Huong Dan Dien Form Tax File Number Declaration

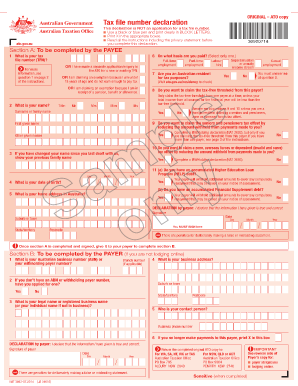

What is the Huong Dan Dien Form Tax File Number Declaration

The Huong Dan Dien Form Tax File Number Declaration is a document used by individuals and businesses to report their tax file number to the appropriate tax authorities. This form is essential for ensuring that taxpayers are correctly identified in the tax system, facilitating accurate processing of tax returns and other related documents. By providing the necessary details, the form helps maintain compliance with tax regulations in the United States.

Steps to Complete the Huong Dan Dien Form Tax File Number Declaration

Completing the Huong Dan Dien Form Tax File Number Declaration involves several key steps:

- Gather necessary information, including your personal identification details and tax file number.

- Carefully fill out the form, ensuring that all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the relevant tax authority, either online or by mail, as per the guidelines provided.

Legal Use of the Huong Dan Dien Form Tax File Number Declaration

The Huong Dan Dien Form Tax File Number Declaration is legally binding when completed and submitted in accordance with tax laws. It serves as a formal declaration of a taxpayer's identification number, which is crucial for tax reporting and compliance. Failure to use this form correctly can result in penalties or delays in processing tax returns.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Huong Dan Dien Form Tax File Number Declaration. Typically, these deadlines align with the overall tax filing deadlines set by the IRS. Taxpayers should ensure they submit their forms on time to avoid any penalties or interest charges.

Required Documents

When completing the Huong Dan Dien Form Tax File Number Declaration, certain documents may be required. These can include:

- Proof of identity, such as a driver's license or passport.

- Social Security number or Employer Identification Number (EIN).

- Any previous tax documents that may provide context for your tax file number.

Form Submission Methods (Online / Mail / In-Person)

The Huong Dan Dien Form Tax File Number Declaration can be submitted through various methods:

- Online submission via the appropriate tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if applicable.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Huong Dan Dien Form Tax File Number Declaration. It is essential to follow these guidelines to ensure compliance and avoid issues with your tax filings. Taxpayers should consult the IRS website or contact a tax professional for detailed instructions related to this form.

Quick guide on how to complete huong dan dien form tax file number declaration

Complete Huong Dan Dien Form Tax File Number Declaration effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventionally printed and signed paperwork, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the features necessary to create, modify, and eSign your documents swiftly without delays. Manage Huong Dan Dien Form Tax File Number Declaration on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to adjust and eSign Huong Dan Dien Form Tax File Number Declaration with ease

- Locate Huong Dan Dien Form Tax File Number Declaration and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive data using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to store your changes.

- Select your desired method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Huong Dan Dien Form Tax File Number Declaration and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the huong dan dien form tax file number declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax declaration sample and how can it be used?

A tax declaration sample is a template that individuals or businesses can use to prepare their tax returns. This sample simplifies the process of documenting income, expenses, and any deductions or credits. Using a well-structured tax declaration sample helps ensure compliance with tax regulations and can expedite filing.

-

How can airSlate SignNow assist with tax declaration samples?

airSlate SignNow enables users to easily create and send tax declaration samples digitally. With its intuitive eSignature features, users can invite recipients to review and sign tax documents securely and legally. This streamlines the filing process and reduces the risk of errors.

-

Are there any costs associated with using the tax declaration sample feature in airSlate SignNow?

The cost of using airSlate SignNow varies based on the subscription tier, which offers different sets of features for optimizing document workflows including tax declaration samples. There are affordable plans available, making it a cost-effective solution for businesses needing eSignature capabilities. You can explore our pricing page to find the best option for your needs.

-

What are the primary benefits of using airSlate SignNow for tax declaration samples?

Using airSlate SignNow for tax declaration samples provides several benefits such as increased efficiency, ease of use, and security. The platform enables quick electronic signing and sharing of documents, which helps to minimize delays in filing. Additionally, you can track the status of each document ensuring a smooth workflow.

-

Can I integrate airSlate SignNow with my existing software for managing tax declaration samples?

Yes, airSlate SignNow offers multiple integrations with popular software platforms such as Google Drive, Dropbox, and Salesforce. This allows for seamless management of tax declaration samples within your existing systems, enhancing productivity by enabling easy access to necessary documents. Integrating SignNow can help centralize document management for your tax processes.

-

Is it safe to use airSlate SignNow for handling tax declaration samples?

Absolutely! airSlate SignNow prioritizes security and compliance, employing advanced encryption protocols to protect your data. When handling tax declaration samples, you can rest assured that your sensitive information is safeguarded through secure access and stringent privacy measures.

-

How can I customize a tax declaration sample using airSlate SignNow?

airSlate SignNow allows users to easily customize tax declaration samples to fit their specific needs. You can modify the template by adding fields, setting up workflows, and branding elements to reflect your business’s identity. This flexibility ensures that your tax documents meet all requirements while also appearing professional.

Get more for Huong Dan Dien Form Tax File Number Declaration

Find out other Huong Dan Dien Form Tax File Number Declaration

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form