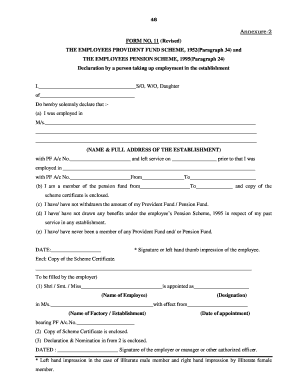

From No 11 Form

What is the Form No 11

The Form No 11 is a crucial document used primarily for tax purposes in the United States. It is designed to collect specific information from taxpayers, ensuring accurate reporting of income and deductions. This form is essential for individuals and businesses alike, as it helps the Internal Revenue Service (IRS) assess tax liabilities effectively. Understanding the purpose and requirements of Form No 11 is vital for compliance with federal tax regulations.

Steps to Complete the Form No 11

Completing Form No 11 involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary information: Collect all relevant financial documents, including income statements and receipts for deductions.

- Fill out personal details: Enter your name, address, and Social Security number accurately at the top of the form.

- Report income: Clearly outline all sources of income, including wages, dividends, and any other earnings.

- Claim deductions: List any eligible deductions you wish to claim, ensuring you have documentation to support these claims.

- Review and sign: Double-check all entries for accuracy before signing and dating the form.

Legal Use of the Form No 11

Form No 11 is legally binding when completed correctly and submitted to the IRS. To ensure its legal validity, the form must be filled out in accordance with IRS guidelines. This includes providing accurate information and adhering to deadlines. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws. Using a reliable eSignature platform can enhance the security and authenticity of your submission.

Required Documents

To complete Form No 11 effectively, you will need several supporting documents. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Bank statements

- Any prior year tax returns for reference

Having these documents on hand will streamline the completion process and help ensure that all information is accurate.

Form Submission Methods

Form No 11 can be submitted through various methods, providing flexibility for taxpayers. The options include:

- Online submission: Many taxpayers prefer to file electronically using tax software, which often includes built-in support for Form No 11.

- Mail: You can print the completed form and send it to the IRS via standard mail. Ensure you use the correct address based on your location and the form type.

- In-person: Some individuals may choose to submit their forms directly at local IRS offices, although this may require an appointment.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form No 11. It is essential to follow these instructions closely to avoid delays or penalties. Key guidelines include:

- Ensure all information is complete and accurate.

- Submit the form by the designated deadline to avoid late fees.

- Retain copies of all submitted documents for your records.

Staying informed about IRS updates regarding Form No 11 can help ensure compliance and avoid complications during tax season.

Quick guide on how to complete from no 11

Prepare From No 11 effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without complications. Manage From No 11 on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

The simplest way to modify and eSign From No 11 without hassle

- Locate From No 11 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your alterations.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign From No 11 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the from no 11

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form no 11 and how can airSlate SignNow help with it?

Form no 11 is a specific document often required for tax purposes in various jurisdictions. airSlate SignNow simplifies the process of completing and eSigning form no 11 by providing an intuitive platform where users can easily fill out, sign, and send documents securely.

-

What features does airSlate SignNow offer for managing form no 11?

airSlate SignNow offers a range of features tailored for managing form no 11, including customizable templates, automatic reminders for signing, and audit trails for tracking document status. These features enhance the efficiency of handling form no 11 for individual and business users alike.

-

Is there a free trial available for airSlate SignNow to use for form no 11?

Yes, airSlate SignNow offers a free trial that allows you to explore all the features, including those for form no 11. This trial enables potential customers to experience the ease of eSigning and document management without any initial investment.

-

How does airSlate SignNow ensure the security of my form no 11 documents?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry regulations, ensuring that your form no 11 documents are kept safe. Features like password protection and two-factor authentication add additional layers of security for sensitive information.

-

Can I integrate airSlate SignNow with other tools for handling form no 11?

Absolutely! airSlate SignNow integrates seamlessly with various applications, making it easier to manage form no 11 alongside your existing workflows. This includes integrations with platforms like Google Drive, Microsoft Office, and CRM systems, enhancing your productivity.

-

What are the pricing options for using airSlate SignNow for form no 11?

airSlate SignNow offers flexible pricing plans that cater to different user needs and budgets for managing form no 11. Plans range from basic to advanced options, providing businesses with cost-effective solutions to streamline their document processes.

-

How can airSlate SignNow improve the turnaround time for processing form no 11?

With airSlate SignNow, the turnaround time for processing form no 11 is signNowly enhanced through features like instant notifications, quick eSigning, and automated workflows. This ensures that your document is completed and sent back in no time, keeping your projects on schedule.

Get more for From No 11

- Li worksheet universalforms

- Certified pool amp spa operator cpo course payment form poolsure

- Mending hearts application form

- Lure operator application form

- Food pantry client information form resurrection life

- Drag race audition tape requirements form

- Storage unit eviction notice template form

- Oasis northrop grumman form

Find out other From No 11

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy