Completed Form 3115 Example

What is the Completed Form 3115 Example

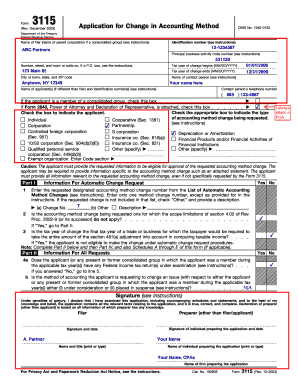

The completed form 3115 example serves as a practical illustration for taxpayers transitioning from cash to accrual accounting methods. This form is crucial for businesses seeking to change their accounting method for tax purposes. It outlines the necessary information, including the taxpayer's identification details, the specific accounting methods involved, and any adjustments required for compliance with IRS regulations. Understanding this example can help ensure that all relevant data is accurately reported, minimizing the risk of errors during submission.

Steps to complete the Completed Form 3115 Example

Completing the form 3115 requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including prior financial statements and tax returns.

- Fill in the taxpayer's information, including name, address, and identification number.

- Indicate the current accounting method and the method to which you are switching.

- Detail any adjustments needed for the transition, including catch-up adjustments for prior periods.

- Review the form for accuracy and completeness before submission.

How to obtain the Completed Form 3115 Example

The completed form 3115 example can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is advisable to use the most current version of the form to ensure compliance with the latest tax regulations. Additionally, many tax professionals can provide guidance and examples tailored to specific business scenarios.

IRS Guidelines

The IRS provides specific guidelines for completing form 3115, which are essential for ensuring compliance. Key points include:

- Understanding the eligibility criteria for changing accounting methods.

- Familiarizing oneself with the different sections of the form and the information required.

- Adhering to deadlines for filing the form, which can vary based on the taxpayer's situation.

Legal use of the Completed Form 3115 Example

Using the completed form 3115 example legally requires adherence to IRS regulations regarding accounting method changes. The form must be filed correctly to avoid penalties and ensure that the accounting method change is recognized by the IRS. Additionally, electronic submission of the form is permitted, provided that the eSignature requirements are met, ensuring that the document is legally binding.

Key elements of the Completed Form 3115 Example

Several key elements make up the completed form 3115 example. These include:

- Taxpayer identification information.

- Details of the current and new accounting methods.

- Adjustments related to the change in accounting methods.

- Signature and date, confirming the accuracy of the information provided.

Quick guide on how to complete completed form 3115 example

Prepare Completed Form 3115 Example effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Completed Form 3115 Example on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Completed Form 3115 Example with ease

- Obtain Completed Form 3115 Example and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only a few seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send the form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Completed Form 3115 Example to ensure smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the completed form 3115 example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 3115 example?

A form 3115 example is a sample document that illustrates how to apply for a change in accounting method with the IRS. Businesses use this form to ensure compliance when making adjustments to their accounting practices. airSlate SignNow provides tools to easily create and eSign such documents.

-

How can airSlate SignNow help with form 3115 examples?

airSlate SignNow streamlines the process of filling out and submitting a form 3115 example. Our platform allows users to fill in templates digitally, making it easy to ensure all necessary information is included. This saves time and helps avoid errors during submission.

-

Are there any costs associated with using airSlate SignNow for form 3115 examples?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Users can choose a plan that fits their budget while accessing features that facilitate the creation of documents, including form 3115 examples. Explore our pricing page for more details.

-

What features does airSlate SignNow offer for managing IRS forms like 3115?

airSlate SignNow includes features like document templates, electronic signatures, and audit trails, which are essential for managing IRS forms such as the form 3115 example. These features enhance compliance and documentation efficiency, allowing businesses to focus on their core activities.

-

Can I integrate airSlate SignNow with other tools for filing form 3115 examples?

Yes, airSlate SignNow offers integrations with various productivity and accounting tools. This allows users to easily manage form 3115 examples alongside other business processes seamlessly. Integrating your tools simplifies workflow and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for form 3115 examples?

Using airSlate SignNow for form 3115 examples provides businesses with a secure, reliable, and user-friendly solution to document signing. The platform streamlines workflows and improves turnaround time, ensuring timely submissions to the IRS. Moreover, it enhances accuracy and reduces the risk of errors.

-

Is there a mobile app for airSlate SignNow to create form 3115 examples on-the-go?

Yes, airSlate SignNow has a mobile app that allows users to create and manage form 3115 examples anytime and anywhere. The app provides full functionality, including document signing, ensuring that you can handle important forms even when you’re away from your office.

Get more for Completed Form 3115 Example

Find out other Completed Form 3115 Example

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple