Ncdor B 202a Form

What is the Ncdor B 202a

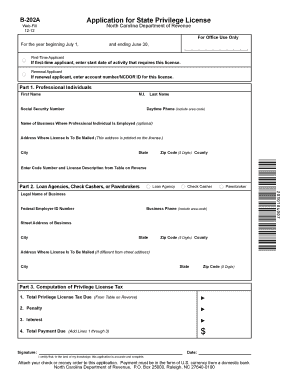

The Ncdor B 202a form is an official document used in the state of North Carolina, primarily for tax-related purposes. It serves as a request for a specific tax exemption or adjustment, allowing taxpayers to communicate their needs to the North Carolina Department of Revenue. Understanding the purpose and function of this form is essential for individuals and businesses seeking to navigate their tax obligations effectively.

How to use the Ncdor B 202a

Using the Ncdor B 202a form involves several straightforward steps. First, ensure you have the latest version of the form, which can typically be downloaded from the North Carolina Department of Revenue website. Next, carefully fill out the required fields, providing accurate information about your tax situation. After completing the form, review it for any errors or omissions before submission. It's crucial to follow the specific instructions provided with the form to ensure proper processing.

Steps to complete the Ncdor B 202a

Completing the Ncdor B 202a form requires attention to detail. Begin by gathering all necessary documentation that supports your request. This may include previous tax returns, proof of income, or other relevant financial documents. Once you have everything ready, follow these steps:

- Download the Ncdor B 202a form from the official website.

- Fill in your personal information, including your name, address, and Social Security number.

- Clearly state the reason for your request and provide any necessary supporting details.

- Attach copies of any required documents that substantiate your claim.

- Review the completed form for accuracy and completeness.

- Submit the form according to the instructions provided, whether online, by mail, or in person.

Legal use of the Ncdor B 202a

The legal use of the Ncdor B 202a form is governed by North Carolina tax laws and regulations. It is essential to ensure that the information provided on the form is truthful and accurate, as any discrepancies may lead to penalties or legal issues. The form must be submitted within the designated time frames to be considered valid. Understanding the legal implications of using this form can help taxpayers avoid complications with the Department of Revenue.

Form Submission Methods

The Ncdor B 202a form can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online Submission: Many taxpayers prefer to submit the form electronically through the North Carolina Department of Revenue's online portal.

- Mail: You can print the completed form and send it via postal mail to the appropriate address listed on the form.

- In-Person: Alternatively, you may choose to deliver the form in person at your local Department of Revenue office.

Who Issues the Form

The Ncdor B 202a form is issued by the North Carolina Department of Revenue, which is responsible for administering the state’s tax laws. This department provides taxpayers with the necessary forms and guidance to ensure compliance with state tax regulations. Understanding the role of the Department of Revenue can help taxpayers navigate their obligations more effectively.

Quick guide on how to complete ncdor b 202a

Finalize Ncdor B 202a effortlessly on any gadget

Web-based document management has gained popularity among companies and individuals. It offers a perfect environmentally-friendly substitute for conventional printed and signed papers, as you can locate the necessary template and securely archive it online. airSlate SignNow furnishes you with all the resources you require to create, modify, and eSign your documents quickly without delays. Handle Ncdor B 202a on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to revise and eSign Ncdor B 202a without hassle

- Obtain Ncdor B 202a and click Get Form to begin.

- Utilize the tools we provide to fill out your template.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred delivery method for your form: by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device. Revise and eSign Ncdor B 202a to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ncdor b 202a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ncdor b 202a form and why is it important?

The ncdor b 202a form is a key document for businesses in North Carolina, used for various compliance and reporting needs. Understanding its requirements is essential for accuracy in tax filings and maintaining good standing with the state. Leveraging airSlate SignNow can simplify the signing and submission of the ncdor b 202a form.

-

How can airSlate SignNow help with filling out the ncdor b 202a?

AirSlate SignNow offers a user-friendly interface that streamlines the process of completing the ncdor b 202a form. Features such as templates and drag-and-drop fields make it easy to customize and fill out necessary information quickly. This saves time and reduces the likelihood of errors in critical documents like the ncdor b 202a.

-

Is there a cost associated with using airSlate SignNow for the ncdor b 202a?

Yes, airSlate SignNow offers flexible subscription plans that cater to different business sizes and needs, including features that support the ncdor b 202a. Pricing is designed to be cost-effective, ensuring businesses can manage their document signing without breaking the bank. You can choose a plan based on your frequency of use and number of users.

-

Can I integrate airSlate SignNow with other tools for handling the ncdor b 202a?

Absolutely! AirSlate SignNow seamlessly integrates with various third-party applications, enhancing your workflow for documents like the ncdor b 202a. Using integrations, you can import necessary data from other platforms and streamline the entire process, making your document management more efficient.

-

What are the benefits of using airSlate SignNow for the ncdor b 202a?

Using airSlate SignNow for the ncdor b 202a helps in automating document processes, improving turnaround times, and enhancing accuracy. The platform ensures that all documents are securely signed and stored, which provides peace of mind. Additionally, you gain access to tracking features that keep you updated on the status of your ncdor b 202a submissions.

-

Is airSlate SignNow suitable for businesses of all sizes when dealing with the ncdor b 202a?

Yes, airSlate SignNow is designed to accommodate businesses of all sizes, making it ideal for anyone needing to manage the ncdor b 202a. Whether you are a small startup or a large corporation, the platform can scale according to your requirements. This ensures that all users, regardless of their size, can efficiently handle their document signing needs.

-

What security features does airSlate SignNow offer for the ncdor b 202a?

AirSlate SignNow provides robust security features to protect your documents, including the ncdor b 202a. With encryption, secure access controls, and compliance with industry standards, your sensitive information is safeguarded. Users can have confidence knowing their documents are protected while being signed and stored.

Get more for Ncdor B 202a

- Go 4less application form

- Election to opt out andor application for a refund of teachers deni gov form

- Walsall council blue badge form

- Application for first test of a heavy goods motor vehicle vtg1 vtg1 application form

- Informed consent requirements for obtaining informed consent

- National landlords association check form

- Wwwmandgcomdaminvestments1 of 4 mampampg withdrawal form dmampampg f or executorpersonal

- Chelson meadow van permit form

Find out other Ncdor B 202a

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors