Fillable Vermont Sales and Use Certificate 2013

What is the Fillable Vermont Sales And Use Certificate

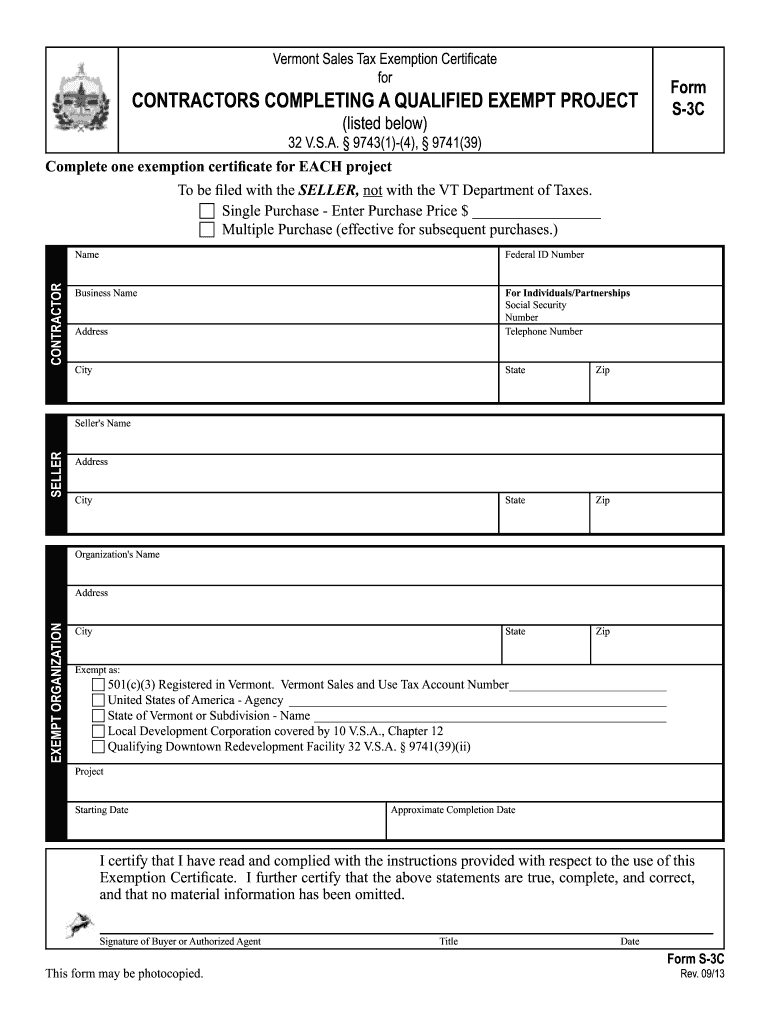

The Fillable Vermont Sales And Use Certificate is an official document used by businesses and individuals to claim sales tax exemptions on qualifying purchases in Vermont. This certificate allows eligible buyers to make tax-exempt purchases for specific goods or services, such as equipment for manufacturing or agricultural use. The form is designed to streamline the process of asserting tax-exempt status, ensuring compliance with state regulations while facilitating efficient transactions.

How to use the Fillable Vermont Sales And Use Certificate

To utilize the Fillable Vermont Sales And Use Certificate, the buyer must complete the form accurately, providing necessary details such as their name, address, and the nature of the exemption being claimed. Once filled out, the certificate should be presented to the seller at the time of purchase. It is essential for sellers to retain a copy of this certificate for their records, as it serves as proof of the tax-exempt transaction in case of audits or inquiries from the Vermont Department of Taxes.

Steps to complete the Fillable Vermont Sales And Use Certificate

Completing the Fillable Vermont Sales And Use Certificate involves several straightforward steps:

- Download the fillable form from a reliable source.

- Enter your name and address in the designated fields.

- Specify the type of exemption you are claiming, such as agricultural or manufacturing.

- Provide any additional required information, including your Vermont tax identification number if applicable.

- Review the information for accuracy and completeness.

- Sign and date the certificate before presenting it to the seller.

Key elements of the Fillable Vermont Sales And Use Certificate

The Fillable Vermont Sales And Use Certificate includes several key elements that ensure its validity and compliance with state tax laws:

- Buyer Information: Name, address, and tax identification number of the purchaser.

- Exemption Type: Clear indication of the specific exemption being claimed.

- Signature: The certificate must be signed by the buyer or an authorized representative.

- Date: The date of signing, which is crucial for record-keeping and compliance.

Legal use of the Fillable Vermont Sales And Use Certificate

The legal use of the Fillable Vermont Sales And Use Certificate is governed by state tax regulations. It is essential to ensure that the exemption claimed is valid under Vermont law. Misuse of the certificate, such as claiming exemptions for ineligible purchases, can lead to penalties, including back taxes and fines. Therefore, it is advisable to consult with a tax professional or refer to the Vermont Department of Taxes for guidance on proper usage.

Eligibility Criteria

To qualify for using the Fillable Vermont Sales And Use Certificate, the buyer must meet specific eligibility criteria. Generally, this includes:

- Being a registered business or organization in Vermont.

- Purchasing items that are explicitly exempt from sales tax under Vermont law.

- Providing accurate information on the certificate to substantiate the claim.

Quick guide on how to complete vermont s 3c sales exemption certificate form

Your assistance manual on how to prepare your Fillable Vermont Sales And Use Certificate

If you're curious about how to generate and transmit your Fillable Vermont Sales And Use Certificate, below are a few brief guidelines on making tax processing easier.

To begin, you just need to sign up for your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to edit, draft, and finalize your tax forms effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures, and return to modify answers when necessary. Streamline your tax administration with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to complete your Fillable Vermont Sales And Use Certificate in just a few minutes:

- Establish your account and begin working on PDFs within minutes.

- Utilize our catalog to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Fillable Vermont Sales And Use Certificate in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes digitally with airSlate SignNow. Please remember that submitting in paper form can lead to return errors and delay reimbursements. Naturally, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct vermont s 3c sales exemption certificate form

FAQs

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

Create this form in 5 minutes!

How to create an eSignature for the vermont s 3c sales exemption certificate form

How to create an eSignature for the Vermont S 3c Sales Exemption Certificate Form in the online mode

How to create an electronic signature for the Vermont S 3c Sales Exemption Certificate Form in Chrome

How to make an electronic signature for putting it on the Vermont S 3c Sales Exemption Certificate Form in Gmail

How to create an electronic signature for the Vermont S 3c Sales Exemption Certificate Form from your mobile device

How to make an eSignature for the Vermont S 3c Sales Exemption Certificate Form on iOS devices

How to create an electronic signature for the Vermont S 3c Sales Exemption Certificate Form on Android

People also ask

-

What is the tax Vermont exempt form and why is it important?

The tax Vermont exempt form is a crucial document that allows eligible individuals or businesses to claim an exemption from sales tax in Vermont. This form ensures that the exemptions are properly documented and can help save money during purchases that qualify for tax-exempt status.

-

How can airSlate SignNow help with the tax Vermont exempt form?

airSlate SignNow streamlines the process of completing and signing the tax Vermont exempt form electronically. Our platform allows you to easily fill out, send, and collect signatures on this form, saving you time and reducing paperwork.

-

What are the pricing options for using airSlate SignNow to manage the tax Vermont exempt form?

AirSlate SignNow offers flexible pricing plans suited for various business sizes and needs. Whether you are a freelancer or a large organization, our plans include features to efficiently manage documents like the tax Vermont exempt form at a cost-effective rate.

-

Can I integrate airSlate SignNow with other software to manage tax Vermont exempt forms?

Yes, airSlate SignNow seamlessly integrates with various software applications, making it easy to manage your tax Vermont exempt forms alongside other business tools. This flexibility enhances productivity by consolidating document workflows in one platform.

-

What security measures does airSlate SignNow provide for tax Vermont exempt forms?

At airSlate SignNow, we prioritize security for all documents, including the tax Vermont exempt form. Our platform employs advanced encryption methods and secure storage to ensure that your sensitive information remains protected throughout the signing process.

-

How can I track the status of my tax Vermont exempt form within airSlate SignNow?

With airSlate SignNow, you can easily track the status of your tax Vermont exempt form in real-time. Our platform provides notifications for each step of the signing process, allowing you to stay updated on who has received, signed, or completed the form.

-

Is it easy to share the tax Vermont exempt form with my team using airSlate SignNow?

Absolutely! Sharing the tax Vermont exempt form with your team is simple with airSlate SignNow. You can send documents for review or signature directly from the platform, ensuring that everyone involved can collaborate efficiently.

Get more for Fillable Vermont Sales And Use Certificate

Find out other Fillable Vermont Sales And Use Certificate

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter