Utah State Tax Forms

What are Utah State Tax Forms?

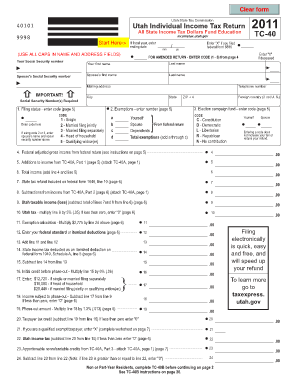

Utah State Tax Forms are official documents required for filing state income taxes in Utah. These forms are used by individuals and businesses to report their income, calculate tax liabilities, and claim deductions or credits. The primary form for individual income tax is the Utah TC-40, while businesses may use various forms depending on their structure and tax obligations. Understanding these forms is crucial for compliance with state tax laws.

Steps to Complete the Utah State Tax Forms

Completing the Utah State Tax Forms involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any supporting documentation for deductions. Next, download the appropriate forms, such as the Utah TC-40 for individuals or other relevant forms for businesses. Carefully fill out each section, ensuring all information is accurate. Review the completed form for any errors before submitting it.

How to Obtain the Utah State Tax Forms

Utah State Tax Forms can be obtained through the official Utah State Tax Commission website. These forms are available for download in PDF format, allowing taxpayers to print and fill them out at their convenience. Additionally, physical copies may be available at local tax offices or public libraries. It is important to ensure you are using the most current version of the forms to avoid any compliance issues.

Legal Use of the Utah State Tax Forms

The legal use of Utah State Tax Forms is governed by state tax laws, which require accurate reporting of income and adherence to filing deadlines. When completed and submitted correctly, these forms serve as legally binding documents. It is essential to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or audits. Utilizing a reliable e-signature platform can enhance the legal validity of the forms when submitting electronically.

Filing Deadlines / Important Dates

Filing deadlines for Utah State Tax Forms typically align with federal tax deadlines. For individual taxpayers, the deadline is usually April 15th of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to these dates and to file on time to avoid penalties. Extensions may be available, but they must be requested in advance.

Required Documents

To complete the Utah State Tax Forms accurately, several documents are required. Taxpayers should gather their W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources. Additionally, documentation for deductions, such as mortgage interest statements, property tax receipts, and educational expenses, should be collected. Having all necessary documents on hand will streamline the filing process.

Form Submission Methods (Online / Mail / In-Person)

Utah State Tax Forms can be submitted through various methods. Taxpayers may choose to file online using the state’s e-filing system, which is often the quickest and most efficient method. Alternatively, forms can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has specific guidelines and requirements, so it is important to follow the instructions carefully to ensure timely processing.

Quick guide on how to complete utah state tax forms

Effortlessly Prepare Utah State Tax Forms on Any Device

The management of documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and electronically sign your documents without obstacles. Handle Utah State Tax Forms on any device using airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

Editing and eSigning Utah State Tax Forms Made Easy

- Obtain Utah State Tax Forms and click Get Form to begin.

- Utilize the tools we offer to submit your form.

- Emphasize important sections of the documents or redact sensitive information with the specialized tools provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details carefully and click on the Done button to save your changes.

- Choose your preferred method for sharing your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Utah State Tax Forms to ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the utah state tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Utah State Tax Form TC 40W?

The Utah State Tax Form TC 40W is a withholding tax form required for certain taxpayers in Utah. This form helps individuals report their income tax withholdings and determine their tax liability. Completing the TC 40W accurately ensures compliance with state regulations.

-

How can airSlate SignNow assist with the Utah State Tax Form TC 40W?

airSlate SignNow streamlines the process of completing and eSigning your Utah State Tax Form TC 40W. Our platform allows users to fill out the form electronically, ensuring it is submitted quickly and securely. With easy document tracking, you'll never lose sight of your form's status.

-

Is there a cost to use airSlate SignNow for the Utah State Tax Form TC 40W?

AirSlate SignNow offers various pricing plans, providing cost-effective solutions to meet your needs. Users can choose from free trials to subscription plans that cater to individual or business requirements. Enjoy the benefits of professionally handling your Utah State Tax Form TC 40W without breaking the bank.

-

What features does airSlate SignNow provide for the Utah State Tax Form TC 40W?

With airSlate SignNow, users can access advanced features like automated workflows and customizable templates for the Utah State Tax Form TC 40W. Users benefit from cloud storage, version control, and secure signing options, making the form submission process seamless. These features are designed to enhance efficiency and reduce the time spent on paperwork.

-

Can I integrate airSlate SignNow with other applications while handling the Utah State Tax Form TC 40W?

Yes, airSlate SignNow integrates with various popular applications, allowing you to streamline your workflow while managing the Utah State Tax Form TC 40W. Whether you use CRM systems, cloud storage, or project management tools, our platform can connect with them easily. This integration helps maintain consistency and improve overall productivity.

-

How secure is airSlate SignNow when using the Utah State Tax Form TC 40W?

Security is a top priority at airSlate SignNow. We employ industry-standard encryption and security protocols to protect your documents, including the Utah State Tax Form TC 40W. You can be confident that your sensitive information remains secure during transmission and storage.

-

What benefits do I get when using airSlate SignNow for the Utah State Tax Form TC 40W?

By using airSlate SignNow for the Utah State Tax Form TC 40W, you gain increased efficiency, accuracy, and convenience. Our electronic signing and document management ensure that you can focus on your core tasks while we handle the paperwork. Additionally, our support team is available to assist you at any stage of the process.

Get more for Utah State Tax Forms

- Dichiarazione sostitutiva del certificato di residenza storicocronologico art comune malalbergo bo form

- The sun warwick castle booking form

- Hoja de matricula revsept2008 form

- Owt1 form

- Form 6 protection order department of justice justice gov

- Dhmh 4582 form

- Full size project thegef form

- Ncaa homeschool core course worksheet form

Find out other Utah State Tax Forms

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe