Ifta Report Sample 2013

What is the IFTA Report Sample

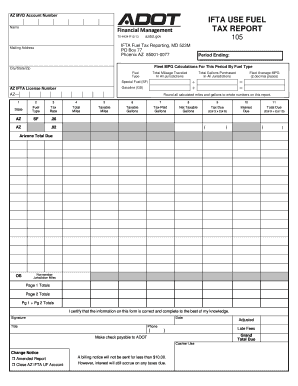

The IFTA report sample serves as a template for businesses engaged in interstate travel to report their fuel usage and mileage across different jurisdictions. The International Fuel Tax Agreement (IFTA) simplifies the reporting of fuel taxes for motor carriers operating in multiple states or provinces. This sample provides a clear representation of the information required, including total miles traveled, gallons of fuel purchased, and tax calculations for each jurisdiction. Understanding this sample is crucial for ensuring compliance with state regulations and for accurate tax reporting.

Steps to Complete the IFTA Report Sample

Completing the IFTA reporting form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including fuel purchase receipts and mileage logs. Next, calculate the total miles traveled and the total gallons of fuel purchased for each state. Then, fill out the IFTA report sample by entering the required data into the designated fields, ensuring that all figures are accurate. After completing the form, review it for any discrepancies before submitting it to the appropriate state authority. This process helps prevent errors that could lead to penalties.

Key Elements of the IFTA Report Sample

The key elements of the IFTA report sample include essential data points that must be reported to comply with IFTA regulations. These elements typically consist of the following:

- Jurisdiction: The states or provinces where fuel was purchased and miles were traveled.

- Total Miles: The total distance driven in each jurisdiction.

- Gallons of Fuel Purchased: The total fuel purchased in each jurisdiction.

- Tax Rate: The applicable fuel tax rate for each jurisdiction.

- Tax Due: The calculated tax owed based on fuel usage and jurisdictional rates.

These elements are vital for accurate reporting and ensuring compliance with state fuel tax laws.

Legal Use of the IFTA Report Sample

The legal use of the IFTA report sample is essential for businesses to fulfill their tax obligations. To be considered valid, the report must be completed accurately and submitted to the appropriate state agency by the designated deadlines. Compliance with IFTA regulations not only helps avoid penalties but also establishes a business's credibility with tax authorities. Additionally, electronic submissions of the IFTA reporting form, when done through compliant platforms, are legally recognized under U.S. eSignature laws, further enhancing the legitimacy of the filed documents.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA report are crucial for businesses to adhere to in order to avoid late fees and penalties. Typically, IFTA reports are filed quarterly, with deadlines falling on the last day of the month following the end of each quarter. For example, the deadlines are usually April 30, July 31, October 31, and January 31. It is important for businesses to mark these dates on their calendars and ensure that all necessary information is compiled and submitted on time to maintain compliance.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting their IFTA reporting form. The most common submission methods include:

- Online: Many states allow for electronic filing through their tax agency websites, providing a quick and efficient way to submit the report.

- Mail: The IFTA report can be printed and mailed to the appropriate state agency. Ensure that the form is sent well in advance of the deadline to allow for processing time.

- In-Person: Some businesses may choose to deliver their IFTA report in person to their state tax office, which can be beneficial for immediate confirmation of receipt.

Choosing the right submission method can streamline the filing process and help ensure compliance with state regulations.

Quick guide on how to complete ifta report sample

Effortlessly Prepare Ifta Report Sample on Any Device

Managing documents online has gained traction among both businesses and individuals. It serves as a great eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your paperwork quickly without hold-ups. Manage Ifta Report Sample on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to Edit and eSign Ifta Report Sample with Ease

- Obtain Ifta Report Sample and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and eSign Ifta Report Sample and ensure smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ifta report sample

Create this form in 5 minutes!

How to create an eSignature for the ifta report sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IFTA reporting form and why is it important?

An IFTA reporting form is a document used by interstate commercial motor carriers to report fuel taxes. It's important because it helps ensure compliance with tax regulations across different states and simplifies the filing process by consolidating information.

-

How does airSlate SignNow streamline the IFTA reporting form process?

airSlate SignNow streamlines the IFTA reporting form process by allowing users to easily create, fill out, and eSign documents online. This user-friendly platform minimizes errors, enhances collaboration, and accelerates the submission process.

-

Is there a cost associated with using the IFTA reporting form on airSlate SignNow?

Yes, there is a subscription cost for using airSlate SignNow, but it offers a range of pricing plans tailored for different business needs. The investment is highly beneficial, considering the time and resources saved by using an efficient IFTA reporting form solution.

-

What features does airSlate SignNow offer for managing IFTA reporting forms?

airSlate SignNow offers features such as document templates, easy editing tools, secure eSigning, and automated reminders for submitting IFTA reporting forms. These features enhance efficiency and keep your team organized.

-

Can I integrate airSlate SignNow with other software for my IFTA reporting needs?

Yes, airSlate SignNow can seamlessly integrate with various software platforms, including accounting and transportation management systems. This integration allows for better data management and streamlined procedures for completing your IFTA reporting form.

-

Does airSlate SignNow provide support for users with IFTA reporting forms?

Absolutely, airSlate SignNow offers comprehensive customer support for all users, including assistance with the IFTA reporting form. Our support team is available to guide you through the process and resolve any issues you might encounter.

-

What are the benefits of using airSlate SignNow for IFTA reporting?

Using airSlate SignNow for your IFTA reporting forms offers numerous benefits, including increased accuracy, faster processing times, and a more straightforward filing process. It allows businesses to focus more on operations instead of paperwork.

Get more for Ifta Report Sample

Find out other Ifta Report Sample

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe