Alabama Form a 4 Rev 100

What is the Alabama Form A 4 Rev 100

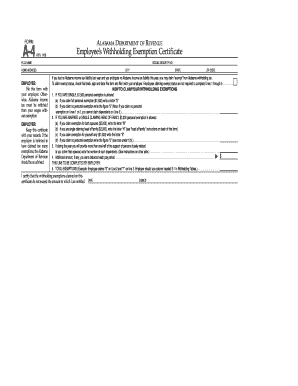

The Alabama Form A 4 Rev 100 is a state-specific document used for tax purposes in Alabama. This form is primarily utilized by employers to report and withhold state income tax from employees' wages. It serves as a declaration of an employee's withholding allowances, which can impact the amount of state tax withheld from their paychecks. Understanding this form is crucial for both employers and employees to ensure compliance with Alabama tax laws.

How to use the Alabama Form A 4 Rev 100

To use the Alabama Form A 4 Rev 100, employers must provide this form to their employees at the time of hiring or when there are changes in their withholding status. Employees need to complete the form by indicating the number of allowances they wish to claim, which will affect their tax withholding. Once filled out, the form should be submitted to the employer, who will then retain it for their records and use the information to calculate state tax withholdings accurately.

Steps to complete the Alabama Form A 4 Rev 100

Completing the Alabama Form A 4 Rev 100 involves several straightforward steps:

- Obtain the form from your employer or the Alabama Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the number of allowances you are claiming based on your personal circumstances.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Legal use of the Alabama Form A 4 Rev 100

The Alabama Form A 4 Rev 100 is legally binding when completed accurately and submitted to the employer. It complies with state tax regulations, ensuring that employers withhold the correct amount of state income tax from employees' wages. Both employers and employees must understand the legal implications of the information provided on this form to avoid potential penalties or issues with state tax authorities.

Key elements of the Alabama Form A 4 Rev 100

Several key elements are essential to the Alabama Form A 4 Rev 100:

- Personal Information: This includes the employee's name, address, and Social Security number.

- Allowances: Employees must specify the number of allowances they are claiming, which affects tax withholding.

- Signature: A signature is required to validate the information provided on the form.

- Date: The date of completion must be included to establish when the form was filled out.

Form Submission Methods (Online / Mail / In-Person)

The Alabama Form A 4 Rev 100 can be submitted through various methods, depending on the employer's preferences. Typically, employees submit the form in person to their employer. Some employers may allow for electronic submission via secure online portals. However, mailing the form is generally not common practice, as immediate processing is preferred to ensure timely tax withholding adjustments.

Quick guide on how to complete alabama form a 4 rev 100

Complete Alabama Form A 4 Rev 100 effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Alabama Form A 4 Rev 100 on any device using airSlate SignNow Android or iOS applications and streamline any document-based task today.

How to modify and eSign Alabama Form A 4 Rev 100 without any hassle

- Locate Alabama Form A 4 Rev 100 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to confirm your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Alabama Form A 4 Rev 100 and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama form a 4 rev 100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alabama Form A 4 Rev 100?

The Alabama Form A 4 Rev 100 is a state-specific form used for various business purposes, including tax filings and governmental applications. With airSlate SignNow, users can easily fill out and eSign this form online, ensuring accuracy and compliance with Alabama regulations.

-

How does airSlate SignNow simplify the completion of Alabama Form A 4 Rev 100?

airSlate SignNow streamlines the completion of Alabama Form A 4 Rev 100 by providing intuitive templates and easy-to-use tools for filling in necessary information. This user-friendly interface helps reduce errors and speeds up the eSigning process, benefiting both businesses and clients.

-

What pricing options are available for using airSlate SignNow for Alabama Form A 4 Rev 100?

airSlate SignNow offers various pricing plans tailored to fit different business needs, ensuring that users can efficiently manage forms like the Alabama Form A 4 Rev 100. Plans include options for individual users, small businesses, and enterprise-level solutions, all designed to provide maximum value.

-

Are there any benefits of using airSlate SignNow for Alabama Form A 4 Rev 100?

Yes, using airSlate SignNow for the Alabama Form A 4 Rev 100 provides numerous benefits, including enhanced efficiency and reduced paper waste. Additionally, the platform ensures secure, legally binding eSignatures that simplify the signing experience for all parties involved.

-

Can I integrate airSlate SignNow with other software for Alabama Form A 4 Rev 100?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, allowing users to streamline their workflows when completing the Alabama Form A 4 Rev 100. This integration capability enhances productivity by allowing data to flow smoothly between platforms.

-

Is there a mobile app available for airSlate SignNow to manage the Alabama Form A 4 Rev 100?

Yes, airSlate SignNow offers a mobile app that allows users to manage and eSign documents, including the Alabama Form A 4 Rev 100, from their smartphones or tablets. This flexibility ensures that important forms can be completed and signed on-the-go, improving overall access and convenience.

-

What security measures are in place for using airSlate SignNow with Alabama Form A 4 Rev 100?

airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect sensitive information when handling the Alabama Form A 4 Rev 100. These security protocols ensure that your documents remain confidential and compliant with industry standards.

Get more for Alabama Form A 4 Rev 100

Find out other Alabama Form A 4 Rev 100

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order