Form 8802

What is the Form 8802

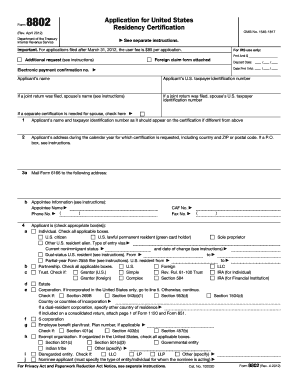

The Form 8802, also known as the Application for United States Residency Certification, is a document used by U.S. taxpayers to request certification of their residency status for tax purposes. This form is essential for individuals and businesses seeking to claim benefits under tax treaties between the United States and other countries. By obtaining this certification, taxpayers can avoid double taxation on income earned abroad.

How to use the Form 8802

Using the Form 8802 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including your taxpayer identification number and details about your residency status. Next, fill out the form carefully, ensuring that all sections are completed accurately. After completing the form, you can submit it to the IRS either by mail or electronically, depending on your preference and the submission guidelines provided by the IRS.

Steps to complete the Form 8802

Completing the Form 8802 requires attention to detail. Follow these steps:

- Start by downloading the latest version of the form from the IRS website.

- Provide your personal information, including your name, address, and taxpayer identification number.

- Indicate the tax year for which you are requesting residency certification.

- Complete any additional sections relevant to your situation, such as information about foreign income.

- Review the form for accuracy before submission.

Legal use of the Form 8802

The legal use of the Form 8802 is governed by IRS guidelines. It is crucial to ensure that the information provided is truthful and accurate, as any discrepancies may lead to penalties or delays. The form serves as an official request for residency certification, which can be used to support claims for tax treaty benefits. Misuse of the form can result in legal consequences, including fines or audits.

Required Documents

When submitting the Form 8802, certain documents may be required to support your application. These documents can include:

- Proof of residency, such as a utility bill or lease agreement.

- Tax returns from the previous year to verify income.

- Any relevant tax treaty documentation that supports your claim.

Having these documents ready will facilitate a smoother application process.

Form Submission Methods

The Form 8802 can be submitted using various methods. You have the option to file it by mail or electronically. When filing by mail, ensure that you send it to the appropriate IRS address specified in the form instructions. If you choose to submit electronically, follow the IRS guidelines for electronic filing. Each method has its own processing times, so consider your deadlines when selecting a submission method.

Quick guide on how to complete form 8802

Complete Form 8802 effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Manage Form 8802 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Form 8802 without hassle

- Locate Form 8802 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method of sending your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document versions. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Edit and eSign Form 8802 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8802

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8802?

Form 8802 is used to apply for a U.S. residency certificate, which is essential for claiming tax benefits under tax treaties. This form certifies that you are a resident of the United States for tax purposes and can reduce withholding rates on your income from foreign sources. By using airSlate SignNow, you can easily prepare, sign, and send your form 8802 efficiently.

-

How can airSlate SignNow help me with form 8802?

AirSlate SignNow streamlines the process of completing and eSigning form 8802. Our platform offers an intuitive interface that allows you to fill out the form quickly, add signatures, and send it to the required parties all in one place. You can ensure greater compliance and accuracy when submitting your form 8802 through our secure solution.

-

Can I track my form 8802 once it's sent?

Yes, with airSlate SignNow, you can easily track the status of your form 8802 after it is sent. Our platform provides notifications when documents are opened and signed, ensuring you stay updated throughout the process. This feature allows you to keep your submissions organized and manage your projects effectively.

-

What are the pricing options for using airSlate SignNow for form 8802?

AirSlate SignNow offers flexible pricing plans designed to meet various business needs. Starting from a cost-effective basic plan to more advanced options, you can select a plan that fits your budget while efficiently managing documents like form 8802. Check our website for detailed pricing information and choose the plan that best suits your workflow.

-

Is airSlate SignNow compliant with legal regulations for form 8802?

Yes, airSlate SignNow complies with all necessary legal regulations for eSigning documents, including form 8802. Our solution adheres to the ESIGN and UETA laws, ensuring that eSigned documents have the same legal standing as traditional paper signatures. This compliance gives you confidence when managing important tax-related documents.

-

Are there any integrations available with airSlate SignNow for form 8802 management?

AirSlate SignNow offers numerous integrations with popular applications such as Google Drive, Dropbox, and CRM systems. These integrations facilitate easy document sharing and storage, making the management of form 8802 and other documents more efficient. You can customize your workflow and enhance productivity using your favorite tools.

-

What benefits does airSlate SignNow provide for handling form 8802?

Using airSlate SignNow for handling form 8802 offers multiple benefits including speed, efficiency, and cost savings. The platform allows you to streamline your document processes, reduce turnaround times, and minimize paper usage. These advantages make it an ideal choice for businesses looking to simplify their tax documentation.

Get more for Form 8802

Find out other Form 8802

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document