Non Filing Letter Sample Form

What is the Non Filing Letter Sample

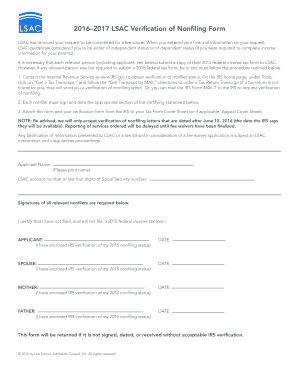

A non filing letter serves as an official document issued by the Internal Revenue Service (IRS) confirming that an individual or entity has not filed a tax return for a specific year. This letter is particularly useful for various purposes, such as applying for loans, securing government assistance, or verifying income status. The sample letter for non filing of income tax return typically includes essential details like the taxpayer's identification information, the tax year in question, and a statement confirming the non-filing status.

How to Obtain the Non Filing Letter Sample

To obtain a non filing letter, individuals must request it directly from the IRS. This can be done by submitting Form 4506-T, Request for Transcript of Tax Return. By selecting the appropriate options on the form, you can request a verification of nonfiling letter. It is advisable to provide accurate information and ensure that all required fields are completed to avoid delays in processing. The IRS typically processes these requests within several weeks, depending on their workload.

Steps to Complete the Non Filing Letter Sample

Completing a non filing letter sample involves several key steps. First, gather all necessary personal information, including your Social Security number, address, and the specific tax year for which you are requesting verification. Next, fill out Form 4506-T accurately, ensuring that you select the option for a verification of nonfiling. After completing the form, submit it to the IRS via mail or fax, as specified in the instructions. Finally, wait for the IRS to process your request and send you the official letter confirming your non-filing status.

Key Elements of the Non Filing Letter Sample

A well-structured non filing letter sample includes several critical elements. These elements typically consist of the taxpayer's name and address, the IRS's contact information, the tax year in question, and a clear statement indicating that no tax return was filed. Additionally, the letter may include a unique identification number assigned by the IRS, which helps verify the authenticity of the document. Ensuring that all these elements are present is essential for the letter to be accepted by institutions requiring it.

IRS Guidelines

The IRS provides specific guidelines regarding the issuance and use of non filing letters. According to IRS regulations, individuals must ensure that they have not filed a tax return for the year in question to qualify for a verification of nonfiling letter. Furthermore, the IRS may require additional documentation or information to process requests. It is also important to note that the letter is only valid for the year specified and may not be reused for subsequent years without a new request.

Penalties for Non-Compliance

Failing to file a tax return when required can lead to significant penalties imposed by the IRS. These penalties may include monetary fines, interest on unpaid taxes, and possible legal actions. Additionally, not having a verification of nonfiling letter when needed could hinder access to loans or government benefits. Therefore, it is crucial to understand the importance of filing requirements and to obtain the necessary documentation to avoid complications.

Quick guide on how to complete non filing letter sample

Complete Non Filing Letter Sample effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to locate the correct form and securely keep it online. airSlate SignNow equips you with everything necessary to design, alter, and electronically sign your documents quickly without interruptions. Handle Non Filing Letter Sample on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Non Filing Letter Sample with ease

- Find Non Filing Letter Sample and then click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Adjust and electronically sign Non Filing Letter Sample and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the non filing letter sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a verification of nonfiling letter?

A verification of nonfiling letter is an official document issued by the IRS confirming that a particular individual or business entity has not filed a tax return for a specified year. This letter is often required for various financial transactions, including loan applications and grant requests.

-

How can airSlate SignNow assist with obtaining a verification of nonfiling letter?

AirSlate SignNow provides a seamless platform for sending and eSigning documents needed to request a verification of nonfiling letter. By streamlining the document management process, users can efficiently obtain necessary signatures and ensure their requests are submitted promptly.

-

Is there a cost associated with using airSlate SignNow for a verification of nonfiling letter?

AirSlate SignNow offers a cost-effective solution for managing eSignatures and document workflows. Pricing depends on the plan you select, with various tiers available to fit the needs of users looking to obtain a verification of nonfiling letter without breaking the bank.

-

What features does airSlate SignNow offer for document signing related to a verification of nonfiling letter?

AirSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for document signing processes. These features enhance the efficiency of obtaining a verification of nonfiling letter and ensure that users remain informed at every step.

-

How long does it typically take to receive a verification of nonfiling letter?

The timeline for receiving a verification of nonfiling letter can vary based on the IRS processing times. However, using airSlate SignNow can expedite the submission process, allowing for quicker handling of necessary documents and potentially reducing wait times.

-

Are there integrations available with airSlate SignNow for my verification of nonfiling letter process?

Yes, airSlate SignNow offers various integrations with popular applications, such as cloud storage and CRM solutions. These integrations streamline the workflow for obtaining a verification of nonfiling letter, allowing users to easily access their documents and manage signings from one central location.

-

What benefits can I expect when using airSlate SignNow for a verification of nonfiling letter?

By using airSlate SignNow, you will benefit from enhanced productivity, reduced turnaround times, and improved document security when managing your verification of nonfiling letter requests. The user-friendly interface simplifies the entire process, making it accessible for everyone involved.

Get more for Non Filing Letter Sample

- Exporter registry form turkey online

- Affidavit of undertaking 212581700 form

- Raa maps trip planner form

- Axa health insurance claim form

- Nkomazi municipality vacancies application form

- Paint sundries form

- Case 106 cv 00407 awi gsa document 98 filed 060713 page 1 of 6 gpo form

- Child in care statementreceipt r 400 1907b form

Find out other Non Filing Letter Sample

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile