure compliance with tax regulations and avoid penalties.

-

How can airSlate SignNow help in managing form no 60 submissions?

airSlate SignNow offers a streamlined solution for electronically signing and storing form no 60 documents securely. This helps businesses manage submissions efficiently and ensures that all forms are readily accessible for future reference.

-

Is there a cost associated with using airSlate SignNow for form no 60?

Yes, airSlate SignNow provides various pricing plans to accommodate different business sizes and needs. By signing up, you can access feature-rich options to efficiently handle form no 60 at competitive rates.

-

What features does airSlate SignNow offer for form no 60 management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, allowing businesses to facilitate and manage form no 60 in a user-friendly manner.

-

Can airSlate SignNow integrate with other systems for form no 60 processing?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, making it easier for businesses to automate and synchronize their form no 60 processing with existing workflows.

-

What are the benefits of using airSlate SignNow for form no 60?

Using airSlate SignNow for form no 60 allows businesses to minimize paperwork, reduce processing time, and ensure better compliance with documentation requirements. Its ease of use enhances overall efficiency.

-

How secure is the data when submitting form no 60 through airSlate SignNow?

Security is a priority at airSlate SignNow. When submitting form no 60, data is encrypted and stored securely, protecting sensitive information and ensuring compliance with data protection regulations.

Get more for Form No 60

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497427889 form

- Virginia workers compensation form

- Bill of sale of automobile and odometer statement virginia form

- Bill of sale for automobile or vehicle including odometer statement and promissory note virginia form

- Promissory note in connection with sale of vehicle or automobile virginia form

- Virginia bill sale form

- Bill of sale of automobile and odometer statement for as is sale virginia form

- Injuries workers compensation form

Find out other Form No 60

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer