1040ez Form

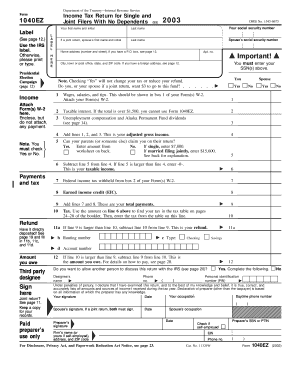

What is the 1040EZ Form

The 1040EZ form is a simplified version of the standard IRS Form 1040, designed for taxpayers with straightforward tax situations. This form is primarily used by individuals with a taxable income below a specified threshold, who do not claim any dependents, and who take the standard deduction. The 1040EZ allows for a faster and easier filing process, making it an appealing option for many taxpayers.

How to use the 1040EZ Form

Using the 1040EZ form involves several straightforward steps. First, gather all necessary financial documents, including W-2 forms from employers and any other income statements. Next, fill out the form by entering personal information, such as your name, address, and Social Security number. Then, report your income and calculate your tax liability. Finally, sign and date the form before submitting it to the IRS.

Steps to complete the 1040EZ Form

Completing the 1040EZ form requires careful attention to detail. Follow these steps:

- Start by entering your personal information at the top of the form.

- Report your income from all sources, including wages and interest.

- Calculate your adjusted gross income (AGI) by following the instructions provided on the form.

- Determine your tax liability using the tax tables included in the IRS instructions.

- Claim any applicable credits, if eligible.

- Sign and date the form, ensuring all information is accurate.

Legal use of the 1040EZ Form

The 1040EZ form is legally valid for filing federal income taxes in the United States, provided that you meet the eligibility criteria. It must be completed accurately, as errors may lead to delays in processing or potential penalties. The form must be submitted electronically or via mail to the IRS by the designated filing deadline to ensure compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1040EZ form typically align with the general tax filing deadlines set by the IRS. For most taxpayers, the deadline to file is April 15th of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to be aware of these dates to avoid late filing penalties.

Eligibility Criteria

To qualify for using the 1040EZ form, taxpayers must meet specific criteria, including:

- Filing status must be single or married filing jointly.

- Taxable income must be less than a specified limit.

- No dependents can be claimed on the tax return.

- Only certain types of income are allowed, such as wages, salaries, and interest.

Quick guide on how to complete 1040ez form

Access 1040ez Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the needed template and securely store it online. airSlate SignNow equips you with all the functionality necessary to create, modify, and electronically sign your documents swiftly and without hold-ups. Handle 1040ez Form on any device through airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign 1040ez Form effortlessly

- Find 1040ez Form and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and has the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign 1040ez Form and maintain excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040ez form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1040ez fillable form?

The 1040ez fillable form is a simplified tax form designed for taxpayers with straightforward financial situations. It allows individuals to report their income and claim any applicable deductions conveniently. Using airSlate SignNow, you can easily fill out and eSign this form online.

-

How can I access the 1040ez fillable form on airSlate SignNow?

You can easily access the 1040ez fillable form by visiting the airSlate SignNow platform. Simply select the form from our extensive document library, fill it out as required, and use our eSignature feature to complete it electronically. This process streamlines your tax preparation.

-

Is the 1040ez fillable form free to use?

While you can access the 1040ez fillable form at no cost, some features on airSlate SignNow may require a subscription. However, our pricing plans are designed to be affordable and provide great value for businesses looking to simplify document management, including tax forms.

-

What are the benefits of using airSlate SignNow for the 1040ez fillable form?

Using airSlate SignNow for the 1040ez fillable form offers several benefits, such as the ease of filling out forms online, secure eSigning, and automatic cloud storage for your completed documents. It's designed to improve efficiency and reduce the hassle of traditional paper forms.

-

Can I track my 1040ez fillable form submissions?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your 1040ez fillable form submissions. You can see when the form is filled out, signed, and completed, ensuring that you have full visibility throughout the process.

-

What integrations does airSlate SignNow offer for the 1040ez fillable form?

airSlate SignNow integrates seamlessly with various productivity tools to enhance your experience. You can connect with platforms like Google Drive, Dropbox, and others, allowing for easy access and sharing of your completed 1040ez fillable form without hassle.

-

What do I need to prepare before filling out the 1040ez fillable form?

Before filling out the 1040ez fillable form, gather your personal information, such as your Social Security number, income statements, and deductions. Having all your necessary documents on hand will streamline the process and allow you to complete your form accurately and efficiently.

Get more for 1040ez Form

- Interrogatories to defendant for motor vehicle accident vermont form

- Llc notices resolutions and other operations forms package vermont

- Vermont partial form

- Notice of dishonored check civil keywords bad check bounced check vermont form

- Mutual wills containing last will and testaments for man and woman living together not married with no children vermont form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children vermont form

- Mutual wills or last will and testaments for man and woman living together not married with minor children vermont form

- Non marital cohabitation living together agreement vermont form

Find out other 1040ez Form

- eSignature Document for Administrative Fast

- eSignature PPT for Administrative Online

- eSignature Document for Administrative Safe

- eSignature PPT for Administrative Mobile

- How Do I eSignature PPT for Administrative

- eSignature PPT for Administrative Free

- eSignature Form for Administrative Online

- eSignature PPT for Administrative Safe

- eSignature Word for IT Online

- eSignature Word for IT Computer

- How Can I eSignature Form for Administrative

- eSignature Word for IT Mobile

- eSignature Word for IT Now

- How To eSignature Word for IT

- eSignature Word for IT Free

- How Can I eSignature Word for IT

- eSignature Document for IT Online

- eSignature Document for IT Computer

- eSignature Presentation for Administrative Mobile

- Can I eSignature Presentation for Administrative