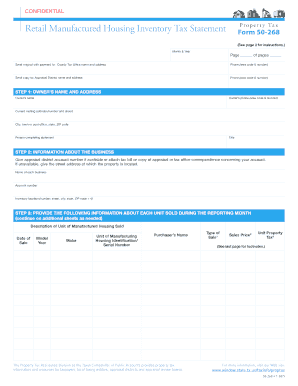

50 268 Form

What is the 50 268

The 50 268 form is a specific document used primarily in the context of tax reporting and compliance in the United States. This form is typically associated with various financial disclosures and is essential for individuals or entities that need to report specific information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the 50 268 form is crucial for ensuring compliance with federal tax regulations.

How to use the 50 268

Using the 50 268 form involves several steps to ensure accurate completion and submission. First, gather all necessary information and documentation required to fill out the form. This may include personal identification details, financial records, and any relevant tax information. Next, carefully complete the form, ensuring that all fields are filled out accurately to avoid delays or issues with processing. After filling out the form, review it for any errors before submission. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the specific requirements associated with the 50 268.

Steps to complete the 50 268

Completing the 50 268 form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary documents, including identification and financial records.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form through the designated method, ensuring it is sent to the correct address or online portal.

Legal use of the 50 268

The legal use of the 50 268 form is governed by IRS regulations. To be considered valid, the form must be filled out accurately and submitted in accordance with the deadlines set by the IRS. Additionally, electronic submissions must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws to ensure that the electronic version of the form is legally binding. It is important to maintain copies of submitted forms for record-keeping and future reference.

Who Issues the Form

The 50 268 form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions on how to properly complete and submit the form, ensuring that taxpayers have the necessary resources to comply with tax regulations. It is essential to refer to the official IRS website or documentation for the most current version of the form and any updates regarding its use.

Quick guide on how to complete 50 268

Effortlessly Prepare 50 268 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, as you can access the necessary forms and securely keep them online. airSlate SignNow equips you with all the tools needed to quickly create, modify, and eSign your documents without delays. Handle 50 268 on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related tasks today.

Edit and eSign 50 268 with Ease

- Locate 50 268 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method for delivering the form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device of your choice. Modify and eSign 50 268 to ensure seamless communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 50 268

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 50 268?

The form 50 268 is a document commonly used for specific business processes. With airSlate SignNow, you can easily create, send, and eSign this form within minutes. Our platform simplifies the workflow, ensuring that you can complete your transactions efficiently and securely.

-

How can I use airSlate SignNow for the form 50 268?

To use the form 50 268 with airSlate SignNow, you simply upload the document to our platform. Once uploaded, you can customize the form, add required fields for signatures, and send it out to recipients for eSigning. This process streamlines your workflow and reduces paperwork hassle.

-

Is there a cost associated with using form 50 268 in airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to different business needs. By subscribing to our service, you gain access to the features necessary for managing the form 50 268 effectively. Plus, our cost-effective solutions ensure that businesses of all sizes can benefit.

-

What are the benefits of eSigning the form 50 268?

eSigning the form 50 268 through airSlate SignNow has numerous benefits, including enhanced security, faster turnaround times, and reduced manual errors. Our platform ensures that all signatures are legally binding and compliant with industry standards. This helps your business maintain professionalism and efficiency.

-

Can I integrate airSlate SignNow with other applications for form 50 268?

Yes, airSlate SignNow supports integrations with various applications to enhance the use of the form 50 268. You can connect our platform with CRM systems, cloud storage services, and more. This integration facilitates a seamless flow of information and optimizes your overall business processes.

-

What features does airSlate SignNow offer for managing form 50 268?

airSlate SignNow offers a range of features to manage the form 50 268, including template creation, real-time tracking, and customizable workflows. Additionally, users can easily invite others to eSign and manage documents digitally. These features streamline your documentation process signNowly.

-

Is my data secure when using airSlate SignNow for form 50 268?

Absolutely! Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and complies with industry regulations to protect your data while managing the form 50 268. You can trust that your sensitive information is safe and secure.

Get more for 50 268

- Medical report form fiji

- Er2 form download

- Bible correspondence courses by mail only form

- Parenting plan template form

- Employers work accident illness report 2022 form

- Cid verification form jk pdf

- This english test consists of 55 multiple choice questions answers form

- Kansas city metro zip code map form

Find out other 50 268

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer