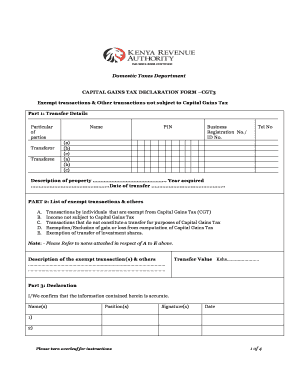

Cgt3 Form

What is the CGT3?

The CGT3 form is a crucial document used in the United States for reporting capital gains and losses for tax purposes. This form allows taxpayers to calculate their net capital gains or losses from the sale of assets, such as stocks, bonds, and real estate. Understanding the CGT3 is essential for individuals and businesses alike, as it directly impacts tax liability and compliance with IRS regulations.

How to Use the CGT3

Using the CGT3 form involves several steps to ensure accurate reporting. Taxpayers must first gather all relevant information regarding their capital transactions, including purchase dates, sale dates, and amounts. Once this data is collected, it can be entered into the appropriate sections of the CGT3 form. It is important to follow the IRS instructions carefully to avoid errors that could lead to penalties or audits.

Steps to Complete the CGT3

Completing the CGT3 form requires a systematic approach:

- Gather all necessary documentation related to capital transactions.

- Determine the basis for each asset sold, including purchase price and any adjustments.

- Calculate the total sales proceeds for each transaction.

- Compute the capital gain or loss by subtracting the basis from the sales proceeds.

- Fill out the CGT3 form with the calculated figures, ensuring accuracy in reporting.

- Review the completed form for any errors before submission.

Legal Use of the CGT3

The CGT3 form must be completed in accordance with IRS regulations to be considered legally valid. This includes adhering to deadlines and ensuring that all information is accurate and truthful. Failure to comply with these legal requirements can result in penalties, including fines and interest on unpaid taxes. It is advisable to consult with a tax professional if there are uncertainties regarding the legal aspects of using the CGT3.

Filing Deadlines / Important Dates

Filing deadlines for the CGT3 form are critical for compliance. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to deadlines, as they can vary based on specific situations, such as natural disasters or legislative updates.

Required Documents

To complete the CGT3 form accurately, several documents are required:

- Purchase and sale records for all assets.

- Brokerage statements showing transaction details.

- Receipts for any improvements made to assets, if applicable.

- Prior year tax returns, which may provide context for carryover losses.

Examples of Using the CGT3

Practical examples can help clarify how to use the CGT3 form effectively. For instance, if an individual sells stocks purchased for $1,000 at a price of $1,500, they would report a capital gain of $500 on the CGT3. Conversely, if another asset was sold for less than its purchase price, such as a property bought for $200,000 and sold for $150,000, the individual would report a capital loss of $50,000. These examples illustrate the importance of accurate reporting for tax calculations.

Quick guide on how to complete cgt3

Effortlessly Prepare Cgt3 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing users to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Handle Cgt3 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and Electronically Sign Cgt3 Without Stress

- Locate Cgt3 and click Get Form to begin.

- Make use of the features we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Cgt3 while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cgt3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cgt3 and how does it relate to airSlate SignNow?

CGT3 is a cutting-edge feature of airSlate SignNow that optimizes document signing processes. With cgt3, businesses can enhance their workflow efficiency by streamlining the eSigning experience and integrating easily with existing systems.

-

How much does airSlate SignNow cost, and what are the payment options for cgt3?

The pricing for airSlate SignNow varies based on the plan selected, but it remains cost-effective for businesses of all sizes. With features like cgt3, users can choose from monthly or annual subscriptions, providing flexibility to suit different budgetary needs.

-

What features does cgt3 include to enhance eSigning processes?

cgt3 offers multiple features, including advanced security measures, customizable templates, and real-time tracking of document statuses. These features help ensure that your eSigning workflow is not only efficient but also secure and reliable.

-

What are the benefits of using cgt3 within airSlate SignNow?

Using cgt3 within airSlate SignNow offers several benefits, such as reducing turnaround times for document signing and improving compliance. It also helps increase productivity by allowing users to manage documents from anywhere, ensuring a smoother workflow.

-

Can cgt3 integrate with other software applications?

Yes, cgt3 is designed to seamlessly integrate with various third-party applications. This means you can enhance your current systems and workflows while leveraging the efficiency of airSlate SignNow's eSigning capabilities.

-

Is cgt3 suitable for small businesses and enterprises?

Absolutely! cgt3 is flexible enough to accommodate the needs of both small businesses and large enterprises. Its scalable features ensure that all users can benefit from advanced eSigning solutions tailored to their requirements.

-

What kind of support does airSlate SignNow offer for cgt3 users?

airSlate SignNow provides comprehensive support for cgt3 users, including tutorials, FAQs, and customer service. Whether you're looking for guidance on implementation or troubleshooting, the dedicated support team is there to assist you.

Get more for Cgt3

- Form 1 exams pdf

- Suffolk county food managers course practice test form

- Etiquette the least you need to know pdf form

- Genki 2 3rd edition pdf form

- Talaros foundations in microbiology pdf form

- Laser hair removal facilities apply for a new certificate form

- Bee county texastime and attendance record circle form

- Employee time sheet template form

Find out other Cgt3

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament