Borrowers Form Example with Answer

What is the borrowers form example with answer

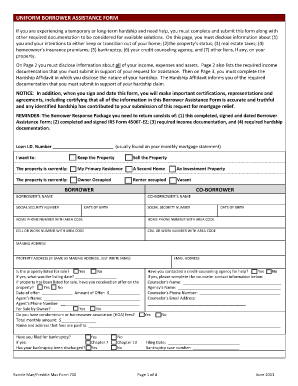

The borrowers form is a crucial document used in various financial transactions, particularly in lending and borrowing scenarios. It serves to outline the terms and conditions under which a borrower agrees to repay a loan. This form typically includes essential details such as the borrower's personal information, the loan amount, interest rates, repayment schedule, and any collateral involved. A borrowers form example with answer may illustrate how to fill out each section correctly, ensuring that all necessary information is provided. This clarity helps both lenders and borrowers understand their rights and obligations.

Key elements of the borrowers form example with answer

Understanding the key elements of the borrowers form is vital for both parties involved in a loan agreement. The primary components include:

- Borrower's Information: This section captures the full name, address, and contact details of the borrower.

- Loan Details: This includes the loan amount, purpose of the loan, interest rate, and repayment terms.

- Collateral Information: If applicable, this outlines any assets pledged against the loan.

- Signatures: Both the borrower and lender must sign the document to validate the agreement.

Each of these elements plays a significant role in ensuring the form's legality and clarity, making it essential for users to understand how to complete it accurately.

Steps to complete the borrowers form example with answer

Completing the borrowers form requires careful attention to detail. Here are the steps to follow:

- Gather Information: Collect all necessary personal and financial details before starting.

- Fill Out Borrower's Information: Enter your full name, address, and contact information in the designated fields.

- Specify Loan Details: Clearly state the loan amount, its purpose, interest rate, and repayment schedule.

- Provide Collateral Information: If applicable, describe any collateral offered to secure the loan.

- Review the Document: Ensure all information is accurate and complete before signing.

- Sign and Date: Both parties should sign and date the form to finalize the agreement.

Following these steps will help ensure that the borrowers form is filled out correctly, minimizing potential disputes in the future.

Legal use of the borrowers form example with answer

The legal use of the borrowers form is grounded in its ability to create a binding agreement between the borrower and lender. For the form to be considered valid, it must meet specific legal requirements, including:

- Compliance with State Laws: Each state may have its own regulations regarding loan agreements, so it is crucial to adhere to these laws.

- Proper Signatures: The form must be signed by both parties to establish consent and agreement.

- Clear Terms and Conditions: All terms must be clearly stated to avoid misunderstandings.

By ensuring these elements are present, the borrowers form can effectively serve its purpose in legal contexts.

How to obtain the borrowers form example with answer

Obtaining a borrowers form example can be done through several methods, depending on the specific needs of the user. Here are some common ways to access this form:

- Online Resources: Many financial institutions and legal websites provide downloadable templates for borrowers forms.

- Consulting with Financial Advisors: Professionals can offer tailored forms based on individual circumstances.

- Legal Offices: Attorneys specializing in financial law can provide official forms that comply with local regulations.

Accessing the appropriate version of the borrowers form is essential for ensuring that all legal requirements are met.

Examples of using the borrowers form example with answer

Examples of how the borrowers form can be utilized include various scenarios in which individuals or businesses seek loans. Common examples are:

- Personal Loans: Individuals may use the form to secure funds for personal expenses, such as home improvements or medical bills.

- Business Loans: Entrepreneurs can utilize the form to obtain financing for starting or expanding a business.

- Student Loans: Students may fill out the form to secure funding for their education.

These examples illustrate the versatility of the borrowers form in facilitating financial transactions across different contexts.

Quick guide on how to complete borrowers form example with answer

Effortlessly Prepare Borrowers Form Example With Answer on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed files, allowing you to access the correct form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Borrowers Form Example With Answer on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Borrowers Form Example With Answer with Ease

- Obtain Borrowers Form Example With Answer and click on Get Form to begin.

- Use the tools available to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and is as legally binding as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document versions. airSlate SignNow fulfills all your document management needs in a few clicks from your chosen device. Edit and eSign Borrowers Form Example With Answer and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borrowers form example with answer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a borrowers form and how can I use it with airSlate SignNow?

A borrowers form is a document designed for loan applications that allows borrowers to provide their information easily. With airSlate SignNow, you can create, send, and eSign your borrowers form securely, ensuring a streamlined process that saves time and reduces paperwork.

-

Is there a pricing plan for creating borrowers forms in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can create and manage your borrowers forms at competitive rates, making it a cost-effective solution for businesses of all sizes.

-

What features are included when using the borrowers form with airSlate SignNow?

When utilizing the borrowers form, airSlate SignNow provides features such as eSignature capabilities, document templates, and a user-friendly interface. These tools help streamline your document management and enhance the borrowing process.

-

How does airSlate SignNow ensure the security of my borrowers forms?

airSlate SignNow prioritizes security by implementing advanced encryption protocols and secure cloud storage. When you use our platform for your borrowers forms, you can trust that your sensitive data is protected throughout the entire signing and storage process.

-

Can I integrate my borrowers forms with other applications using airSlate SignNow?

Absolutely! airSlate SignNow supports various integrations with popular applications, allowing you to seamlessly incorporate your borrowers forms into your existing workflows. This flexibility enhances efficiency and simplifies the process for both you and your clients.

-

What benefits do I get from using airSlate SignNow for my borrowers forms?

Using airSlate SignNow for your borrowers forms brings numerous benefits, including faster turnaround times, reduced paperwork, and improved customer satisfaction. The platform's automated processes help you manage your documents efficiently, making the lending experience smoother for everyone involved.

-

Can I customize my borrowers forms in airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your borrowers forms to meet your specific needs. You can add your branding, create custom fields, and adjust the layout, ensuring that the forms reflect your business's identity while collecting all necessary information.

Get more for Borrowers Form Example With Answer

Find out other Borrowers Form Example With Answer

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile