Tarrant County Business Personal Property Tax Rendition Form

What is the Tarrant County Business Personal Property Tax Rendition Form

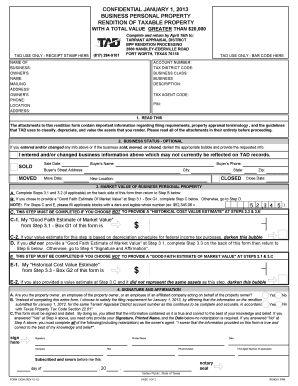

The Tarrant County Business Personal Property Tax Rendition Form is a critical document used by businesses to report their personal property for taxation purposes. This form is essential for ensuring that businesses comply with local tax regulations. It provides the Tarrant Appraisal District with necessary information about the personal property owned by a business, including equipment, furniture, and other tangible assets. Accurate completion of this form helps determine the appropriate tax liability for the business.

Steps to Complete the Tarrant County Business Personal Property Tax Rendition Form

Completing the Tarrant County business personal property tax rendition form involves several key steps:

- Gather necessary information about your business assets, including descriptions, values, and acquisition dates.

- Obtain the form, which can be accessed online or through the Tarrant Appraisal District office.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline to avoid penalties.

How to Use the Tarrant County Business Personal Property Tax Rendition Form

The Tarrant County business personal property tax rendition form can be used in various ways. Primarily, it serves as a declaration of the personal property owned by a business. This form can be filled out digitally, allowing for easier submission and record-keeping. Businesses can also utilize the form to track changes in their assets over time, ensuring that they remain compliant with tax regulations. Using digital tools, such as eSignature solutions, can streamline the process and enhance security.

Legal Use of the Tarrant County Business Personal Property Tax Rendition Form

The legal use of the Tarrant County business personal property tax rendition form is governed by state and local tax laws. To be considered valid, the form must be completed accurately and submitted within the designated timeframe. Failure to comply with these regulations can result in penalties, including fines or increased tax assessments. It is important for businesses to understand their obligations and ensure that the form is submitted in accordance with the law.

Required Documents for the Tarrant County Business Personal Property Tax Rendition Form

When completing the Tarrant County business personal property tax rendition form, certain documents may be required to support the information provided. These may include:

- Proof of ownership for the reported assets.

- Purchase invoices or receipts for equipment and furniture.

- Previous tax returns or renditions for reference.

- Any relevant financial statements that provide additional context for asset valuation.

Filing Deadlines for the Tarrant County Business Personal Property Tax Rendition Form

Filing deadlines for the Tarrant County business personal property tax rendition form are crucial to avoid penalties. Typically, the form must be submitted by April fifteenth of each year. Businesses should mark their calendars to ensure timely submission and maintain compliance with local tax regulations. Late submissions may incur penalties or result in an estimated assessment by the Tarrant Appraisal District.

Quick guide on how to complete tarrant county business personal property tax rendition form

Complete Tarrant County Business Personal Property Tax Rendition Form effortlessly on any device

Web-based document management has become widely favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Tarrant County Business Personal Property Tax Rendition Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Tarrant County Business Personal Property Tax Rendition Form with ease

- Find Tarrant County Business Personal Property Tax Rendition Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Tarrant County Business Personal Property Tax Rendition Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tarrant county business personal property tax rendition form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Tarrant County BPP rendition online?

A Tarrant County BPP rendition online is a digital declaration form that business personal property owners in Tarrant County use to report their business assets. This streamlined process helps businesses comply with local tax requirements efficiently and simplifies asset management.

-

How does airSlate SignNow facilitate Tarrant County BPP rendition online?

airSlate SignNow facilitates Tarrant County BPP rendition online by providing an intuitive platform to prepare, send, and eSign the required documentation. Users can easily manage their forms online, ensuring compliance with Tarrant County regulations without needing to print or physically submit documents.

-

What are the pricing options for using airSlate SignNow for Tarrant County BPP rendition online?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. The subscription provides access to features specifically designed for sending and managing Tarrant County BPP rendition online, ensuring you get great value for your compliance efforts.

-

What features does airSlate SignNow provide for Tarrant County BPP rendition online?

airSlate SignNow includes features such as document templates for Tarrant County BPP rendition online, eSignature capabilities, and seamless document sharing. These features allow businesses to streamline their reporting process and maintain organized records.

-

What benefits does using airSlate SignNow for Tarrant County BPP rendition online offer to businesses?

Using airSlate SignNow for Tarrant County BPP rendition online helps businesses save time and reduce errors in their reporting. The platform also enhances compliance, improves document security, and supports efficient communication between business owners and tax authorities.

-

Can airSlate SignNow integrate with other software for Tarrant County BPP rendition online?

Yes, airSlate SignNow offers integrations with various software tools that can enhance your workflow for Tarrant County BPP rendition online. This allows businesses to synchronize their data and streamline processes, improving overall efficiency.

-

Is it secure to use airSlate SignNow for Tarrant County BPP rendition online?

Absolutely! airSlate SignNow employs advanced security measures such as encryption and secure servers to protect your data during the Tarrant County BPP rendition online process. You can trust that your sensitive information is handled safely.

Get more for Tarrant County Business Personal Property Tax Rendition Form

Find out other Tarrant County Business Personal Property Tax Rendition Form

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free