A49 Form

What is the A49 Form

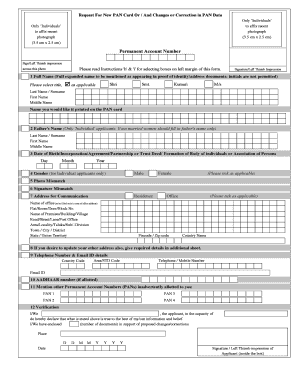

The A49 form, also known as the pan A49 form, is a crucial document used primarily for the application and correction of Permanent Account Numbers (PAN) in the United States. This form is essential for individuals and businesses to ensure proper identification for tax purposes. It helps in maintaining accurate records with the Internal Revenue Service (IRS) and is vital for financial transactions. The A49 form can be used to apply for a new PAN or to make corrections to existing PAN details, ensuring compliance with tax regulations.

How to use the A49 Form

Using the A49 form involves a straightforward process. First, determine whether you need to apply for a new PAN or make corrections to an existing one. If applying for a new PAN, fill out the required personal details, including your name, address, and date of birth. For corrections, provide the existing PAN and specify the changes needed. Ensure all information is accurate and complete to avoid delays. Once filled, the form can be submitted electronically or via mail, depending on your preference.

Steps to complete the A49 Form

Completing the A49 form requires careful attention to detail. Follow these steps:

- Gather necessary personal information, including identification and address proof.

- Download the A49 form from the official source or access it through a digital platform.

- Fill in the required fields accurately, ensuring that all information matches your identification documents.

- If making corrections, clearly indicate the changes needed and provide the existing PAN.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, depending on your chosen submission method.

Legal use of the A49 Form

The legal use of the A49 form is governed by specific regulations set forth by the IRS. This form is recognized as a legitimate document for tax identification purposes. To ensure its legal standing, it must be completed accurately and submitted according to IRS guidelines. Additionally, the form must be signed by the applicant, affirming that the information provided is true and correct. Failure to comply with these legal requirements may result in penalties or delays in processing.

Required Documents

When filling out the A49 form, certain documents are required to support your application or correction request. These typically include:

- Proof of identity, such as a government-issued ID or passport.

- Proof of address, which can include utility bills or bank statements.

- Any previous PAN documentation if you are making corrections.

Having these documents ready will facilitate a smoother submission process and help avoid any potential issues.

Form Submission Methods

The A49 form can be submitted through various methods to accommodate different preferences. You can choose to:

- Submit the form electronically via a secure online platform.

- Print the completed form and mail it to the designated IRS address.

- Visit a local IRS office to submit the form in person.

Each method has its own processing times, so consider your urgency when selecting a submission option.

Quick guide on how to complete a49 form

Effortlessly Prepare A49 Form on Any Device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage A49 Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Edit and eSign A49 Form with Ease

- Locate A49 Form and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and has the same legal standing as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign A49 Form to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the a49 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an A49 form and why is it important?

The A49 form is a crucial document that businesses use for eSigning agreements and contracts securely. It helps streamline the signing process, ensuring that all parties are compliant with legal standards. Using the A49 form can enhance your business efficiency and reduce the time spent on document management.

-

How does airSlate SignNow facilitate working with the A49 form?

airSlate SignNow provides an intuitive platform for easily creating, sending, and eSigning the A49 form. Our solution ensures that all signatures are legally binding and trackable, improving your workflow. This feature helps businesses maintain organization and saves valuable time.

-

Is there a cost associated with using the A49 form in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include features for managing the A49 form. Each plan is designed to provide cost-effective solutions tailored to your business needs. You can choose a plan that fits your budget and get value from our eSigning capabilities.

-

What features does airSlate SignNow offer for the A49 form?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage specifically for the A49 form. These features allow you to manage documents efficiently and collaborate effortlessly with team members. Additionally, the platform ensures data security with advanced encryption.

-

Can I integrate airSlate SignNow with other applications for handling the A49 form?

Absolutely! airSlate SignNow supports integrations with various applications to facilitate handling the A49 form seamlessly. Whether it's your CRM, project management tool, or other software, our integrations make it easy to enhance your workflow and connect all your business systems.

-

What are the benefits of using the A49 form with airSlate SignNow?

Using the A49 form with airSlate SignNow offers numerous benefits, including increased efficiency and reduced paperwork. The platform allows quick document turnaround and ensures that all signatures are securely recorded. This leads to improved compliance and peace of mind for your business transactions.

-

Is the A49 form legally binding when signed through airSlate SignNow?

Yes, the A49 form is legally binding when signed through airSlate SignNow, as the platform complies with eSigning regulations. Our solution provides an audit trail that verifies each signature, ensuring legitimacy. Furthermore, you can trust that your documents are handled with the utmost legal integrity.

Get more for A49 Form

Find out other A49 Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT