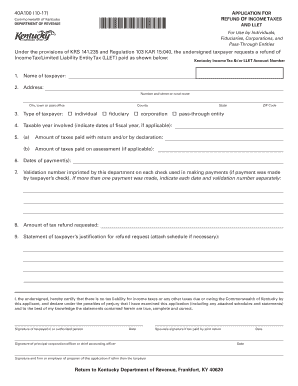

REFUND of INCOME TAXES Form

What is the refund of income taxes?

The refund of income taxes refers to the amount returned to taxpayers by the government when they have overpaid their taxes throughout the year. This can occur due to various reasons, such as withholding too much from paychecks or qualifying for tax credits that reduce overall tax liability. Understanding this concept is essential for taxpayers to manage their finances effectively and ensure they receive any funds owed to them.

How to obtain the refund of income taxes

To obtain a refund of income taxes, taxpayers must first file their tax returns accurately and on time. This involves reporting all income, claiming deductions and credits, and calculating the total tax owed. Once the return is submitted, the IRS processes it, and if a refund is due, it is typically issued within a few weeks. Taxpayers can choose to receive their refund via direct deposit, which is the fastest method, or by check through the mail.

Steps to complete the refund of income taxes

Completing the refund of income taxes involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any relevant receipts for deductions.

- Choose a filing method, whether online using tax software or by paper.

- Fill out the appropriate tax forms accurately, ensuring all income and deductions are reported.

- Submit the tax return by the filing deadline, which is typically April 15.

- Track the status of your refund using the IRS online tool or by contacting the IRS directly.

IRS guidelines

The IRS provides specific guidelines for filing tax returns and claiming refunds. Taxpayers must adhere to the rules regarding eligibility for deductions and credits, as well as the proper completion of forms. The IRS also outlines the timeline for processing refunds and the necessary steps to take if there are issues with the return. Staying informed about these guidelines helps ensure a smooth filing process.

Required documents

To complete the refund of income taxes, several documents are required:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Previous year’s tax return for reference.

Having these documents organized and accessible can streamline the filing process and increase the likelihood of receiving a timely refund.

Filing deadlines / Important dates

Taxpayers should be aware of key filing deadlines to avoid penalties. The standard deadline for filing income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can file for an extension, but this does not extend the time to pay any taxes owed. Important dates also include deadlines for estimated tax payments, which are typically due quarterly.

Penalties for non-compliance

Failing to comply with tax regulations can result in penalties, including fines and interest on unpaid taxes. Common reasons for penalties include late filing, underreporting income, and failing to pay taxes owed by the deadline. Understanding these consequences emphasizes the importance of timely and accurate tax filing to avoid unnecessary financial burdens.

Quick guide on how to complete refund of income taxes

Easily Prepare REFUND OF INCOME TAXES on Any Device

Digital document management has become increasingly popular among both businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the suitable form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage REFUND OF INCOME TAXES on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to Modify and Electronically Sign REFUND OF INCOME TAXES Effortlessly

- Obtain REFUND OF INCOME TAXES and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which only takes a few seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it directly to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Edit and electronically sign REFUND OF INCOME TAXES and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I am an Indian citizen and living in India, but I'm employed by a US company working remotely from India, earning a salary in USD. What should I know about filing a tax return in India?

So even if you are employed by an US company, for the purpose of income tax laws, you are an Indian resident, your global income is taxable in India. To say it in simple terms, it is no different then you being employed by an Indian Company. In case your total income before deduction is above 2.5 lacs, you are required to file an income tax return. The due date for the current year is extended till 31st August otherwise it is normally 31st July of the following year of the financial year. Moreover since the tax might have been deducted by the US company from your salary, you may get a credit for such tax paid by your US employer against your Indian income tax liability. As far as Indian tax liability is concerned, you have to discharge this by way of advance tax in case the credit available in respect of tax deducted by your US employer is not sufficient. In case you have not been able to pay your advance tax, the same can be paid by way of self assessment tax. For delay or default in payment of advance tax, read the below article written by me.What if you have failed to pay advance tax? You can avail other tax deduction under Section 80 C, 80 D, 80 E in case you have taken education loan etc. In case you want to need clarification on any specific issue, please ask specific question as the area of income tax very wide and one is not able to under stand it fully even one signNowes grave.

-

What happens if you do not file income tax return in India, or if you do not have sufficient documents?

If your income fall under income tax category and you don't file the tax, the following will be done with you:Income Tax department will send you a notice to file your returnIf you ignore that notice, an alert again will be sent outYou will not be given your refundIf still you don't pay your taxes, you are found to owe the government taxesThe interest keeps adding up in your account still you pay your complete tax amountIt may be possible that you are levied by any penaltyYou could be agonised with more difficulties according to rules and regulation of Indian constitution. As an individual when not pay its taxes on time he/she will be treated as accused.You can face numbers of punishments in case you don't fie your income tax:Criminal fraudCivil fraudNegligenceNo loan, No credit cardNo refund, No carry forward of lossesYou can Face Judgement Assessment – Sec 144Who are Required to File Income Tax:To begin with, you first need to check your gross annual salary from various sources. Is it turning out to be Rs. 2,50,000 or less. If yes, then you do not have to file any income tax. If your income is above this amount and you have not filed the income tax, then you might receive a notice from the income tax department, a penalty will be imposed depending on your salary and the date by which you were supposed to file the return, and lastly, you may not get back the deducted tax amount as refund which you are eligible for, which is also known as TDS refund.Next, regarding the documents:Whenever you file your income tax returns, you need to provide your basic details such as name, address, date of birth, bank account details, father’s name, Aadhaar number and a few other details regarding your income. All these details are usually available with the applicant and there is no need for you to make these documents available. You just need to provide the details which are asked.When it comes to documentation, the only area where people face issues is that pertaining to the deductions. For this, the best recourse would be to keep your bank statements handy and seek the help of a tax professional who will help identify all the concerned sources of income and the appropriate deductions to be filled.How to File Income Tax Return:If you are an salaried individual, and your salary falls under circumstances of income tax deduction, your employer will provide you the Form 16. To file an ITR it is necessary to understand the concept of Form 16. It is an essential certificate that your employer issues to validate that the TDS has been deducted and deposited on behalf of the employee.

-

What deductions (income taxes...) do I have to face in California (San Francisco)?

The tax calculations have a lot more parameters than you mention, and it is far simpler to look them up than to calculate them from the underlying formulas. If you are an employee, your employer will calculate payroll deductions that more or less approximate the tax you will owe but tend to be on the high side.The government sites' tax calculators are downloadable applications, so instead I used one from surepayroll, which seems to have the best search optimization (it was the first relevant-looking google search for "payroll tax calculator"). Here: http://www.surepayroll.com/calcu...Filling in your numbers: 2012 taxes for single person living in California, 3 allowances, no additional allowances or voluntary withholding, produces:$210,000 salary$49,356.50 federal withholding (23.5%)$4,626.20 social security (2.2%)$3,045 medicare tax (1.45%)$18,173.54 california state tax (8.65%)Total taxes withheld: $75,201.24 (35.8%)At the end of the year you will calculate your actual taxes, and make up the difference with a refund or payment.To give you an imprecise sketch of how those taxes are determined, federal taxes are applied in bands, as successive portions of your income are taxed at increasingly higher rates (see http://taxes.about.com/od/Federa...10% of income from $0 to $8,700, plus15% of income over $8,700 to $35,350, plus25% of income over $35,350 to $85,650, plus28% of income over $85,650 to $178,650, plus33% of income over $178,650 to $388,350, plus35% of income over $388,350Your total income throughout the year (which might include side jobs, interest, bonuses, and other things not taken into account on your payroll witholding) is considered "gross income". Several small items are deducted in order to calculate "adjusted gross income", and then a number of larger items are deducted to produce "taxable income", which is what the above formula applies to. Most importantly, the total amount of state taxes you have paid throughout the year are deducted. This includes the $18,173.54 California withholding - not the amount of California taxes you will owe on your yearly California tax forms, but the actual amount you paid. If there's a refund or make-up payment, that comes in next year unless, realizing that, you make an additional contribution to the state before the end of 2012. Certain portions of real estate taxes, home mortgage payments, vehicle license fees, unreimbursed business expenses, etc., may be deductible if they qualify, and there can be some other special tax breaks that get thrown in. This is where the politicians like to tweak things in order to say they're giving people a bonus, but they usually amount to no more than a few hundred dollars, if that. If the total of all the state and local tax payments and all of these other deductions and they exceed a threshold called the "standard deduction" ($5,950 for married filing separately) you use this amount and file a more lengthy return; otherwise you take the standard deduction and typically file a shorter return. State taxes are based on federal income, with a different but roughly parallel set of deductions. On the tax form this is expressed as "adjustments" that apply to your federal income in order to get state taxable income. California has a series of marginal tax brackets just like the federal government, starting at 1% and rapidly topping out at 9.3% of income over $46,766 (10.3% of income over $1 million).If you run your own business or receive consulting rather than payroll income, you have to pay a special "self employment tax", and your business expenses are direct reductions in your calculated income rather than tax deductions. Other forms of income like royalties, capital gains, and income from rental property have their own rules.Here are a couple additional issues if you are a nonresident alien. If you are on an F-1, J-1, M-1, or Q-1 visa (not sure about H-1B), you do not owe social security or medicare tax (or self-employment tax), as you are not eligible for these government benefits. If that has been deducted from your paycheck it is refundable at the end of the year. You are also ineligible to file a joint married return, so instead you file as "married filing separately". That option is not available on the payroll forms, so you check the box for "married, but withhold at the higher single rate". See http://www.irs.gov/businesses/sm...I'm not an accountant, and I might have missed a few things. This is intended as an illustration of how taxes work and not financial advice to you.

-

How are students taxed when they work outside of their state of residence? Specifically a student working in NYC and living in NJ.

You pay three taxes.My youngest son attended a college outside of Philadelphia and had a part-time job in Philadelphia and his home address was in Massachusetts.His employer deducted:Federal income taxesPennsylvania income taxesPhiladelphia income taxesHe was able to claim is Penn and Philadelphia taxes against his Federal and Massachusetts income taxes (he also had summer jobs at home). It would have cost too much money and/or time/effort to file to get the Philadelphia taxes refunded.Since NYC has its own income tax, you will pay three sets of income tax for that NYC job (Federal, New York State and NYC). If you have a separate summer job in New Jersey and are a resident of NJ you will file tax forms in NJ as well. Depending upon the amount that you pay to NYC you may decide not to bother filing for a refund. It costs MONEY to use TurboTax for city taxes and it takes time and effort to get the paper forms from the city to fill out. You will have to decide what is cost-effective for you.

-

If a child becomes a successful entrepreneur at an early age, say 11 or 12 years old, how do they go about paying their taxes?

In the US, being an entrepreneur has nothing to do with it. So forget that part.Anyone with income may be subject to income tax, depending on the amount and type of income, age and whether you are blind. Here is a portion of the instructions for form 1040:Note that there is nothing about minimum age or whether the taxpayer is an “entrepreneur.”But suppose your earned income was only $2,000 - should you file? If estimated Federal Income tax was deducted from your pay, and you want a refund, then YES; even though you are not legally required to file, you must do so to get the refund.My first tax return was filed when I was age 15; I had income from my summer job as a field laborer for the State of Maryland, from which payroll taxes had been deducted. I think I had $600 of total earned income, and my refund was perhaps $25. The form was easy to fill out -even a 15 year old could do it.Hope that helps.

-

How can I check my ITR status?

Once you have filed your income tax return (ITR) and verified it, the Income Tax (I-T) Department starts processing your return. Refund, if any is due, is issued only after processing is complete. Normally after verification, the ‘status’ of your ITR would be ‘Successfully Verified’ or ‘successfully e-Verified’. After processing is complete, the status would be ‘ITR Processed’.Consequently, one can buy things online, purchase policies and can also go for online money transactions. On the top of this now you can easily file Income tax returns online and can also track the status of your Income Tax Refund. This allows the Taxpayers to view the status of their refund within 10 days of applying for the refund. All you need to do is to type in your Permanent Account Number (PAN) and pick the year of your Assessment.You need to complete the online filing of Income Tax Refund. It is advised to e-file your returns this year as this helps you to process your Tax Refund faster. Here we will discuss the process of checking the status of Income Tax Returns in case you have not received the refund of the Income Tax Returns that you filed this year.There can be several reasons responsible why you have been unable to receive the refund till date. It might be possible that your Income Tax Return is not processed yet. You will certainly receive the refund if the department receives the filing of the returns.In order to check your IT Return filing status online, you need to login into your e-Filing of the official Income Tax website and visit ‘My Account’ and from there go to ‘My Returns Forms’. Another case may be that your Income Tax Department might have processed your Income Tax Return but the Income Tax Department was unable to determine the refundSteps to file Returns OnlineFirst of all, you need to first register or login (in case if you have already registered) on the home page of the website.When you will type in your PAN number, you will get to know if you have already registered or not. It can be possible that you might have filed your returns online before, so it might be possible that your registration already exists.Therefore, you need to first check your inbox for “http://www.incometaxindiaefiling... [dot] in” to seek any piece of useful information. If you have memorized your password, then login to the website. You must remember that your PAN number is your User ID.In case you have forgotten your password, then you have to reset it. There are cases when we are unable to reset your password by the options they provide, so you can send the mail to validate@incometaxindia.gov.in and fill in the required details mentioned below:PAN:Name of the PAN Card Holder:Father’s Name:Date of Birth:Registered PAN address:Verifying the Income Tax Returns:One of the first things to be done immediately after e-filing, the taxpayer has to e-verify or dispatch his ITR-V to CPC Bangalore. Here are the steps on how to go about this process:There are two methods to verify the Income Tax Returns (ITR). First is the electronic verification. After logging into the official portal of the government, go to the main menu and navigate to ‘E-Verify Return’ option.The Aadhar Card can be linked with PAN number to generate an OTP, or One Time Password. The password will be delivered to the taxpayer’s registered mobile number, which can be used to validate the e-filing.An electronic verification code (EVC) can also be generated to verify the ITR. The EVC gets delivered to both the mobile number and email id of the taxpayer. However, the EVC method of verification can only be used by taxpayers with annual income more than Rs 5 lakh.Tracking the ITR-V Receipt Status:In case the taxpayer has opted for ITR verification, then it is important to track its status regularly. At times, during a non-receipt of the ITR due to postal loss can be intimated by the IT department, which can be missed if not tracked.Once they receive the form, an acknowledgement email is sent to the taxpayer. The email is sent one month after the receipt of the income tax returns verification document.The status of the ITV-R form can be checked as follows:An acknowledgement email to sent to the taxpayer’s verified email ID, mentioned in the ITR. Since such mails can often end up in the Spam folder, it is advisable to check all folders.The status can also be checked using the PAN, year of assessment, or e-filing acknowledgment number that is found under the status tab of the ‘Services’ section of the e-filing website.Tracking the Intimation Status:Post the e-verification, which takes almost a month, the IT department sends an email intimation, under Section 143(1). Details such as total tax paid, total TDS deducted, and deductions, if any are available in the intimation. Any information regarding the difference in the amount of income tax paid, deductions, income, TDS, or income tax payable is also provided.There are two columns where the status is intimated. One is the income tax as provided in return of income by taxpayer. The other is income tax payable calculated under Section 143(1). It is essential to analyse the intimation under Section 143(1) provided by the IT Department, so that you are aware of any alterations or mistakes in the details provided by you.In some cases the intimation may specify difference between the tax paid and the amount computed by the Department. This is referred to as Notice of Demand under Section 156. In such instances, the taxpayer will have to pay additional tax if specified by the intimation.Tracking status of tax return:Social Security – The IRS or SSN that is shown on the tax return must be entered by you.Filing status – You must ensure that the Filing Status shows up on the tax return.Refund amount – The entire amount that is being refunded must be entered as shown on the tax return.Tracking Status of Income Tax Refund:When the income tax computed by the IT Department is more than the amount paid, the taxpayer can claim for a refund. The refund will be deposited in the taxpayer’s bank account, as furnished in the income tax return form. Status of the tax refund status can be checked by logging to the registered account from the Government Website. After the income tax return (ITR) gets processed, it can be checked at TIN Website.Ways to check status of ITR:After filing your return, if you want to check what stage it is at, here are 2 easy ways to check the status of your ITR:1. Using acknowledgement number without login credentialsOn the homepage of the e-filing website, on the extreme left under the services tab, you’ll find the option to check the ITR Status.Once you click the ITR Status option, you’ll be redirected to a new page where you need to fill out your PAN number, ITR acknowledgement number and the captcha code.After you fill out your details and submit, the status will be displayed on your screen.2. Using login credentialsLogin to the e-filing website and on the dashboard you’ll see an option ‘View Returns / Forms’.Go the ‘View Returns / Forms’ option, select income tax returns and assessment year from the dropdown menu and submit.On submitting, the status will be displayed on the screen showing if the ITR is only verified or if it has been processed.You can apply for an attractive offer with best possible Rate of Interest and Terms for Personal, Business and Home Loan.FundsTiger is an Online Lending Marketplace where you can avail fast and easy Home, Business and Personal Loans via 30+ Banks and NBFCs at best possible rates. We will also help you to improve your Credit Score. We have dedicated Relationship Managers who assist you at every step of the process. We can also help you in Balance Transfers that will help you reduce your Interest Outgo.

-

How do I fill out Form 16 if I'm not eligible for IT returns and just want to receive the TDS cut for the 6 months that I've worked?

use File Income Tax Return Online in India: ClearTax | e-Filing Income Tax in 15 minutes | Tax filing | Income Tax Returns | E-file Tax Returns for 2014-15It is free and simple.

-

What is a tax return, and how do I get the taxes back?

What is a tax return?There are different types of tax returns, but I'll assume you mean an income tax return.An income tax return is basically a form that you fill out annually which reports the income you made for the year. Income can mean money you made as an employee, an independent contractor, gains from the sales of securities or other investments, among other things.Offsetting all these types of income are tax deductions. The federal government allows you a 'standard deduction' which is a fixed amount that can change from year to year. There is also something called 'itemized deductions' which are amounts you paid for things like mortgage interest, state income taxes, charitable contributions, real estate (property) taxes, unreimbursed job expenses, and a few others. It is to your advantage to use whichever deduction type is greater, as it will lower your taxable income.How do I get my taxes back?I can't tell if this is just awkward phrasing on your part or if you are completely misunderstanding that the taxes deducted on your paychecks will be 'refunded' to you, but let me try to explain.You may get nothing back even have to pay more when you file your tax return.Here is how this works. If you work for a company, they withhold both federal and, in all probability, state income taxes from your paycheck. Some states do not have an income tax, so you may be lucky enough to live in one of those states.So, throughout the year, you're paying against an unknown liability, via your payroll tax deductions. Your tax liability is not known throughout the year and only becomes known when you tabulate everything (i.e. basically, total income minus total deductions) at the end of the year. For example, if your final tax liability turns out to be $10,000 for the year and the aggregate of your payroll deductions throughout the year total only $9,000, you will owe and additional $1,000. If, on the other hand, your payroll deductions totaled $11,000 instead of $9,000, you will get a refund of $1,000 instead of having to pay $1,000.Conclusion and summary.This is an extremely high level and conceptual explanation of what a tax return is. There are literally thousands of pages of literature which outline the many nuances of tax law and the variables not discussed in this answer.

-

How is federal income tax withholding for each paycheck calculated?

In essence, what you described is what happens. There are different payroll periods (daily (other), weekly, bi-weekly, semi-monthly, monthly, quarterly, semi-annually, annually) and each payroll period has a different amount associated with it.The next part that is used to determine is if you marked single or married and number of allowances on your W-4.The last part that is used to determine the withholding amount is the amount you are paid during the payroll period.The calculations for the amount being withheld can be convoluted and difficult to understand because of the way the Circular E is written.Over But not over of excess over$87 $436 $0.00 plus 10% $87 $436 $1,506 $34.90 plus 15% $436 $1,506 $3,523 $195.40 plus 25% $1,506 $3,523 $7,254 $699.65 plus 28% $3,523 $7,254 $15,667 $1,744.33 plus 33% $7,254$15,667 $15,731 $4,520.62 plus 35% $15,667$15,731 $4,543.02 plus 39.6% $15,731This is the chart from the current Circular E for a single person that gets paid bi-weekly and I'll do my best to explain how your taxes are calculated.Step 1: Subtract the number of allowances (according to pay schedule of bi-weekly) claimed on your. For this instance, let's say you claimed only yourself so that would be 1. The amount associated is $151.90.Step 2: Your bi-weekly earnings are $2,000 so subtract $151.90 which leaves $1,848.10Step 3: Locate where $1,848.10 falls within the chart (see bold).This is where it gets confusing because you're going to use the information on the line where your wages fall and read from right to left (see below) when doing the calculationsStep 4: Using the result from step 2 ($1,848.10) and subtract the amount in the "of excess over" column ($1,506) and this leaves you $342.10Step 5: Multiply the result from step 4 ($342.10) by the percentage (in bold) from above (25%) and the result is $85.525 (rounded up to $85.53)Step 6: Add the amount on the same line in bold ($195.40) to the result from step 5 ($85.53) and this is the amount ($280.93) to be withheldSome payroll software will withhold dollars and cents whereas others will withhold only whole dollar amounts. If the software being used to calculate your withholding rounds, the amount withheld will be $281.There is also a chart in the Circular E that makes the calculations easier and that can be found at Page on irs.gov.You asked if you're going to have too much withheld? Technically the answer is yes because you will receive a refund (based on the potential of $52,000 annually). You can change the number of allowances on your W-4 since you know that you'll only be making $26,000 this year (technically) and may only want to have enough taxes withheld to cover the amount you earn.

Create this form in 5 minutes!

How to create an eSignature for the refund of income taxes

How to create an eSignature for your Refund Of Income Taxes in the online mode

How to make an eSignature for the Refund Of Income Taxes in Chrome

How to generate an electronic signature for signing the Refund Of Income Taxes in Gmail

How to make an electronic signature for the Refund Of Income Taxes right from your mobile device

How to generate an electronic signature for the Refund Of Income Taxes on iOS

How to make an electronic signature for the Refund Of Income Taxes on Android devices

People also ask

-

What is the process for obtaining a REFUND OF INCOME TAXES using airSlate SignNow?

To obtain a REFUND OF INCOME TAXES with airSlate SignNow, start by electronically signing your tax documents through our secure platform. Once completed, you can easily submit these documents to the IRS or your tax professional. Our service streamlines the signing process, ensuring you receive your refund promptly.

-

How does airSlate SignNow help in preparing tax documents for a REFUND OF INCOME TAXES?

airSlate SignNow provides a user-friendly interface for preparing and eSigning your tax documents. With customizable templates, you can ensure all necessary information is included to maximize your REFUND OF INCOME TAXES. This efficiency reduces errors and speeds up the submission process to the IRS.

-

Is there a cost associated with using airSlate SignNow for REFUND OF INCOME TAXES?

Yes, airSlate SignNow offers a range of pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to manage your documents efficiently while focusing on maximizing your REFUND OF INCOME TAXES.

-

What features does airSlate SignNow offer for tracking my REFUND OF INCOME TAXES?

With airSlate SignNow, you can track the status of your signed documents in real-time, ensuring you are updated on your REFUND OF INCOME TAXES. Our platform provides notifications and reminders, helping you stay informed throughout the tax process.

-

Can I integrate airSlate SignNow with my existing accounting software for a smoother REFUND OF INCOME TAXES process?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your tax documents. This integration allows you to streamline the process of filing for your REFUND OF INCOME TAXES without any hassle.

-

How secure is my information when using airSlate SignNow for REFUND OF INCOME TAXES?

Security is our top priority at airSlate SignNow. We utilize advanced encryption methods to ensure that all your documents and personal information remain confidential and secure while you work on your REFUND OF INCOME TAXES.

-

What benefits does airSlate SignNow provide for businesses seeking REFUND OF INCOME TAXES?

airSlate SignNow enhances efficiency for businesses seeking a REFUND OF INCOME TAXES by simplifying the document signing process. Our platform reduces the time spent on paperwork, allowing you to focus on your core business activities while ensuring timely submission of tax documents.

Get more for REFUND OF INCOME TAXES

Find out other REFUND OF INCOME TAXES

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple